Market Insights from 2024

As we close out another dynamic year in the financial markets, one theme that investors may have overlooked is the power of diversification. While U.S. equity markets dominated headlines with exceptionally strong back-to-back annual returns, a wide array of asset classes also contributed positively to portfolios. From the S&P 500 achieving its first consecutive 20%+ annual gains since the late 1990s to gold surging over 25%1, and even Bitcoin reaching new highs after regulatory advancements, this year underscored the importance of looking beyond a single market segment. Amid improving economic growth, a robust consumer, and easing short-term interest rates, diversified portfolios can offer investors a cushion against concentrated risks and access to less-publicized opportunities in 2025.

Market Review 2024: Equity, Fixed Income, and Economic Highlights

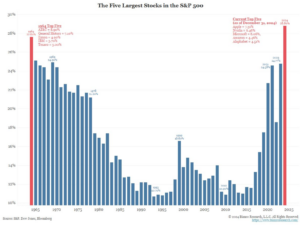

By the end of last year, U.S. equity markets stood out with back-to-back years of 20%+ performance. The S&P 500 delivered a remarkable 23.3% return, following its 2023 return of 24.2%, driven largely by the “Magnificent 7” large-cap stocks. These few key players contributed 53% of the index’s 2024 gains, continuing the concentrated nature of the prior year’s rally and evident by the chart below, concentration in the top 5 names is at the highest point over the last 60 years.2

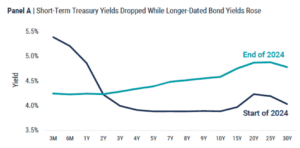

In the fixed-income markets, the story was more nuanced. The Federal Reserve’s decision to cut interest rates three times beginning in September, totaling 100 basis points, played a pivotal role in shaping bond market performance. Despite these rate cuts, longer-term rates trended higher, offsetting some of the benefits from elevated starting income levels.

The bond market ended the year with a modest 1.2% gain. For the third consecutive year, maintaining a short-duration posture proved to be the optimal strategy, marking a significant departure from trends seen over the past 40 years.

On the economic front, resilience was the defining theme. The labor market remained strong, with the unemployment rate edging up slightly to 4.2% from an incredibly tight 3.7% at the start of the year.3 Meanwhile, average wage earnings grew by over 4%, bolstering consumer strength.4 Inflation, while moderating, continued to present challenges as it inched closer to the Federal Reserve’s 2% target. The inflation rate, as measured by CPI, declined to 2.7% from 3.3% at the start of the year, but shelter costs and food prices remained stubbornly high, highlighting the complexities of achieving price stability.5

2025 Investment Outlook: Small Caps, International Equities, and Bonds

Looking ahead, the interplay between government policy, central bank actions, and macroeconomic trends will continue to shape the investment landscape. On the positive side, economic growth has been resilient, and inflation, while uneven, continues to trend downward. Technological advancements, particularly in Artificial Intelligence, are enhancing productivity in unexpected ways, adding to optimism for future returns.

However, there are reasons for caution, including elevated U.S. equity market valuations and the potential impact of new policies under the Trump administration. Following consecutive years of strong, highly concentrated returns in the U.S. stock market, the S&P 500 is trading at valuations higher than at any point since the dot-com bubble, except for a brief period in 2021. Additionally, concentration in the top 10 positions of the index has reached its highest point in the last 30 years.6 While these factors do not necessarily signal an immediate threat to the bull market, they do warrant a closer look at other, potentially more attractive areas.

Why Small-Cap Stocks Are Poised for Growth in 2025

Given cheaper valuations, the likelihood of lower interest rates, and the Trump administration’s focus on domestic policies, small caps appear well-positioned for a strong year. Tariff implementation or negotiation strategies could benefit domestically oriented small-cap companies, while lower interest rates may improve profit margins for these companies, which often rely on floating-rate debt. With valuations already at attractive levels, small caps seem poised to deliver compelling returns.

