Market Rally Amid Election Season

Investors have plenty to cheer for as we enter the final stretches of election season. The S&P 500 has rallied 22.1% over the first nine months of the year, and the Bloomberg US Aggregate Bond Index posted a tremendous third quarter rallying 5.2% to bring the year-to-date return back into positive territory at 4.2%.

While market performance has been solid, elections will continue to dominate the news cycle and likely create short term volatility, but history shows that investors don’t need to be overly concerned. The CFA Institute found that political events, including elections, have only short-term impacts on the markets. Over the long term, market performance is more closely tied to economic fundamentals than to political outcomes. This means that investors who diversify their portfolios and stay focused on long-term goals are often rewarded, regardless of election outcomes.

Election Year Market Trends: History and Insights

U.S. markets have historically performed well during election years, regardless of which party is in power. According to Morgan Stanley, the S&P 500 has averaged positive returns in 19 of the last 23 election years since 1928, with an average gain of 7.1%. This means that while political events dominate the headlines, they don’t always have a significant impact on long-term market trends.

The Impact of a Divided Congress on Market Performance

Interestingly, the absence of partisanship does not lead to market instability. History shows that a divided Congress—where different parties control the House and Senate—has been correlated with stronger market returns. Data from LPL Financial reveals that the S&P 500 has posted an average annual return of 12.5% when one party or the other controls both the House and Senate, compared to 17.2% with a split Congress.

Why does this happen? When the government is divided, there is often gridlock, which reduces the likelihood of sweeping legislative changes. For markets, this translates to less policy uncertainty during a current administration. Companies can plan for the future with greater confidence, which is reflected in stronger market performance. So, rather than fearing political deadlock, investors can view it as a stabilizing force.

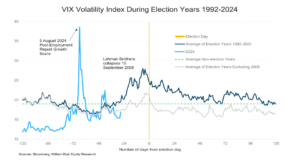

Election-Induced Volatility: What to Expect

Looming elections do offer a possibility of change away from existing policy, so often the volatility surrounding elections is increased due to this uncertainty about changes that may affect taxes, regulations, trade agreements, or government spending. Investors often become anxious about how new policies will impact the economy and specific sectors, leading to fluctuations in market sentiment. As you can see from the chart, volatility (as measured by the VIX Volatility Index) tends to rise in the weeks and months leading up to an election, before moving back to long term averages post election when investors have had time to digest any possible changes.

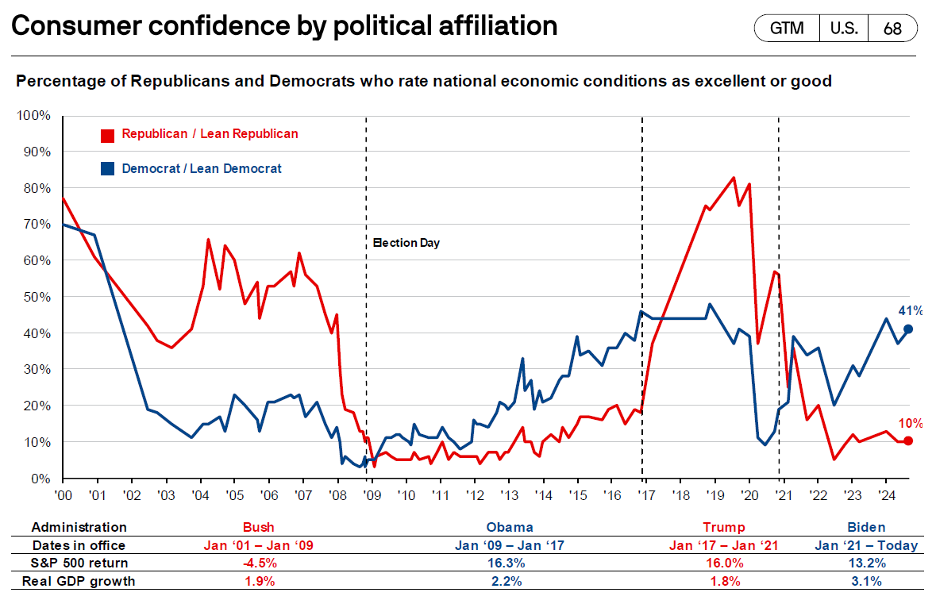

The Role of Media and Political Bias in Market Reactions

Media coverage and political rhetoric can also heighten emotions, prompting more reactive buying or selling. Markets dislike uncertainty, and elections introduce unpredictability until the results and new policies become clearer. This can be further accentuated by people’s own political affiliations. Without fail, political supporters leaning toward one side of the aisle or the other, have a more positive view about the markets and the economy when their preferred party is in power, regardless of the fundamentals of the economy. The chart below highlights how quickly views on the economy can change after an election. This sharp reaction to the results of an election can fuel further volatility post-election.