David v. Goliath: Why Small Caps Will Slay Market Giants in 2023

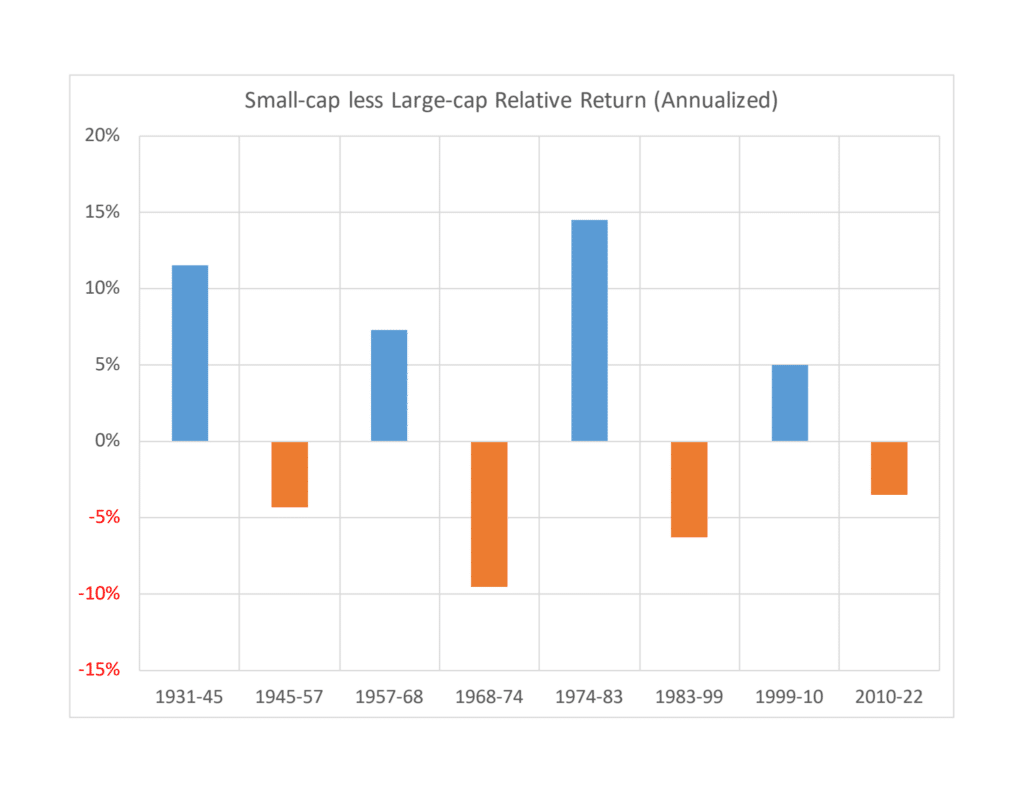

By Adam Peck. After more than a decade of being out of favor, we (and our friends at Furey Research Partners) believe that small-caps are poised to become stock market leaders over the next decade. Timing is everything they say.

Three reasons why now is the time for small-caps: (1) they are cheap, (2) the large-cap cycle is ending, and (3) they typically do well in the exact environment we are in right now.