International Equities: A Hidden Opportunity for 2025 Investors

Similarly, international equities, which have underperformed U.S. large-cap stocks over the past decade, present a potential opportunity. While U.S. markets have historically traded at a premium relative to international markets, current valuation disparities exceed two standard deviations from historical norms—meaning this only happens less than 2.5% of the time. Coupled with the Trump administration’s desire for a weaker dollar to boost exports, a shift in the dollar’s trajectory could catalyze international outperformance for the first time in over a decade. While this shift may not happen immediately, a mean reversion appears increasingly likely over time.7

The Bond Market Outlook: Challenges and Opportunities in 2025

On the bond side, the outlook is cautiously optimistic. Longer-term rates remain elevated, while shorter-term rates are expected to stay higher for longer. Although some Trump policies have stoked inflation fears, leading to an uptick in interest rates and inflation expectations, falling inflation levels could set the stage for a strong year in bonds. If inflation remains stubbornly high, however, rates may continue to rise, presenting challenges for fixed-income markets. A prudent approach would involve focusing on high-quality bonds with a duration slightly shorter than the index average.

How Diversification Protects Your Portfolio in Uncertain Times

This year’s market performance reinforces the importance of maintaining a diversified portfolio, particularly in an environment of evolving economic and political conditions. While U.S. large-cap equities have driven recent gains, their elevated valuations and concentrated nature suggest caution. Small caps and international equities, with their more attractive valuations and potential catalysts such as domestic policy shifts and a weaker dollar, offer compelling opportunities for the year ahead. Bonds, despite recent challenges, remain essential for portfolio stability and income.

The true strength of diversification lies not just in its ability to enhance returns but in its role as a risk mitigator. By maintaining exposure across a range of asset classes, investors can better navigate market volatility and position themselves for sustainable, long-term growth. As always, disciplined asset allocation and incremental adjustments are key to aligning portfolios with long-term objectives while adapting to changing conditions. Diversification remains the cornerstone of prudent investment strategy, offering both opportunity and resilience in an uncertain world.

Responsible Investing in Action: Impax Asset Management

To underscore Riverwater Partners’ commitment to making the world a better place through responsible investing, we spotlight the positive impact of our fund managers through their sustainable investments. Impax Asset Management is a specialist asset management firm based in London that focuses on investing in the transition to a more sustainable global economy. Founded in 1998, the company is dedicated to generating superior investment returns by supporting environmentally and socially responsible businesses.

Impax manages environmentally focused equity investments across several key domains: renewable energy, water management, waste management and sustainable infrastructure.

An example of this in action is Impax’s engagement with Generac, a supplier of standby power generators headquartered just outside Milwaukee, WI. Since 2019, Impax has engaged with Generac on multiple topics including measuring and disclosing greenhouse gas emissions, setting science-based emission reduction targets, and developing a net-zero transition plan. In 2023, Generac disclosed its Scope 1 and 2 greenhouse gas emissions for the first time. It is currently assessing Scope 3 emissions and intends to disclose the data along with climate-related risk management assessment findings. Impax continues to engage with Generac and has encouraged it to set emission reduction targets aligned with the Science Based Targets initiative (SBTi) framework.

Impax continues to implement its stewardship and advocacy framework in addition to being a thought leader in sustainable investing.

Closing Thoughts: Building Resilient Portfolios with Diversification

As we reflect on 2024 and look ahead to 2025, one lesson stands out: the strength of a well-diversified portfolio. Diversification is more than a strategy—it is a cornerstone of resilience in uncertain markets. By spreading investments across asset classes, geographies, and sectors, investors can mitigate risks, capitalize on opportunities, and maintain steady progress toward their long-term financial goals.

While the concentrated performance of U.S. large-cap equities has dominated recent headlines, the elevated valuations and concentrated nature of these gains warrant caution. Instead, the potential for growth in small caps, international equities, and high-quality bonds offers compelling opportunities for those willing to look beyond the spotlight.

At Riverwater, we remain committed to helping our clients navigate these shifting landscapes by aligning portfolios with their unique goals and values. Our disciplined approach to asset allocation, coupled with a focus on responsible investing, ensures that your investments are positioned not only for returns but also for meaningful impact. Together, we can build resilient portfolios that weather market uncertainties and drive long-term success.

As always we appreciate your continued trust and confidence.

Footnotes

1. Ycharts SPDR Gold Shares Performance

2. Factset

3. YCharts Unemployment Rate

4. Ycharts Average Hourly Earnings Growth YoY

5. Ycharts US Inflation Rate

6. JPM Guide to the Markets – Q1 2025

7. id

Disclosures: The information contained within this update represents the opinion of Riverwater Partners and should not be construed as personalized or individualized investment advice. Reader should not assume that investments in the securities identified were or will be profitable. Timing differences of purchases and sales may have a modest impact on the actual contribution numbers presented. The holdings identified do not represent all the securities purchased, sold, or recommended. Past performance does not guarantee future results.