Limoneira: Turning Lemons into Guacamole –

At Riverwater Partners, we focus on idiosyncratic investment opportunities—overlooked or misunderstood cases where hidden catalysts can unlock asymmetric returns. Our research process favors fundamental analysis, contrarian perspectives, and a disciplined search for companies where hidden catalysts are poised to drive outsized long-term value.

An Idiosyncratic Value Opportunity Overlooked by the Market

Limoneira Company (Nasdaq: LMNR) exemplifies this philosophy: a 131-year-old agricultural business that stands out not only for its longevity, but also for its commitment to environmental stewardship. The company is undergoing what we consider to be a profound — and under-appreciated — transformation with the stock trading at what we consider to be less than half of its true worth. Why is that, and how does the gap close?

Investment Highlights

- Secular tailwinds: U.S. avocado consumption has grown at a 4.4% CAGR over the past decade1

- Business model evolution: Transition to an asset-lighter model may potentially improve margins and capital efficiency

- Hidden asset value: Real estate holdings and water rights could represent substantial premium to balance-sheet value

- Multiple near-term catalysts: Several potential monetization events expected over the next 24–36 months

These characteristics are representative of many of the idiosyncratic investment opportunities we pursue, where pricing inefficiencies can lead to attractive upside.

Why This Opportunity Is Misunderstood

Our research suggests that investors may be overlooking key aspects of Limoneira’s strategic transformation. While the stock declined significantly following the conclusion of a strategic review without an outright sale, we believe this decline created an opportunity for long-term investors.

The company initiated a strategic review in late 2023, with management incentivized to achieve a minimum value of $28 per share. Based on public disclosures and our analysis, it appears bids were submitted but potentially fell short of this threshold.2 We believe this outcome triggered selling by investors who were primarily focused on a near-term sale rather than the company’s long-term value creation potential.

The key distinction between speculating and investing is the depth of due diligence and investment time horizon. We believe a large portion of Limoneira’s shareholder base consisted of speculators betting on a quick sale within a 12-month timeframe. When this did not materialize, they exited their positions.

What these short-term traders missed, in our view, is the substantial value that could be created through several catalysts over a multi-year horizon. As the CEO of Limoneira Harold Edwards noted at the 2025 ICR investor conference, converting agricultural land to residential or commercial use “typically comes with a 10 times increase in value.”3 Just recently, another publicly traded agricultural company, Alico (ALCO), announced they were exiting crop production entirely to focus on developing their land in Florida. We surmise they agree with the thesis of value creation in land conversion.

While the value creation through land conversion typically requires a ten-year entitlement process, we don’t believe investors need to wait nearly that long for the Limoneira management team to create value. The short-term disappointment in the sale process created what we see as a classic idiosyncratic investment opportunity—mispriced, misunderstood, and ripe for long-term value creation.

Four Catalysts for Near- and Mid-Term Value Creation

- Converting lemon acreage to avocados that are at least 5x more profitable per acre

- Monetizing non-core land and water rights

- Developing Harvest at Limoneira

- Continuing the transition from a predominant lemon grower to serving grower partners

1. Strategic Shift to Avocado Production

Limoneira is strategically shifting towards avocado production, a significantly more profitable segment with growing demand in the United States.

US avocado consumption has grown at a 4.4% CAGR over the past decade, reaching 9.2 pounds per person annually.4 In comparison, avocado consumption in Mexico is 23.5 pounds per person per year! While it is unlikely that the US will reach Mexico’s consumption rate in the near future, we believe that US avocado consumption will continue to increase.

Our research indicates compelling unit economics:

- Avocados generate $25,000 revenue per acre at $1.30/lb, with $8,500 per acre production costs, compared to lemons at $2,000–$5,000 revenue per acre5 in today’s oversupplied market

- Expansion plans: Increasing from 800 to 2,000 avocado acres while doubling tree density from 90 to 180 trees per acre5

- Potential financial impact: At full production post-2028, our models project possible revenues of $40M at $1.30/lb pricing (management’s conservative estimate) or up to $74M at year-to-date 2025 market pricing (~$2.50/lb) and $25M+ in operating income at 70% margins based off of 2024 EBIT margins

- Potential tariff benefit: With approximately 90% of U.S. avocados consumed in the United States imported from Mexico,6 recent tariff implementations could create favorable pricing conditions for domestic producers like Limoneira

When compared to industry peer Mission Produce (trading at 13.5x operating earnings), the avocado business alone could potentially be valued at $338 million—exceeding the company’s entire current market cap of $300 million.7 While this projection depends on planting fully producing trees, the execution risk is very very low in our opinion. We’ll take a bet on growing trees with tariff upside any day over estimating imported goods pricing over the next few years.

2. Asset Monetization Opportunities

Limoneira has demonstrated its commitment to asset monetization, having sold $130M in non-core assets in 2022–2023 before pausing during the strategic review process. Our research identifies several potential additional monetization opportunities:

- Selling a 724-acre vineyard in Paso Robles that is currently being marketed8

- Water rights portfolio: Three recent sales confirmed $30,000 per acre-foot valuations across multiple transactions9

- 1,300 acre-feet of Arizona water rights are likely to appreciate significantly as the Bureau of Reclamation’s 2026 mandate approaches and could reduce Colorado River consumption by 30% depending on water levels10

We estimate non-core land and water rights are worth at least $100M, with potential for near-term monetization of $30M+ (10% of current market cap) through selective water rights sales.

3. Real Estate Development

Limoneira’s 50/50 partnership with the Lewis Group of Companies is developing 200 acres in Santa Paula, California, currently in its third and final phase.11 Their share of the joint venture has:

- No recourse debt and +$20M in cash (following a recent $10M distribution)

- Projected $165 million in additional cash distributions over the next six years

- Both residential and 40 acres of commercial development remaining

This represents more than 50% of the current market cap in relatively predictable cash flows. Last year the company received $15 million from this venture, with additional distributions expected in coming years.

