Page 19 - Riverwater 2020 Sustainability Report

P. 19

2020 SUSTAINABILITY REPORT

OUTSIDE MANAGER IMPACT

OUTSIDE MANAGER IMPACT

Riverwater Partners conducts extensive due diligence on third-party investment managers to complete our clients’ asset allocations in diversified portfolios. These “outside” managed investments include publicly traded stocks and bonds as well as private equity and debt funds.

We regularly monitor the ESG impact of these outside managers, in addition to their investment performance. During 2020, many of these managers demonstrated resilience in adapting their strategies in light of unprecedented events. Here are a couple of inspiring examples:

ECOTRUST FOREST MANAGEMENT (EFM FUND III)

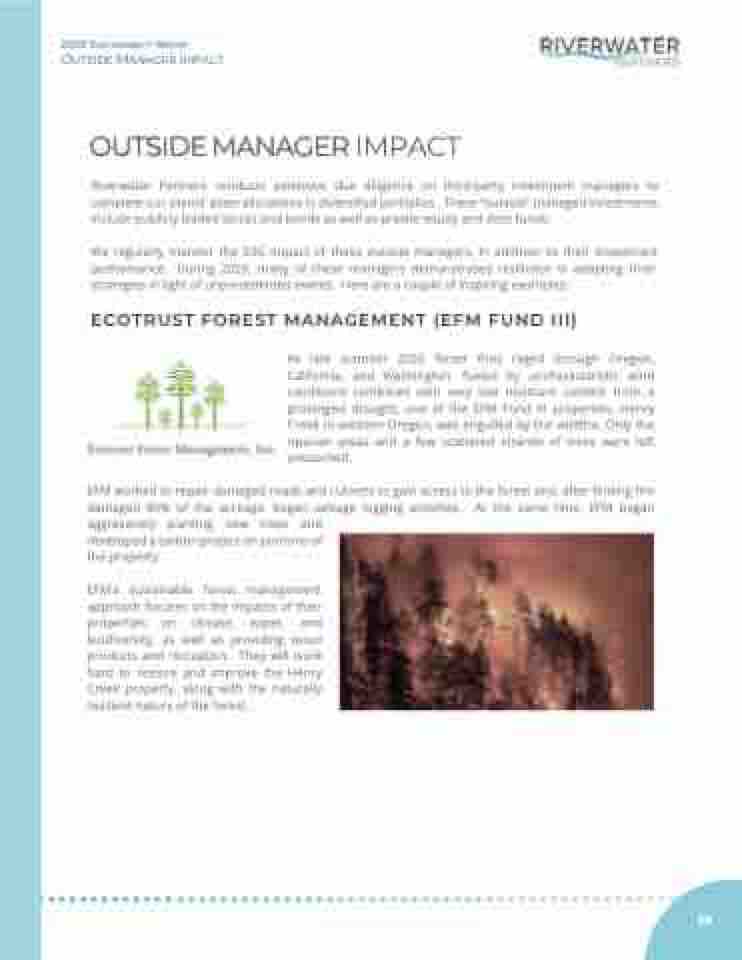

As late summer 2020 forest fires raged through Oregon, California, and Washington, fueled by uncharacteristic wind conditions combined with very low moisture content from a prolonged drought, one of the EFM Fund III properties, Henry Creek in western Oregon, was engulfed by the wildfire. Only the riparian areas and a few scattered strands of trees were left untouched.

EFM worked to repair damaged roads and culverts to gain access to the forest and, after finding fire damaged 80% of the acreage, began salvage logging activities. At the same time, EFM began aggressively planting new trees and

developed a carbon project on portions of

the property.

EFM’s sustainable forest management approach focuses on the impacts of their properties on climate, water, and biodiversity, as well as providing wood products and recreation. They will work hard to restore and improve the Henry Creek property, along with the naturally resilient nature of the forest.

19