Q2 2025 Market Paradox: Trade Chaos (Check ✔), Market Rally (Check ✔)

The quarter brought the paradoxical combination of unprecedented global trade volatility with surprisingly resilient market performance. From the United States’ military engagement with Iran—which counterintuitively drove oil prices below pre-war levels—to the dramatic “TACO trade” saga where Liberation Day tariffs sparked violent market reactions before being postponed, Q2 proved exceptionally turbulent. Complex tariff negotiations continued reshaping global supply chains, while renewed Middle East tensions created additional uncertainty. It’s hard to recall a quarter so packed with sweeping global economic and geopolitical events impacting nearly every industry.

Most investors would have predicted market declines had they foreseen these events. Instead, most global equity markets not only rallied but approached or hit all-time highs, with both equity and bond markets demonstrating surprising resilience. One notable exception is U.S. small-caps. As we’ve discussed previously, we believe their relative underperformance lacks fundamental justification, and we continue to stand by that view.

Why We Invest Responsibly: The Riverwater Philosophy

My grandparents, Bernie and Micki Peck

On a personal note, I lost my grandmother this quarter, just weeks shy of her 98th birthday. Loss often brings reflection, prompting us to revisit the “whys” in our lives. I found myself asking: Why do we invest responsibly?

At Riverwater, we believe business can—and should—be a force for good. This philosophy isn’t abstract theory— it is rooted in my family’s entrepreneurial and philanthropic legacy, which directly shaped our commitment to responsible investing.

The Riverwater journey truly began generations ago, in the late 1800s, when my great-great-great-grandfather, Bernhardt Peck, established the Peck Meat Packing Corporation in Milwaukee. By the time my grandfather Bernie assumed leadership as the fourth-generation steward, the company had become one of the Midwest’s premier meat processors, employing 1,500 individuals across three states.

Here’s the crucial connection: Bernie was not only a visionary entrepreneur, but also a dedicated advocate for doing business with integrity and innovation. His unwavering commitment to quality, ethical practices, and genuine care for employees didn’t just create a positive workplace culture; it drove sustained competitive advantage. Under his guidance, the business introduced groundbreaking patented technologies and developed innovative products that transformed industry standards. His unwavering commitment to quality, ethical practices, and genuine care for employees created a model for responsible leadership that continues to influence how we operate today at Riverwater Partners. At our core, we believe that companies that prioritize stakeholder welfare outperform competitors who focus solely on short-term profits. His contributions to the industry were so significant that he was later inducted into the Wisconsin Meat Industry Hall of Fame.

Beyond his business success, my grandfather deeply understood that sustainable growth requires community investment. He established a charitable foundation to support education, arts, and civic initiatives in Milwaukee, often working quietly behind the scenes to elevate and enrich the community. By strengthening the community, he created a more skilled workforce, loyal customer base, and stable operating environment that benefited the company for decades. His example demonstrated that true leadership encompasses a commitment to broader societal impact, embedding in me a conviction that businesses and investments should generate lasting, positive change.

This family experience crystallized a fundamental truth: businesses that genuinely serve customers while treating their environment and communities well don’t just do good—they consistently outperform over time. They attract better talent, inspire greater innovation, build stronger customer loyalty, and create more resilient business models. That direct correlation between responsible practices and superior long-term returns is our WHY—and it’s why we actively seek companies that operate with this same stakeholder-focused mindset.

AI’s Impact on Small-Cap Investment Opportunities

We believe artificial intelligence (AI) will transform our lives even more profoundly than the internet did. Research suggests AI agents could become fully autonomous within a few years, reshaping industries and professions across the board.

At Riverwater, we are dedicating time to analyzing these impacts—not just theoretically, but practically. We see firsthand how integrating GPTs and AI agents into our processes unlocks operational efficiencies. This mirrors what’s happening across the economy: companies are discovering margin opportunities while employees are freed to focus on higher-value work as menial tasks become automated. We also believe nuclear energy will benefit substantially from this shift in computing demand.

The AI investment opportunity is entering a new phase. Currently, a small group of large-cap stocks have led the charge in AI, building semiconductors and data centers that required trillions in upfront investment—resources only these giants could mobilize. While companies like Nvidia have reaped early rewards from this infrastructure buildout we believe the next wave belongs to small caps which will benefit from the democratization of coding and automation over time.