4. Business Model Transformation

Limoneira is transitioning from predominantly growing its own lemons (80% self-grown, 20% third-party)12 to primarily serving as a packer and marketer for partner growers (20% self-grown, 80% third-party). As part of this effort, they modernized their packing facility which can handle 7 million cartons of lemons per year. At 150 lemons per carton we are talking about 1 billion lemons flowing through their system. This shift:

- Maintains similar revenue levels while potentially providing more stable, consistent cash flows

- Generates approximately $2 per carton in margins on third-party packing

- Reduces exposure to the currently oversupplied lemon market

- Leverages their modernized packing facility capable of handling 7M cartons annually

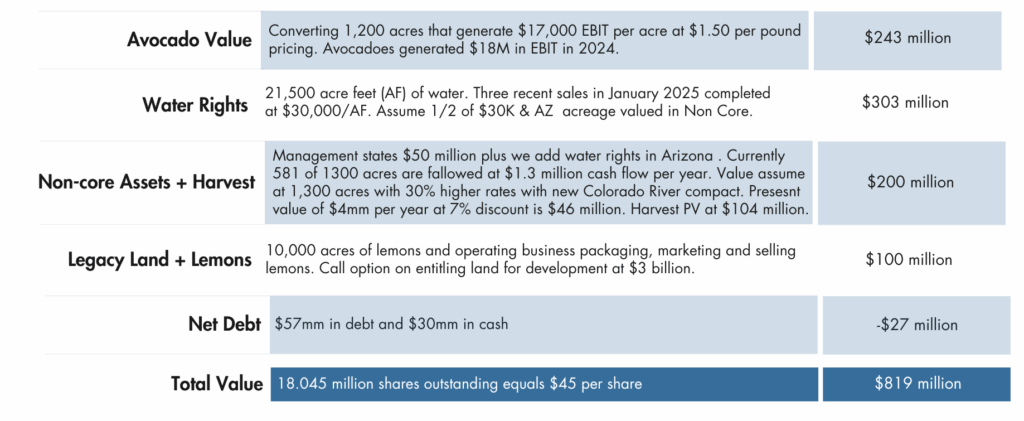

Sum of the Parts Valuation: Significant Discount to Intrinsic Value

“When life gives you lemons, keep them, because hey, free lemons.” – Ricky Gervais

We see a lot of “free lemons” with Limoneira. Our analysis suggests a potential disconnect between market value and intrinsic value:

- Agricultural land and water rights: Company estimates values between $450–$550M13

- Development joint venture: Expected to generate $165M in additional cash flows14

- Accounting for debt and other factors: Our analysis suggests a potential fair value of $800M or approximately $45 per share—more than double the current market price.

Additionally, the management team has outlined various operational initiatives that they believe could improve cash flows by up to $30 million over the next seven years. If these improvements materialize as projected, a 50% increase in cash flows within three years seems achievable, potentially translating to a 50% increase in stock value just from operational improvements and absent ANY monetizations.

Sustainability Leadership: A Competitive Advantage

We also commend Limoneira’s commitment to sustainability, with 44% of its operations now powered by renewable energy, up from over 30%15. The company uses high-efficiency irrigation and moisture monitoring systems for 85% of its water usage, conserving water and supporting sustainable agricultural practices.15 Over the last ten years Limoneira has applied 16,320 tons of compost to 1,860 acres of what would have been waste sent to landfills.15

Investment Considerations

- Timeline: Full realization of value from avocado expansion may take 3–5 years

- Agricultural risks: Weather events, disease, and commodity price fluctuations

- Real estate development uncertainties: Potential timing delays or market shifts

- Water rights valuation: Regulatory changes could affect water asset values

Limoneira’s sustainability profile further strengthens its appeal as an idiosyncratic investment opportunity aligned with both values and value.

Conclusion: A Unique and Idiosyncratic Investment for Long-Term Investors

The company’s combination of agricultural transformation, hidden asset value, and clearly identified monetization catalysts appears to align with our investment philosophy of identifying idiosyncratic drivers that may create asymmetric opportunities.

This commentary reflects the views of Riverwater Partners as of April 2025 and is subject to change without notice. It is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. References to specific securities are for illustrative purposes only and may not be representative of all client portfolios. Any forward-looking statements or forecasts are based on assumptions that may not come to pass. Past performance is not indicative of future results. Investors should consult their financial adviser before making any investment decisions. These projections represent Riverwater’s internal estimates based on publicly available information and are not guarantees of future performance. Riverwater Partners and its clients may hold positions in the securities discussed, which may create a conflict of interest.

Links to third-party sites are provided for convenience and do not imply endorsement. Riverwater is not responsible for the accuracy or content of external sites.

Footnotes

-

-

-

Limoneira Co.(LMNR-US), Stephens Investment Conference, 21-November-2024 Transcript.

-

Limoneira Investor Deck, April 2025.

-

Q1 2025 Earnings Call Transcript; April 2025.

-

Limoneira Co.(LMNR-US), Stephens Investment Conference, 21-November-2024 Transcript.

-

Limoneira Investor Deck, April 2025.

-

Id.

-

Limoneira Co.(LMNR-US), Stephens Investment Conference, 21-November-2024 Transcript.

-

https://homes.sothebysrealty.com/windfallfarms/full-view.html

-

Limoneira Co.(LMNR-US), Stephens Investment Conference, 21-November-2024 Transcript.

-

Id.

-

Id.

-

Id.

-

Limoneira Investor Deck, April 2025.

-

Id.

-

Limoneira Investor Deck, April 2025.

-

-