When a friend or family member names you as trustee, it feels like an honor—a profound sign of trust and respect. But along with that honor comes something they rarely mention upfront: the keys to somebody’s financial legacy, a 100-page legal document written in dense legalese, anxious beneficiaries with competing needs, and the constant shadow of personal liability. Welcome to the complex reality of serving as a trustee.

What becomes clear quickly is the considerable knowledge and experience required to fulfill this responsibility effectively. As one client recently confided, “I thought I was simply honoring my brother’s wishes—I had no idea I was signing up for a part-time job without training or support.

Beyond the Honor: The Unseen Burden

This sentiment echoes what we regularly hear from trustees. While banks were traditionally appointed as trustees, today’s families increasingly choose individual trustees who must navigate a labyrinth of complex responsibilities:

- Deciphering trust documents written in legal language

- Making investment decisions that balance growth with preservation

- Justifying discretionary distributions while maintaining family harmony

- Documenting and disclosing decisions

- Making decisions in the best interest of someone you may not have a relationship with

Three Decisions Critical to Every Trustee

In our decades working alongside trustees, we’ve identified three critical decision points that separate successful trusteeships from problematic ones:

1. The Investment Paralysis Trap: When markets fluctuate dramatically—think 2008, 2020 and 2022—many trustees freeze. They don’t know whether to act, how to act, or what to communicate to beneficiaries. This paralysis itself becomes a decision with serious consequences. Managing extreme market volatility is challenging enough with your own assets, let alone with a trust designed to benefit others for whom you bear fiduciary responsibility.

2. The Communication Chasm: Even well-intentioned trustees often under-communicate with beneficiaries. Sometimes it’s uncertainty about what to share; other times it’s discomfort with difficult conversations. Poor communication creates suspicion where none should exist.

3. The Documentation Dilemma: Many trustees make sound decisions but fail to document their reasoning—creating vulnerability if decisions are later challenged. Proper documentation demonstrates thoughtful stewardship and protects the trustee.

From Burden to Confidence: A Strategic Approach for Trustees

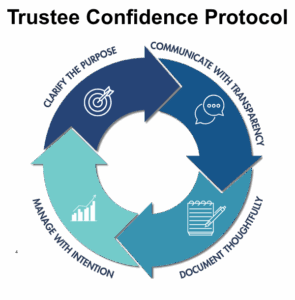

Rather than viewing the duties of a trustee as isolated, forward-thinking fiduciaries embrace a holistic framework. This approach connects documentation, communication, and investment management into a cohesive strategy revolving around the purpose of the trust and the beneficiaries —both current and future.

At Riverwater Partners, we have developed a “Trustee Confidence Protocol” that transforms overwhelming trustee duties into a manageable, systematic process. This framework provides both peace of mind and confidence for trustees and transparency for beneficiaries.

With this integrated approach, trustees no longer have to piece together disparate advice from multiple sources. Instead, every decision becomes part of a documented process designed to fulfill fiduciary duty with clarity and purpose.

The Privilege Hidden Within the Responsibility

Here’s what I’ve learned after two decades: when done right, being a trustee can transform lives—including your own. You’re not just managing assets—you’re stewarding someone’s deepest hopes for their family’s future.

I’ve watched trustees light up when they realize they’ve helped a beneficiary start a business, complete their education, or navigate a difficult transition. That’s when you see the real purpose: you’re the bridge between someone’s loving intentions and their family’s flourishing future.

But good intentions alone won’t get you there. Trustees who thrive are thoughtful stewards focusing on what the grantor wanted to accomplish. This often requires educating beneficiaries about the trust’s purpose, making decisions that empower rather than enable, and building strategies that consider each person’s unique circumstances.

The Path Forward

Whether you’re managing your first family trust or you’re a professional handling multiple relationships, today’s trust landscape is more complex than ever. Markets are volatile, families are complicated, and regulations keep changing.

I’ve seen trustees navigate 2008’s market crash, family disputes that could have torn relationships apart, and regulatory changes that kept everyone up at night. What I’ve learned is that the trustees who succeed aren’t necessarily the smartest or most experienced—they’re the ones who recognize when they need support and aren’t afraid to ask for it.

The truth is, you don’t have to figure this out alone. When you have the right guidance and framework, your role transforms from burden to privilege. You get to be the person who helps fulfill both the letter and spirit of someone’s deepest wishes for their family—and that’s a responsibility worth embracing with confidence.

Contact Brian Gigl, CFP® at bgigl@riverwaterllc.com or 414.850.7553 to discuss how Riverwater Partners can transform your trustee experience from obligation to opportunity.