Here’s why: As AI tools become democratized, smaller companies will gain access to coding and automation capabilities previously exclusive to tech giants. This levels the competitive playing field in ways that could dramatically benefit quality small-cap companies.

Small Cap Performance Outlook: Valuations vs. Growth Fundamentals

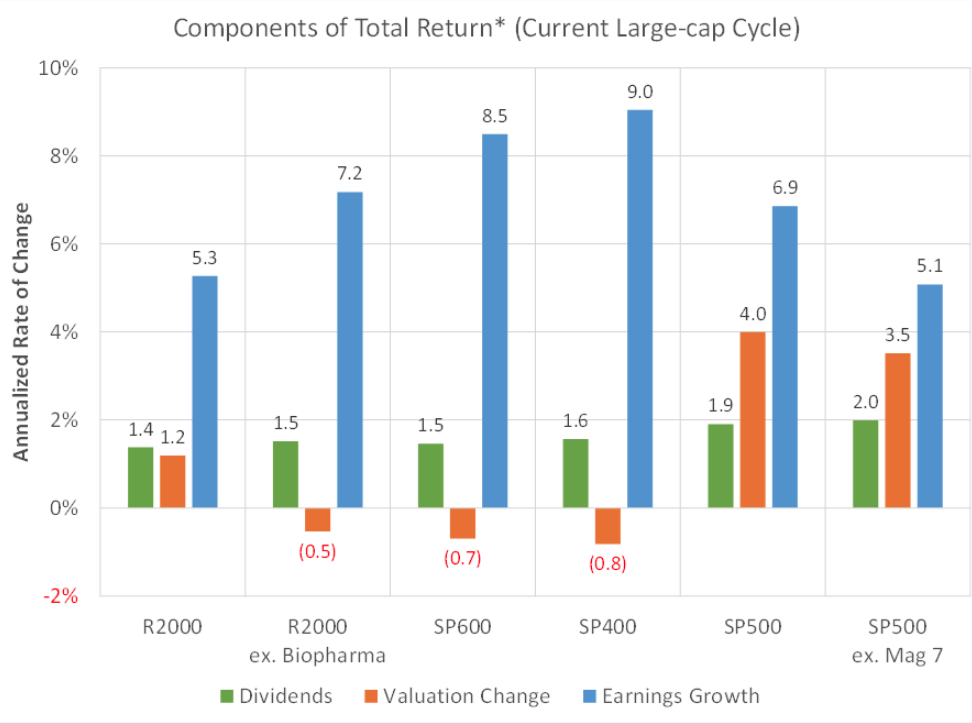

It is never easy to predict when small-caps will retake the performance lead. However, we are encouraged by two compelling fundamentals:

- Valuations remain attractive relative to history and compared to large-caps, and

- Quality small caps (excluding biopharma) have delivered superior revenue growth versus large-caps over the past decade

The puzzle is clear: if small-caps are growing faster, why have they underperformed? We believe the answer lies in investor sentiment and likely passive flows. Large-cap dominance has been driven by investors’ willingness to pay higher multiples for each dollar of earnings since 2011—four turns higher, to be precise.

We are confident this relative multiple expansion cannot continue indefinitely. When it reverts, we think that the fundamental strength of quality small-caps will drive superior returns and the WHY of investing in small-caps will become self-evident.

Adam J. Peck, CFA

Founder and CIO

The information contained herein represents the opinion of Riverwater and should not be construed as personalized or individualized investment advice. Analysis and opinion expressed in this report are subject to change without notice. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. References to “responsible investing” reflect our investment philosophy but do not guarantee performance results. Environmental, social, and governance (ESG) criteria may limit investment opportunities and could result in different performance compared to strategies that do not incorporate such criteria. Personal and family business experiences shared in this communication are for illustrative purposes only and should not be construed as evidence of investment management skill or as a predictor of future investment performance. This communication is not intended to provide tax, legal, or investment advice. Prospective investors should consult with qualified tax, legal, and investment professionals before making any investment decisions. Investment strategies discussed may not be suitable for all investors. For questions about this communication or our investment services, please contact Riverwater Partners at contact@riverwaterllc.com. Additional information about our firm is available in our Form ADV Part 2A, which is available upon request.