Riverwater Partners’ asset management team based in Milwaukee, WI actively manages three small-cap equity strategies for institutional and individual investors. We apply a value-oriented approach to responsible investing using our disciplined research process.

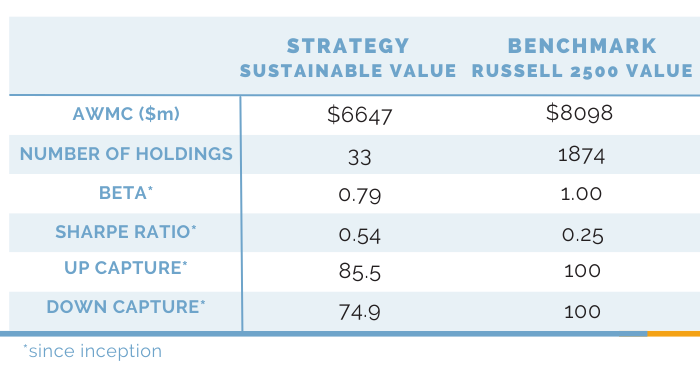

Riverwater Sustainable Value Strategy

The Riverwater Sustainable Value Strategy seeks to provide attractive risk-adjusted returns versus its benchmark, the Russell 2500 Value Index. The Riverwater Sustainable Value Strategy holds 25-40 small and mid-sized companies generally between a range of $500 million and less than $15B in market capitalization at initial purchase.

| 3 mo | 1 YR | 3 YR | 5 YR | Since Inception | |

|---|---|---|---|---|---|

| Composite (gross) | -9.60% | 2.89% | -1.09% | 21.21% | 8.55% |

| Composite (net) | -9.82% | 1.87% | -2.07% | 20.01% | 7.48% |

| Russell 2500 Value | -9.48% | -4.01% | 0.53% | 13.27% | 4.24% |

| Russell 2000 Value | -14.42% | -9.25% | -1.34% | 12.00% | 3.37% |

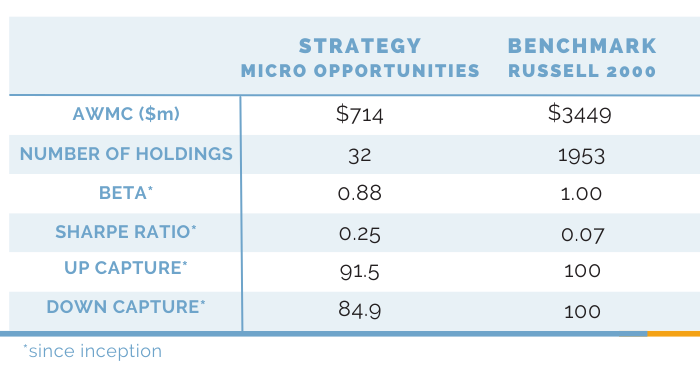

Riverwater Micro Opportunities Strategy

The Riverwater Micro Opportunities Strategy seeks to provide attractive risk-adjusted returns versus its benchmark, the Russell 2000 Index. The Micro Opportunities Strategy holds 20-40 Micro Cap companies generally below $1.5 billion in market capitalization at initial purchase.

| 3 mo | 1 YR | 3 YR | 5 YR | Since Inception | |

|---|---|---|---|---|---|

| Composite (gross) | -9.60% | 2.89% | -1.09% | 21.21% | 8.55% |

| Composite (net) | -9.82% | 1.87% | -2.07% | 20.01% | 7.48% |

| Russell 2000 | -9.48% | -4.01% | 0.53% | 13.27% | 4.24% |

| iShares Microcap ETF (IWC) | -14.42% | -9.25% | -1.34% | 12.00% | 3.37% |

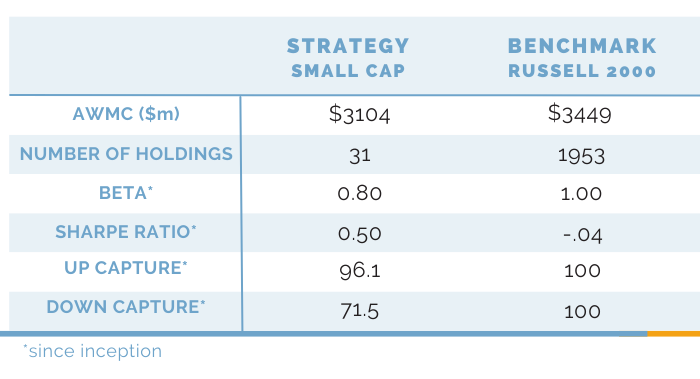

Riverwater Small Cap Strategy

The Riverwater Small Cap Strategy seeks to provide attractive risk-adjusted returns versus its benchmark, the Russell 2000 Index. The Small Cap Strategy holds 25-45 small-cap companies generally greater than $250 million and less than $5 billion in market capitalization at initial purchase.

| 3 mo | YTD | 1YR | Since Inception | |

|---|---|---|---|---|

| Composite (gross) | -7.86% | 1.28% | 14.66% | -7.86% |

| Composite (net) | -8.09% | 0.28% | 13.53% | -8.09% |

| Russell 2000 | -9.48% | -4.01% | 4.02% | -9.48% |