Small-Cap Stocks Q1 2025 Update: Pinching Pennies Amid Tariff and Fiscal Headwinds

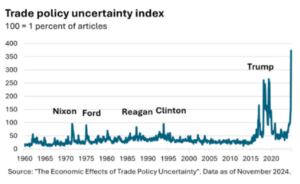

Small-cap stocks took a step back in this quarter. This followed strong momentum after the November election. Tariff announcements created significant business uncertainty as they flipped between on again off again tariff announcements with two of our largest trading partners, Canada and Mexico. The current administration’s tariff policies differ in two ways from the last tariff policy initiations in 2018. First, the previous round of tariffs came after significant corporate tax cuts. Second, the last round was focused on China and not Canada, Mexico, and the rest of the world.

Canada and Mexico are intricately enmeshed in our supply chains. We have had the largest free trade zone in the world for over 30 years with NAFTA and then its successor the USMCA. Businesses gained confidence to allocate capital in both Canada and Mexico thanks to these agreements. Business sentiment surveys are already reflecting sudden uncertainty around these trade relationships.

Government Spending and Fiscal Policy

Fiscal policy shifts are adding another layer of uncertainty to the economic outlook. The new administration’s emphasis on spending cuts coincides with the final phaseout of pandemic-era stimulus measures. This will likely slow economic growth in the short term.

President Trump’s recent decision to eliminate the penny is symbolic. It shows how cost-cutting policies can have hidden consequences. Like the penny—which costs 3.7¢ to mint but is worth only 1¢—many federal programs are being evaluated for their immediate cost rather than their broader economic impact. This mindset echoes the administration’s tariff approach: headline-driven policies that overlook supply chain complexity. For example, it’s estimated the average American-made car could cost $3,500 to $10,000 or more under the proposed tariffs.

Eliminating the penny may seem like a cost-saving measure, but it raises further questions. The nickel, which costs 13.8¢ to produce versus its 5¢ face value, results in an even greater loss—8.3¢ per coin. If more nickels are minted to offset penny loss, the US Mint’s net losses could increase. And removing both coins would force retailers to round prices, potentially pushing them higher and contributing to inflation. Tariffs could have a similar effect: narrow, targeted measures that lead to broad and compounding economic consequences as trade partners retaliate. Tariff announcements are coming in as we write and clearly the market has reacted negatively to both US tariffs and affected countries counter tariffs.

As we look to add new companies to our portfolios, we are certainly cognizant of companies’ supply chain dependencies and foreign sales exposures. We’re likely to avoid businesses vulnerable to an extended tariff war. Fortunately, we believe small-caps are better positioned than large caps as it relates to tariff exposures because of their domestic orientation.

Valuation: The Small-cap Opportunity

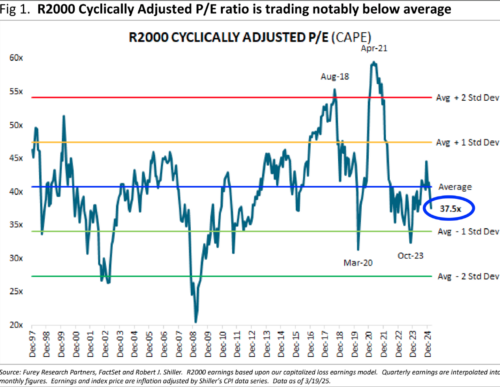

Investors pulled back from the Russell 2000 in Q1 2025, driving a 9.5% decline and underperformance versus large caps, with the S&P 500 declining 4.3% over the same period. This reversal highlights small-cap volatility in response to policy shifts. While the media focuses obsessively on the “Magnificent Seven,” small-caps are quietly trading below their historical valuation averages. Using the Shiller CAPE (cyclically adjusted price-to-earnings) methodology, which smooths earnings over a ten-year period to temper the effects of earnings booms and busts, we find compelling evidence that small caps offer significant value. Thanks as always to our friends at Furey Research Partners for actually creating a CAPE for the small cap market.

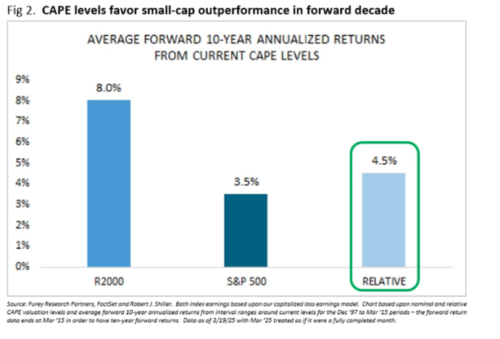

Analysis of Furey’s work on the Russell 2000 CAPE ratio reveals:

- Small-cap CAPE valuation is trading below its long-term average at 37.5x

- Large-cap CAPE valuation is near one standard deviation above its long-term average

- Small vs. large relative CAPE valuation is near all-time lows

- Historical data suggests small-caps may deliver approximately 8.0% annualized returns over the next decade from current levels, compared to just 3.5% for the S&P 500

This significant valuation discount suggests that despite near-term challenges, the stage is being set for potential small cap outperformance over the long term. The last time small caps traded at such a significant discount to large caps was in the late 1990s, which was followed by several years of substantial outperformance.

Looking Ahead: Navigating the Changing Landscape

Despite the challenging quarter, two potential catalysts could drive small-cap outperformance as 2025 progresses. First a resolution of tariff and fiscal uncertainties. Second, valuation recognition: the substantial discount of small cap valuations compared to large may finally attract increased investor attention, especially if large cap growth begins to slow. Valuations are never a catalyst in themselves, but they could certainly add fuel to the fire if they do take the mantle of leadership.

Conclusion

While small-caps face real challenges in the current environment, history suggests that periods of significant underperformance and valuation discounts often present the most attractive entry points for long-term investors. The Russell 2000’s current CAPE ratio–well below historical averages– provides a substantial margin of safety that should help mitigate downside risks while positioning for future appreciation.

For investors with appropriate time horizons, the current environment may offer an opportunity to increase small-cap exposure at valuations that have historically preceded periods of outperformance. While near-term volatility is likely to persist until tariff and fiscal policies stabilize, the compelling valuation case for small-caps continues to strengthen.

Adam J. Peck, CFA

Founder and CIO

The information contained herein represents the opinion of Riverwater and should not be construed as personalized or individualized investment advice. Analysis and opinion expressed in this report are subject to change without notice. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.