US Consumers and Valuation Gaps: Can the US Consumer Keep Carrying the Market?

(July 15, 2025).

The second quarter reminded us why staying grounded matters in investing. While markets celebrated new highs—with the S&P 500 breaking through 6,200—the foundations supporting this rally deserve closer examination. The quarter’s volatility, from April’s sharp selloff on tariff fears to the subsequent rebound, illustrates how quickly sentiment can shift. As we look ahead, we remain strategically grounded in our approach, focusing on where genuine opportunities lie and where risks may be underpriced.

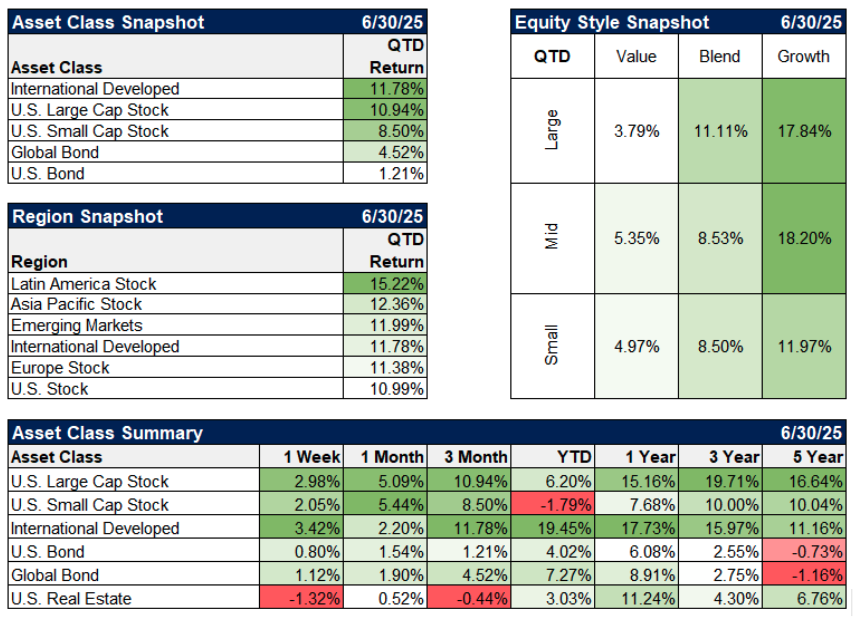

Market Performance: A Tale of Two Halves

The second quarter gave investors a masterclass in market sentiment. April’s renewed tariff threats sparked a swift selloff as investors feared escalating trade tensions. But markets proved resilient—perhaps too resilient. As trade rhetoric softened and the worst-case policy scenarios were postponed, stocks bounced back with remarkable speed, ultimately pushing major indices to new all-time highs by quarter-end.

This sharp rebound, while welcome, raises important questions about market resilience and whether current prices fully reflect the range of possible outcomes ahead.

Consumers Are Still Spending — But Can They Keep It Up?