Small-caps are cheap right now

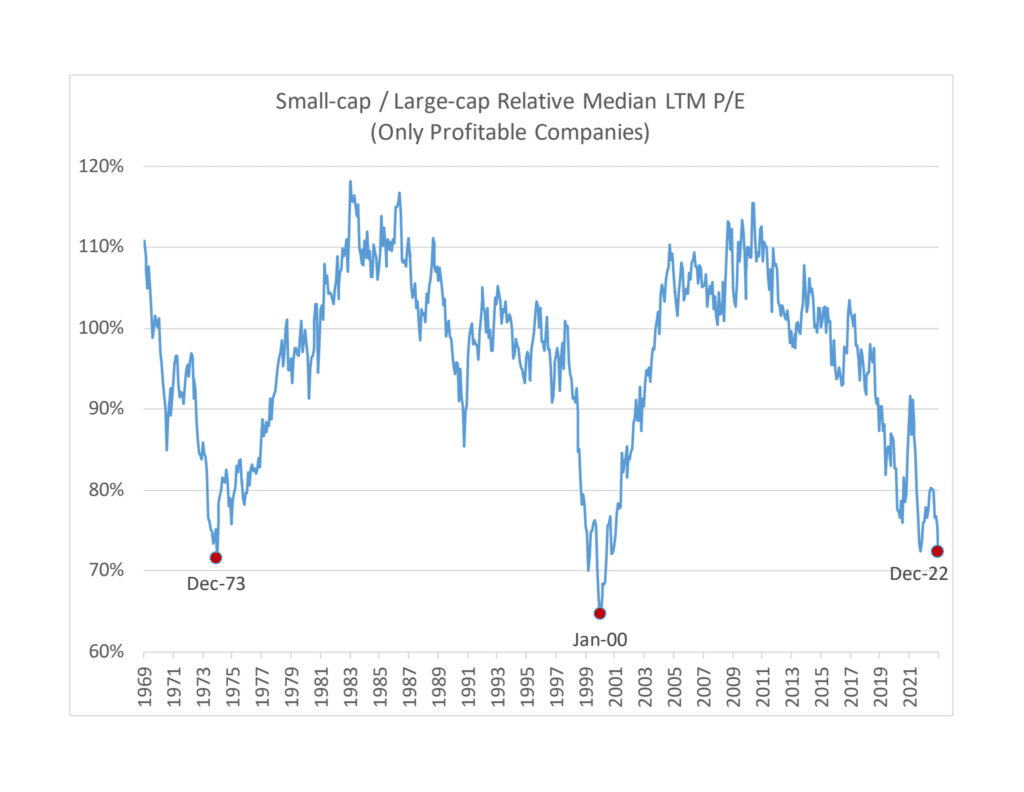

The Russell 2000 is trading one standard deviation below its average valuation over the last 35 years. It is also trading at historically low levels vs large-caps. This past October, small-cap stocks traded at 72% of the value of large-cap stocks on LTM P/E, which is very close to the previous small-cap lows at similar levels in 1973 and 2000.

The large-cap cycle is ending

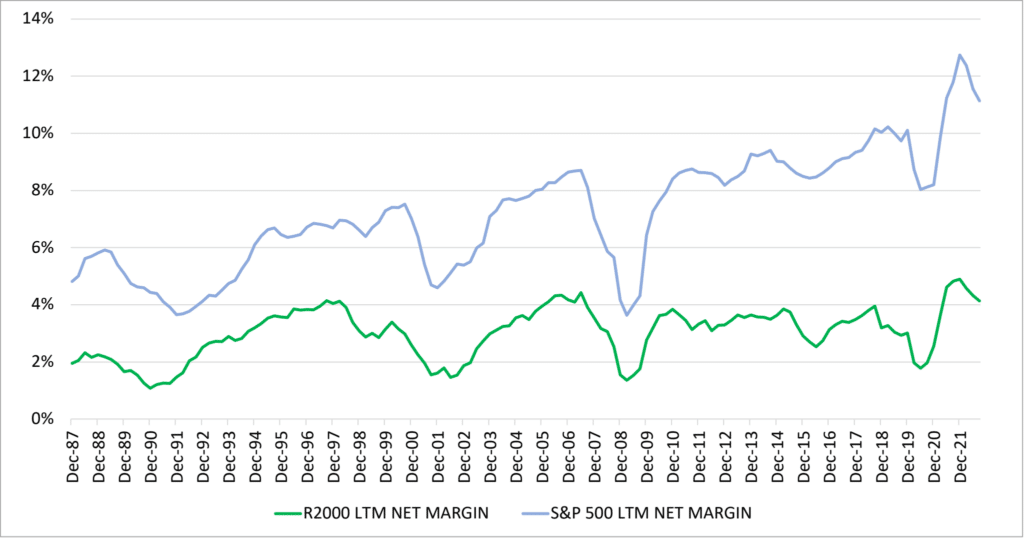

The large-cap cycle looks to be nearing an end given that margins seem to have hit peak levels.

