Small-Cap Returns in 2024: Breaking a 46-Year Pattern

Small caps logged respectable returns in 2024, but like a broken record, took another turn and lagged behind their large cap brethren. That is neither awe inspiring nor shocking given small caps’ 14-year relative underperformance run. What is truly shocking is that the Russell 2000’s 11.5% return in 2024 marked the first time in the index’s 46-year history that it had a return between 6% and 14%. Prior to this, the Russell 2000 had seen returns greater than 14% in 27 years, and returns below 6% in 18 years, but never a return in the 6-14% range until this past year. Shocking because the index’s average return is 11%.

Why a Small-Cap Cycle May Be on the Horizon

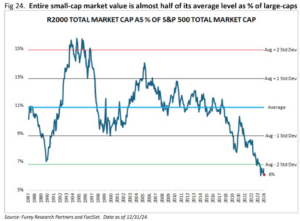

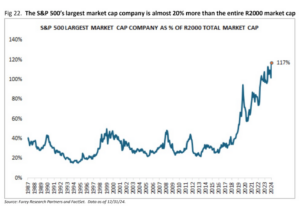

In prior commentaries, we have covered why we think we are close to seeing a small cap cycle. First, everything is inherently cyclical and large cap leadership is long in the tooth. Second, small cap valuations are near the low end of their range compared to large. (Furey Research, 2024 Year End Letter. pg. 51). Third, small caps kick butt in the year after presidential elections with average returns of 17.6% and no negative years (Furey Research, 2024 Year End Letter. pg. 5). And lastly, the world’s largest companies can’t grow to the moon!

Economic Shock and Awe: Implications for Small-Cap Companies in 2025

Shock and awe is a military strategy that overwhelms an enemy’s perception of the battlefield. It uses rapid, concentrated strikes to create confusion and disarray. This approach, popularized during the Gulf War, relies on the element of surprise and the swift execution of force to incapacitate the opponent psychologically, and physically. As we look ahead, incoming President Trump has signaled plans for bold, sweeping actions that could reshape not just the geographic landscape–think Panama and Greenland–but also the economic landscape. Policies such as significant tariff increases on our closest allies, Canada and Mexico, and stringent immigration reforms could deliver an economic “Shock and Awe,” profoundly affecting many industries.

How Economic Policies Could Spark Small-Cap Growth

While these policies may seem disruptive at first glance, their broader economic implications could create unexpected opportunities, particularly for small-cap companies poised to thrive in a domestic-focused landscape. Higher tariffs would likely raise the cost of imported goods, driving inflationary pressures across the economy. Similarly, policies aimed at reducing the immigrant workforce could exacerbate labor shortages in key sectors, further pushing wages and costs upward. While these measures may create near-term turbulence, they could also ignite opportunities for small-cap companies better positioned to adapt to a shifting domestic-focused economy.

The ripple effects of such policies could set the stage for a revitalized era of growth for small caps.

Looking Ahead: Small-Cap Market Opportunities in 2025

At Riverwater, our focus remains on identifying high-quality small-cap companies with sustainable business models and durable competitive advantages, and we feel confident that we can continue to uncover opportunities no matter where the economic and geopolitical cycle takes us.

Small-Cap Investment Spotlight: National CineMedia (NCMI)

One company that highlights the resilience and growth potential of small caps is National CineMedia (NCMI). Known for its pre-movie advertisements featuring major brands like Coca-Cola and AT&T, NCMI built a stable business model that thrived until the disruptions of COVID.

COVID happened and many people stopped going to the movies; the company actually declared bankruptcy as advertisers stopped advertising with no one around to watch. So what is great about that for new shareholders is they wiped out a billion dollars of debt and left the company in a net cash position.

Once COVID pressures eased, there was unfortunately a writer and an actor’s strike in 2023. So we really haven’t had as many great movies for the last couple of years as we did pre-Covid. That is now changing. We believe if we can just get back to 85 percent of attendance versus where we were in 2019, the wheels will really start to turn on cash flows for National CineMedia. We did “boots on the ground” due diligence in December to see the re-release of Interstellar on IMAX. The theatre was full on a weeknight and we saw ten minutes of Fortune 500 companies advertise with NCMI, which included Amazon, Google and Allstate.

The box office will improve again in 2025 but really starts to become interesting in 2026, with a very solid movie slate already announced, where we think the odds are high that the box office for the year can get back to pre-pandemic sales levels of $11.4 billion in 2019. Another aspect of the story is that all the pre-Covid advertisers have not yet returned with the lack of quality movies not being what we historically had. That changes in 2025 and 2026. With the investments management has made in technology and tracking ROAS (return on ad spend) we think advertisers will shift ad spend back to the movies.

Using pre-pandemic box office numbers and still using conservative estimates on advertising inputs, we estimate sales north of ~$350million in 2026 (vs. $445 million in 2019). This significantly outperforms what wall street is forecasting. Using a 30% EBITDA margin (in 2019 it was 45%), NCMI produces $105mil of EBITDA which mostly converts to free cash flow because of minimal need for CapEx. With an enterprise value of ~$560mil today, NCMI is valued at roughly 5.3x EBITDA and we believe our estimate is conservative.

Over the next two years, we believe they’ll generate close to a hundred million dollars each year in free cash flow. That is roughly a 17 percent free cash flow yield per year with no debt, and we believe attendance is heading in the right direction.

While any shock and awe could permeate through the economy we feel confident that the movie industry will be somewhat insulated and the only “Shock and Awe” for NCMI would be a re-release of the 2017 movie starring Woody Harrelson, Rob Reiner, and Tommy Lee Jones. It only receives 28% on Rotten Tomatoe’s Tomatometer so doubtful it sees a reappearance like Interstellar which earned 72%.

Positioning for Small-Cap Success Amid Market Uncertainty

As we navigate the complexities of 2025, we remain steadfast in our belief that small-cap companies, like National CineMedia, offer compelling opportunities for growth. Their ability to adapt, innovate, and thrive in a dynamic economic environment underscores the value of investing in high-quality businesses with sustainable competitive advantages.

While market uncertainty is inevitable, our disciplined approach to identifying resilient companies positions us to deliver strong results for our clients. We look forward to the coming year with optimism and commitment to our mission of making the world a better place by growing wealth through sustainable investing.

Wishing you a prosperous and fulfilling 2025!

Sincerely,

The Riverwater Small Cap Team

The information contained herein represents the opinion of Riverwater and should not be construed as personalized or individualized investment advice. Analysis and opinion expressed in this report are subject to change without notice. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.