“Competitive strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value.” – Michael Porter

Competitive Strategy

At Riverwater Partners, we believe that incorporating a responsible investment lens enhances traditional value investing. This approach promotes resilience, captures inefficiencies, and improves return potential. As it relates to value investing, we define Value as paying a fair price for the responsible deployment of physical, human, and financial capital in pursuit of superior returns. Our process is thoughtfully executed through a unique blend of stewardship, security selection, and portfolio construction.

Enhancing Value Investing Through Deliberately Different Portfolio Construction

Riverwater’s portfolio construction is a collaborative process that values diverse perspectives, requiring unanimous agreement for buy/sell decisions. We focus on investing in companies whose value is underappreciated by the market and holding them as they mature through the small- to mid-cap spectrum. This approach is designed to reduce turnover and volatility. The focused portfolio requires discipline to choose the best companies in each sector relative to each strategies’ defined benchmark. Stock selection drives nearly all relative performance. This approach minimizes idiosyncratic risks while staying aware of macroeconomic factors. All components of portfolio construction are designed without regard to outwardly-defined style boxes. Our deliberately different method seeks to capitalize on our definition of value toward the realization of our clients’ real world and financial objectives.

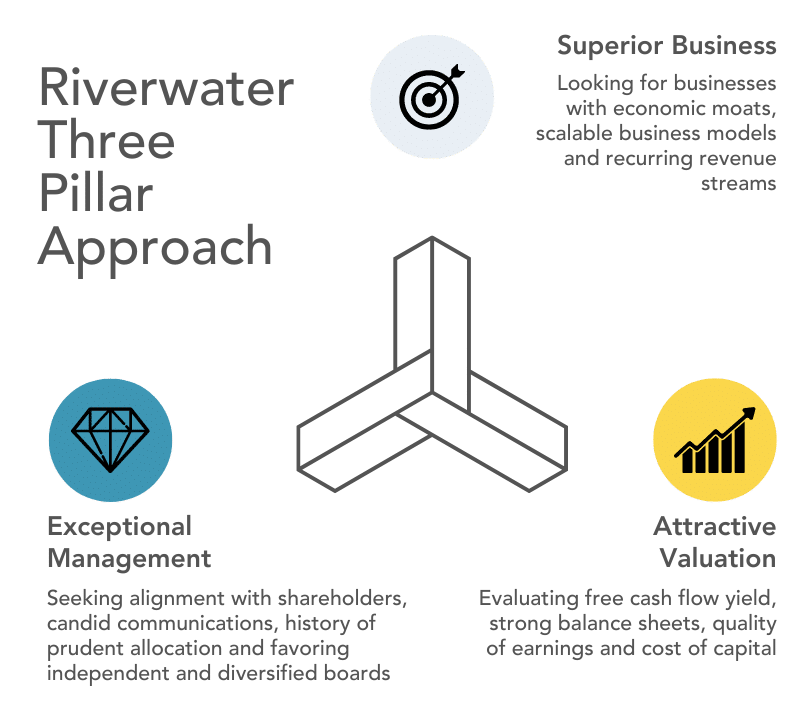

Discovering Superior Businesses & Exceptional Management Teams

Riverwater consistently applies its The Three Pillar Approach™, the foundation for evaluating each investment candidate. Our research uncovers opportunities in superior businesses that leverage their competitive advantages and are led by exceptional management teams with a proven history of prudent capital allocation and alignment with shareholders. We invest in companies trading below their long-term intrinsic value, focusing on unique, high-quality assets in each sector aiming to generate superior returns and maximize downside protection.

Making the World a Better Place

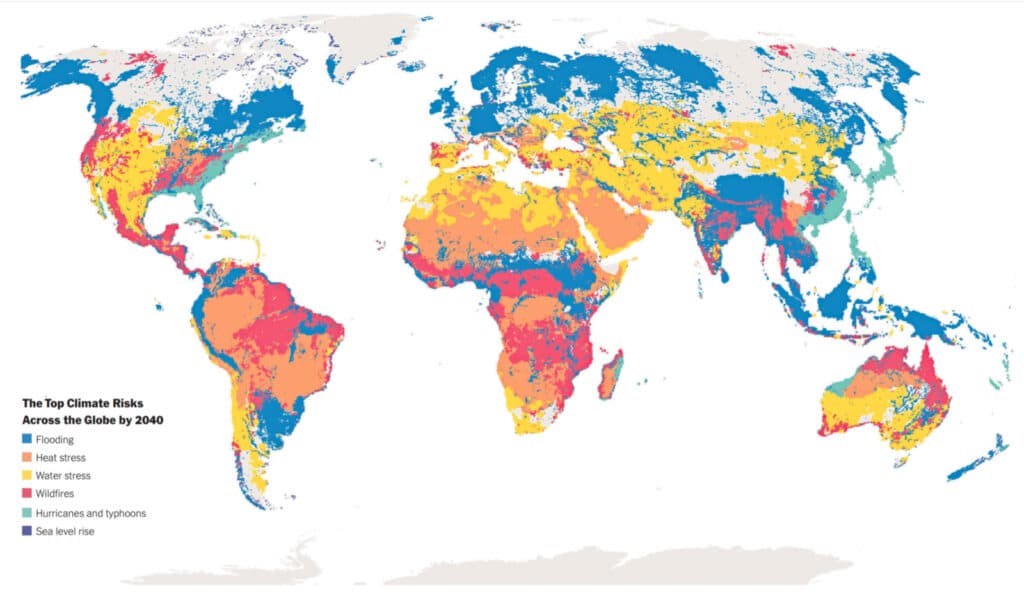

Our mission is “to make the world a better place by growing wealth through sustainable investing.” Through this lens, and as fiduciaries, we consider portfolio candidates’ attention to environmental, social, and governance factors because the risks and opportunities posed by the ever-changing world have the potential to materially (positively/negatively) impact portfolio returns. Using a proprietary database dedicated to small- and mid-cap companies, we exploit inefficiencies in the nascent journeys of small-cap companies to discover opportunities. Additionally, we engage with companies toward improvement on salient ESG factors. Materiality matters. We exclude industries that, in our view, are not essential for global prosperity. The accompanying map illustrates that climate risk is omnipresent.

Yet, unlike many responsible investors, we consider fossil fuel indispensable and invest in energy companies focused on reducing their environmental footprint and/or facilitating the transition to cleaner energy solutions. Simultaneously, we favor companies whose business by their very nature offers a societal or environmental benefit.