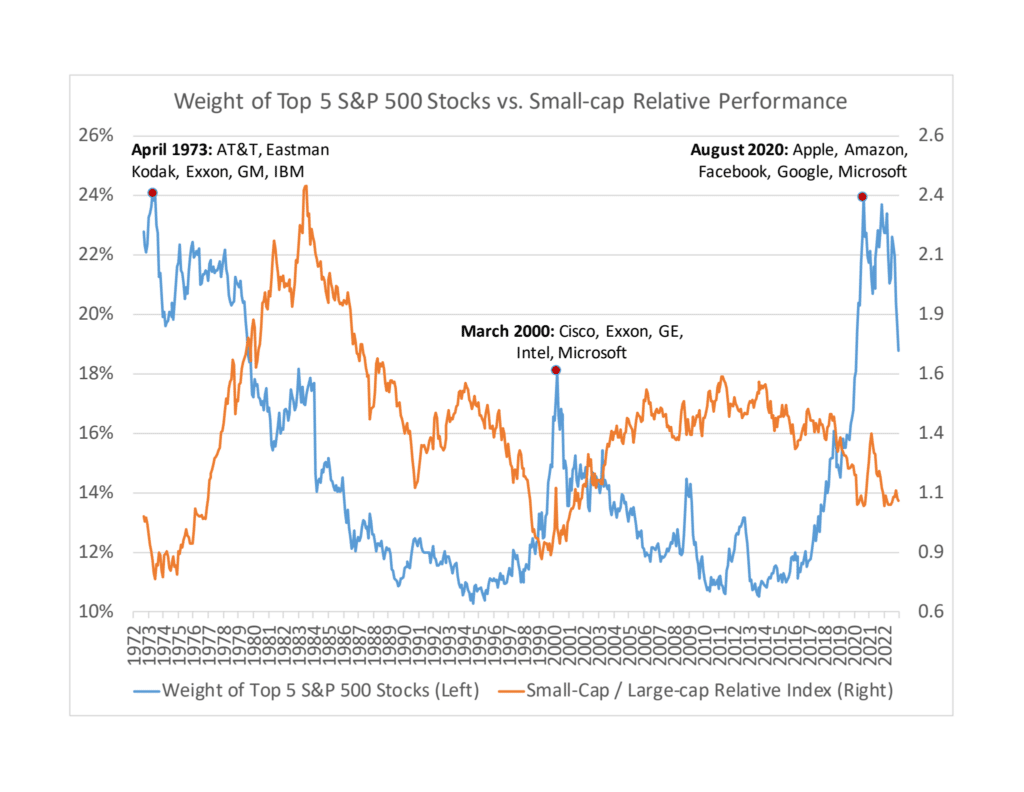

As seen in the chart below, peak concentration in the S&P500’s top 5 largest constituents has historically coincided with long small-cap outperformance cycles that last on average 10-12 years. After the peak of large-cap concentration (red dot), small-caps’ relative performance vs. large trends up (orange line).

Prime environment for small-caps

Lastly, the environment we are in today – both politically and economically – sets up well for small caps. First, politically, small-caps happen to have a great track record in years coming out of midterm elections.

