It’s tax time! Investors may be thinking of ways to reduce their tax payments. For investors with realized capital gains, investing in Qualified Opportunity Zones (“QOZ”) may be an approach to consider for the deferral or reduction of capital gains tax.

Origin & purpose of Qualified Opportunity Zones

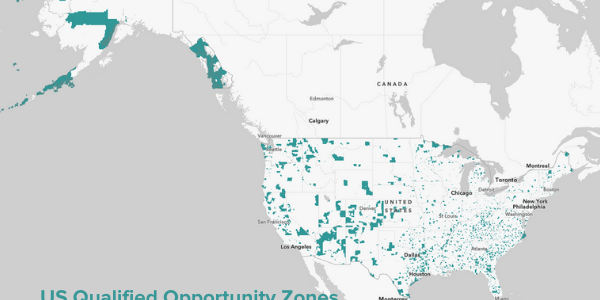

First, a brief history of the QOZ. As part of the Tax Reform and Jobs Act (“TRA”) of 2017, the creation of Opportunity Zones was a rare bipartisan effort 1 to catalyze long-term private investment in low-income communities, designated as QOZs. Individuals who make long-term investments in QOZ Businesses or QOZ Business Properties through Qualified Opportunity Funds (“QOFs”) receive certain tax benefits as an incentive to invest. Currently, there are over 8,700 designated QOZs across all 50 States, the District of Columbia and five U.S. territories.

Map of US Qualified Opportunity Zones

Investors who reinvest capital gains into QOFs generally within 180 days, may be able to derive tax benefits, including:

- Deferral of the original gain until December 31, 2026.

- Reduction of the original gain by 10% if the QOZ investment is held for at least five years.

- Elimination of any subsequent gain in the QOZ investment itself if held for at least ten years.

Violations of original purpose

While the original purpose of QOZs was to encourage economic growth and job development in distressed areas of the country, some QOFs have violated the spirit of the law and developed real estate properties in areas that are not necessarily low-income communities. Because the confirmation of QOZs was based on outdated data (2010 U.S. Census), some of them have already experienced redevelopment and would not be viewed by most as distressed. These properties may indeed generate good returns and tax benefits for investors, but they do not necessarily spur economic growth where most needed.

Impact investors have seen through this mirage, thus sullying the perception of QOFs as an avenue for job creation.

Opportunities to do good remain

We believe that, with proper due diligence, QOFs are still viable tax-favored investments worth considering. As responsible investors, we evaluate every investment opportunity through the lens of environmental, social and governance (“ESG”) criteria. This may include our evaluation of publicly traded securities or private investments. Therefore, when we evaluate QOFs, our primary objectives are to ensure that they have the kind of positive social or environmental impact intended by the TRA, while also offering the potential for competitive long-term returns.

So, what kind of funds would appeal to impact investors who are interested in favorable capital gains tax treatment? Here are a couple of examples of funds that we are familiar with 2:

- North Sky Infrastructure Investment Fund, LLC – this QOF seeks positive social and environmental impact by creating high quality green jobs and new clean energy, waste, water, and related infrastructure. This fund has no direct real estate exposure, eliminating a key market risk associated with most Opportunity Zone investments. North Sky has successfully managed prior infrastructure funds and seeks alignment with the UN Sustainable Development Goals, notably Goal 7 (Affordable and Clean Energy) and Goal 8 (Decent Work and Economic Growth).

- Alliant Strategic (ASI) Opportunity Zone Fund I, LLC – this fund seeks positive social impact by investing in multi-family residential real estate with a focus on workforce and affordable housing. ASI screens projects within QOZs that exhibit the best mix of a variety of social, economic, infrastructural, and environmental factors. ASI is one of the nation’s largest sponsors of affordable multi-family real estate.

Impact investments can generate significant social and environmental benefits and QOFs provide investors with tax incentives to make a difference for people who live in distressed neighborhoods. While the tax incentives are attractive, investors must be on guard for fund sponsors that violate the spirit of the TRA or utilize risky strategies.

Riverwater Partners can help you assess the risks and rewards of Qualified Opportunity Funds and guide you on a path to impact investing. Together we can work toward our mission of making the world a better place by growing wealth through sustainable investing.

1 The “Investing in Opportunity Act” was introduced by Senators Cory Booker (D-NJ) and Tim Scott (R-SC) in 2017.

2 These examples are not intended to be recommendations of Riverwater Partners. These funds may be available only to accredited investors and/or closed to new investors. Each investor situation is unique, and many factors must be considered when investing in QOFs.