The Truth About Trying to Time the Stock Market

Many investors convince themselves that they know the stock market is going to move one way or the other. They have a “feeling” – a “hunch” – that drives their investment timing. Here’s the deal: the markets* are full of surprises and “feelings” have little to do with it.

Don’t let your emotions dictate your investments.

With the stock market volatility we’ve experienced this year, it’s no wonder people are feeling stuck on the sidelines or experiencing high levels of anxiety. Fear of loss almost always wins out over FOMO -fear of missing out. In fact, research shows that the pain of loss is three times greater than the joy of a gain. In regard to investing, fear is part of a larger concept called Behavioral Finance – and it is now such an established field that it is incorporated into the curriculum at many business schools. Behavioral Finance is the study of the influence of psychology on the behavior of investors. It focuses on the fact that investors are not always rational, have limits to their self-control, and are influenced by their own biases.

Lots of emotions creep into our investment decisions. Certainly, political bent is one of the most common biases that many have. In today’s highly charged and divided political environment it’s easy to see why. Despite this form of bias, markets go up (and down) regardless of the ruling party in our country. That’s not to say that company stocks in certain sectors don’t react to regulation changes, because they do. But think about it: when one sector “loses” another sector could “win” with changing regulations, laws, taxes and tariffs. Also, businesses have a very good track record of adjusting to regulatory and market changes to remain profitable.

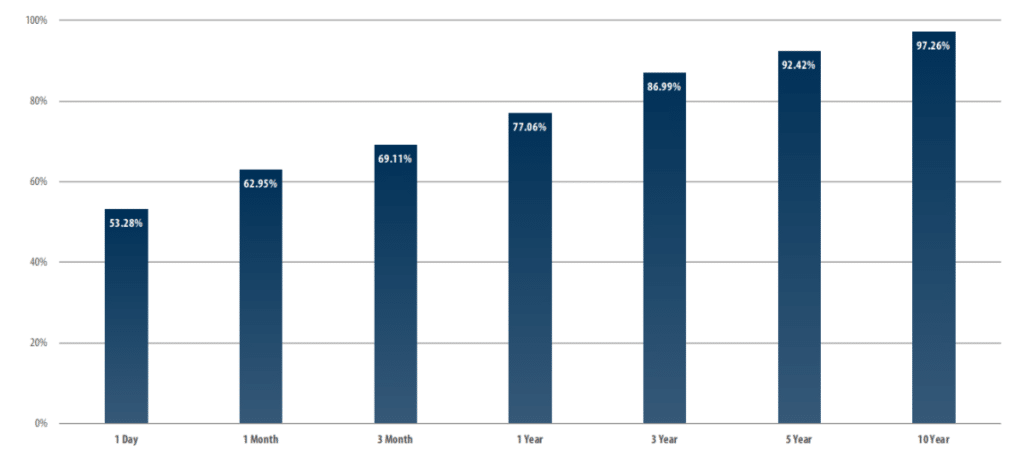

Possibility of positive returns increases over time

In any given year, markets have “their best day” and “their worst day”. Our media outlets love to turn bad days into headlines and for good reason.

Rules of Thumb

- Be aware of your biases.

- Don’t put long term savings in short term investments and vice versa. Save money earmarked for short term goals in low- or no-risk accounts (like the bank). Invest for long-term growth of wealth.

- Use dollar cost averaging; invest a predetermined amount, on a regular basis, to take advantage of market volatility.

- Diversify your investments across different asset classes and types of securities.

- Rebalance your portfolio; periodically sell the winners and keep your diversification intact

- Seek quality; whether it’s a stock, bond, mutual funds or ETF, quality matters.

As author Peter McWilliams observed, “The news media are … the bringers of bad news… and it’s not entirely the media’s fault, bad news gets higher ratings and sells more papers than good news”.

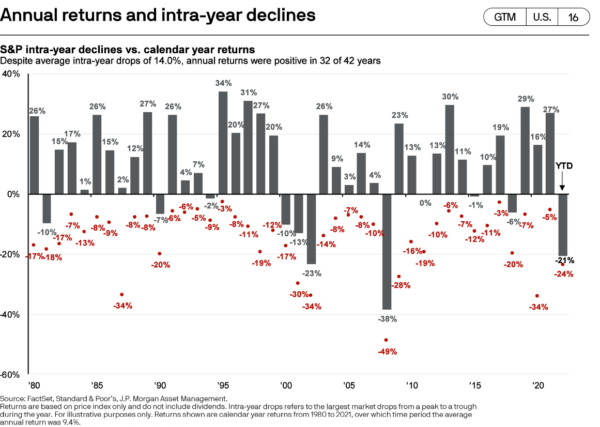

Historically, corrections in the markets have lasted anywhere from a few weeks to a few months. Since 1980, the S&P 500 index has experienced an average intra-year decline of -14%, which is significant. But since 1980, the market has also finished the year in positive territory 76% of the time.

No one can predict the top, or the bottom of the market. Studies have shown that even bad timing is better than not investing at all. Data also shows that staying the course and continuing to invest, regardless of market conditions, can lead to greater wealth accumulation. The chart below illustrates that the probability of positive returns grows increasingly higher as you extend your investment time horizon. The 2020 market environment provides the perfect example: The S&P 500 bottomed on March 23, 2020, followed by three days, when it rallied almost 18% and continued to recover. Despite the ongoing recession, the market hit its prior high by mid-August, roughly six months after its prior peak.

Take a Wholistic Approach to Your Investments

This is not to suggest that you simply utilize a “set it and forget it” strategy. Goals, risks, and other metrics change over time and your financial picture should be reviewed on a regular basis. I suggest that being proactive and designing a long-term plan will help ease your anxiety around money and your investments. As your life changes, your goals and concerns change – especially as you near retirement and your goal for accumulation changes to preparing for long-term distributions.

Bottom line: it’s time in the market, not timing the market that will determine your long-term success in investing.

At the end of the day, investing is a long game and although day-to-day ups-and-downs are sometimes hard to swallow and may trigger worry, daily moves in the market will not permanently alter a portfolio’s expected returns of the next 10, 15 or 20 years. Over time, markets have shown to remarkably resilient. Generally, working with trusted and experienced investment professionals can help you override your emotions, create diversified investment portfolios and keep you disciplined when things get choppy.

*For purposes of this article we are limiting economic markets to traditional investing markets and excludes markets such as cryptocurrency, derivatives and NFTs.