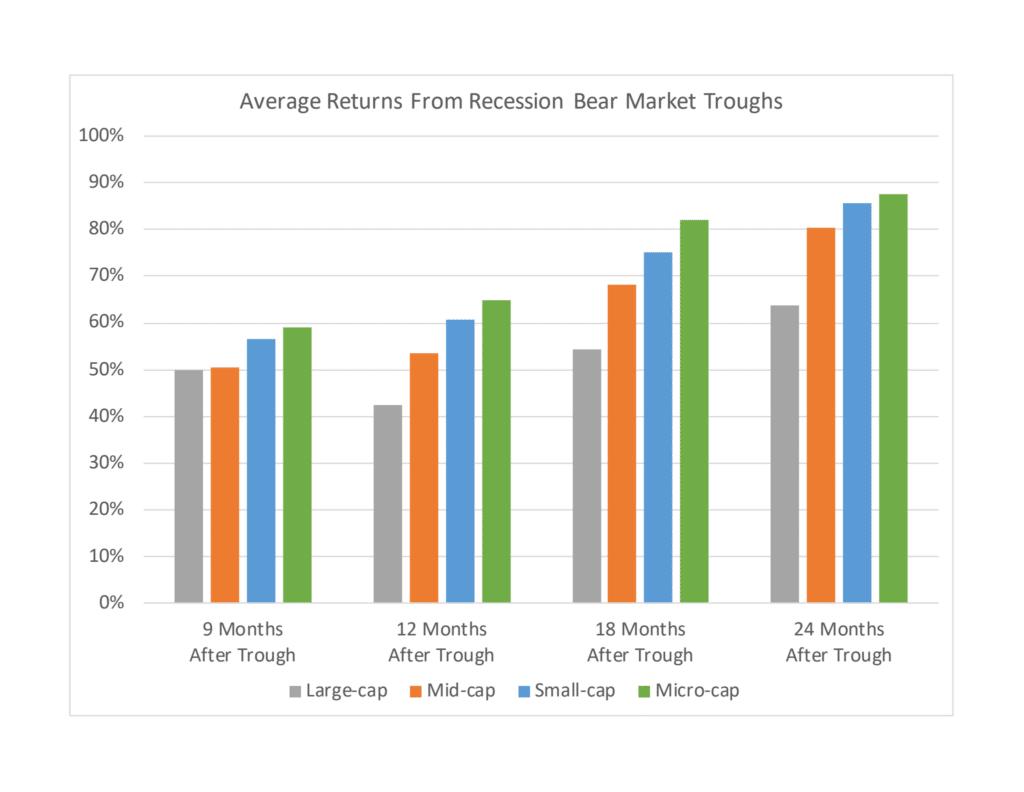

Second, small-cap returns coming out of bad years are reliably positive and relatively better than those for large-caps.

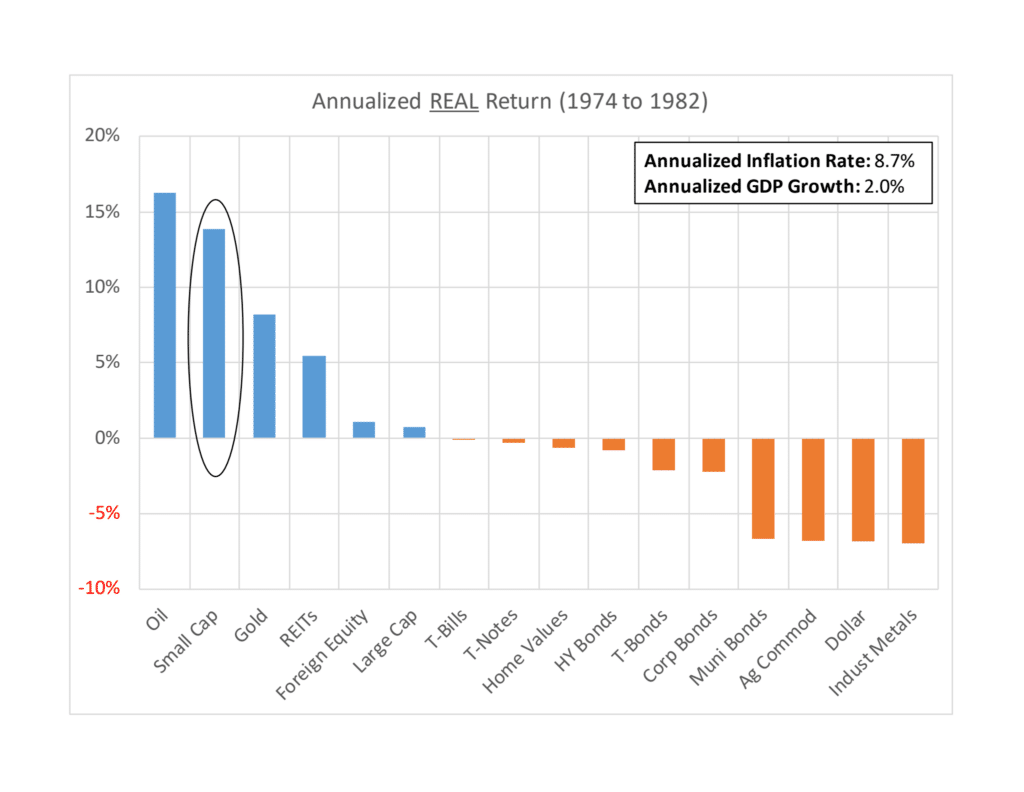

Lastly, small caps do best in environments where inflation and central bank tightening have peaked, like it is now.

Based on these factors we are bullish on small-caps potential for both positive absolute and relative returns over the short, medium and long term.