Riverwater Partners’ asset management team based in Milwaukee, WI actively manages three small-cap equity strategies for institutional and individual investors. We apply a value-oriented approach to responsible investing using our disciplined research process, the Three Pillar Approach.®

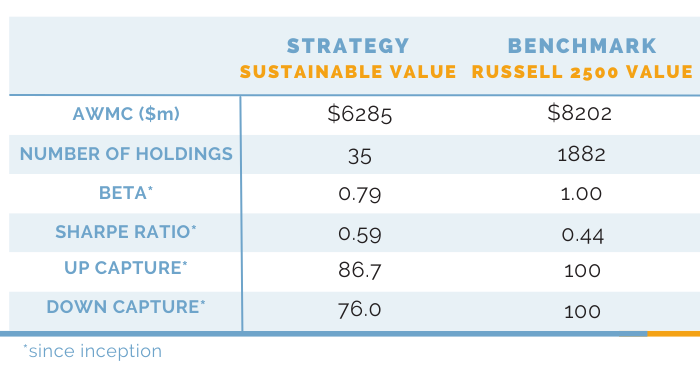

Riverwater Sustainable Value Strategy

The Riverwater Sustainable Value Strategy seeks to provide attractive risk-adjusted returns versus its benchmark, the Russell 2500 Value Index. The Riverwater Sustainable Value Strategy holds 25-40 small and mid-sized companies generally between a range of $500 million and less than $15B in market capitalization at initial purchase.

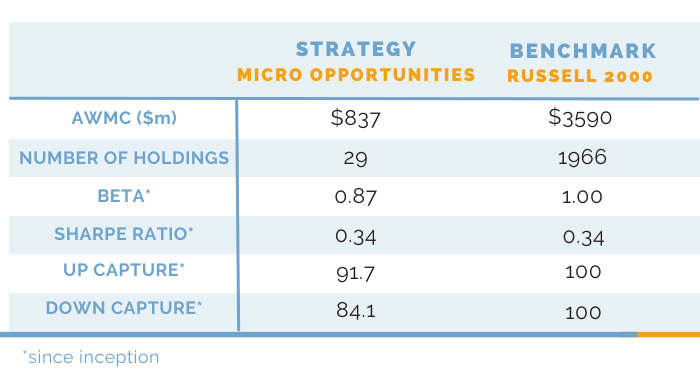

Riverwater Micro Opportunities Strategy

The Riverwater Micro Opportunities Strategy seeks to provide attractive risk-adjusted returns versus its benchmark, the Russell 2000 Index. The Micro Opportunities Strategy holds 20-40 Micro Cap companies generally below $1.5 billion in market capitalization at initial purchase.

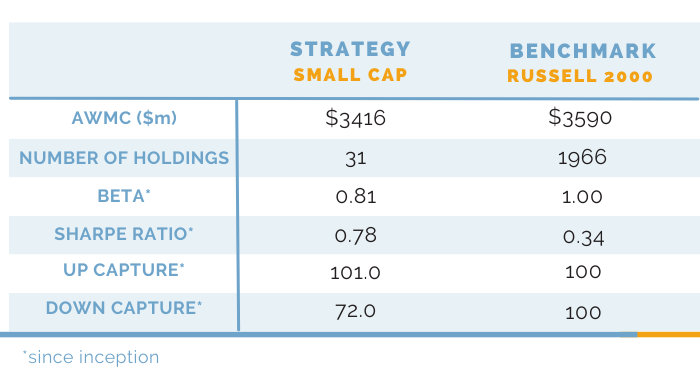

Riverwater Small Cap Strategy

The Riverwater Small Cap Strategy seeks to provide attractive risk-adjusted returns versus its benchmark, the Russell 2000 Index. The Small Cap Strategy holds 25-45 small-cap companies generally greater than $250 million and less than $5 billion in market capitalization at initial purchase.