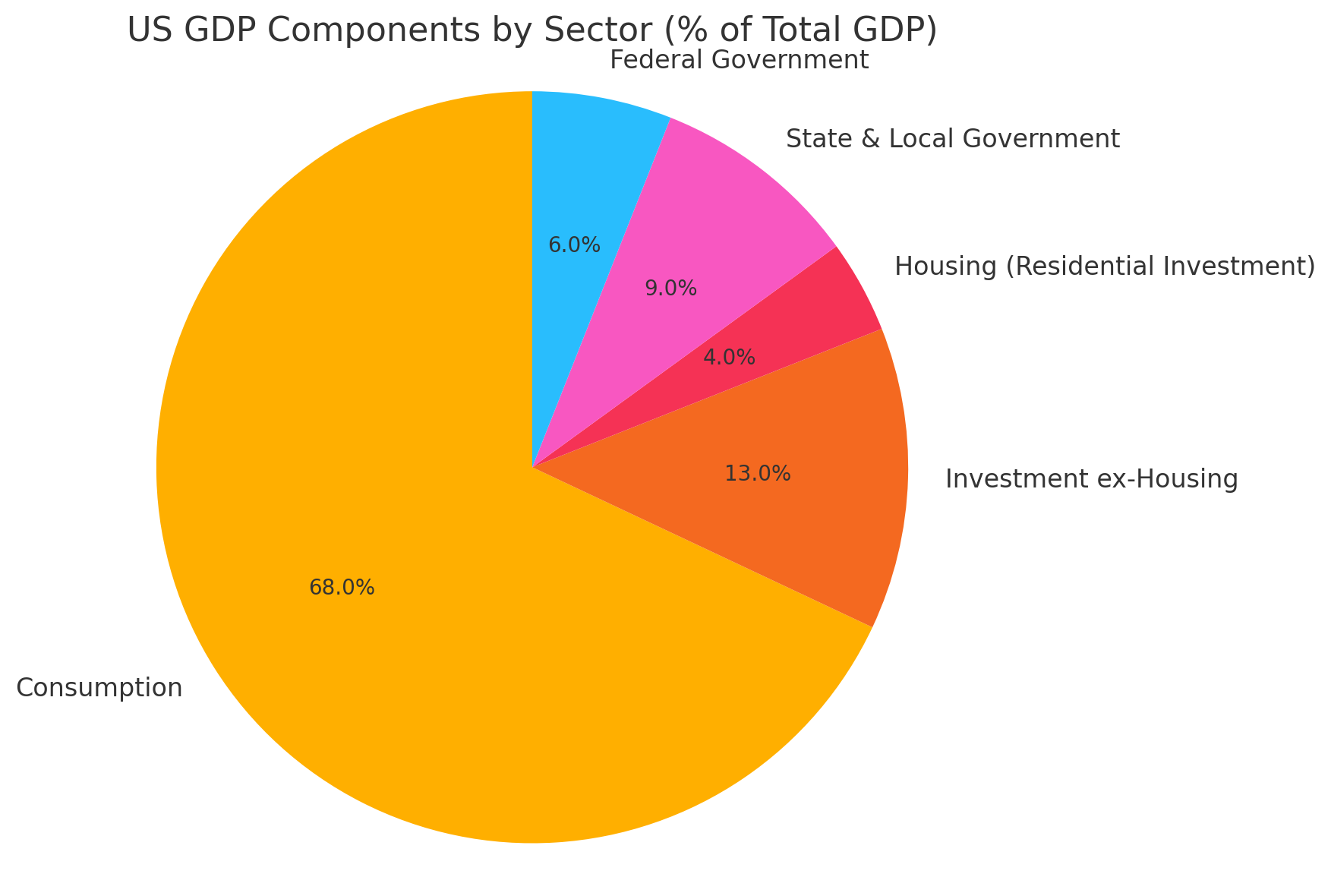

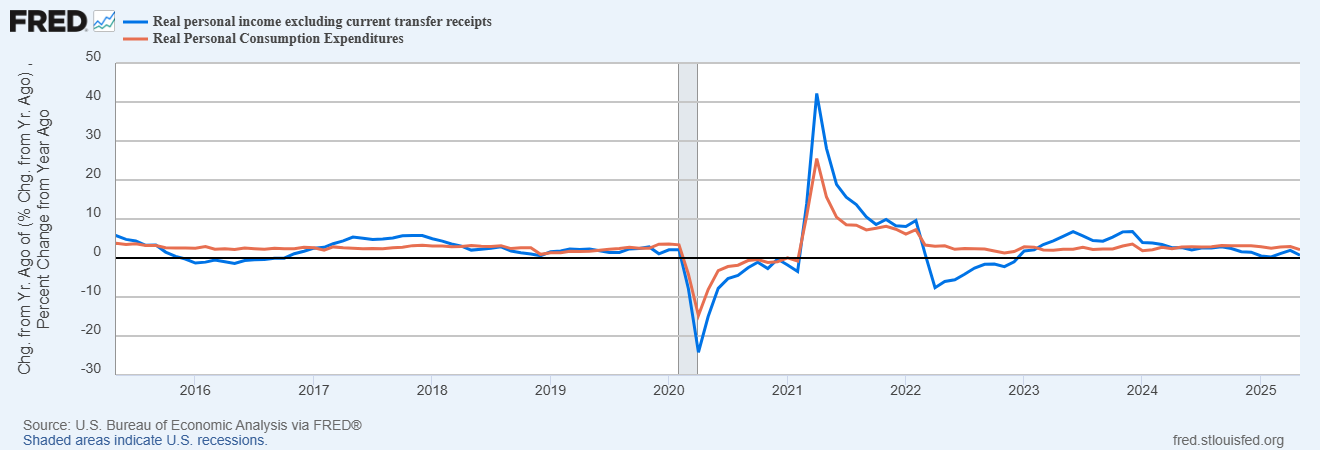

Here’s what we’re watching most closely: the health of the American consumer, which drives nearly 70% of U.S. economic activity. While headline spending numbers remain solid, the underlying picture grows more complex by the month.

The recent consumer spending strength masks some concerning underlying trends. The increase in personal income in April primarily reflected increases in government social benefits. This increase in government social benefits led by an increase in Social Security payments, reflects new payments associated with the Social Security Fairness Act, which broadened eligibility for certain groups. This dependency on transfer payments rather than organic wage growth suggests consumer resilience may be more fragile than it appears.

This doesn’t mean a downturn is inevitable, but it does suggest that consumer strength may be more fragile than markets assume. If job growth slows or prices rise again — especially due to trade-related uncertainty — spending habits could shift quickly.

Stocks Are Up — But Expectations Are High

Meanwhile, the recent market rally has pushed stocks — and valuations — to levels that, from our perspective, are pricing in perfection. The S&P 500 now trades at over 22 times expected earnings, well above its long-term average. Based on this, we would argue that investors are paying a premium for growth that assumes everything will go just right.

This quarter’s policy whiplash—from aggressive tariff announcements to subsequent rollbacks—served as a reminder of how quickly conditions can change. Tariff announcements and reversals in Q2 created short-term chaos in both business planning and investor sentiment. While markets breathed a sigh of relief after the most stringent tariff policies were rolled back, the back-and-forth on trade policy underscores the elevated uncertainty we’re seeing in the market.

Our Strategic Response: Three Core Concepts

Our positioning for the second half of 2025 reflects three core convictions:

U.S. Equities: Neutral to Slight Underweight

With the S&P 500 at elevated valuations while consumer fundamentals weaken, we’re taking a more selective approach. We’re keeping a neutral to slightly underweight stance on U.S. large cap stocks, where we believe current prices may not reflect the full range of possible outcomes.

International Equities: Strategic Overweight

Beyond attractive relative valuations, we see three compelling catalysts overseas, particularly in Europe:

- Economic Stimulus: Germany’s €500 billion modernization program and similar initiatives across the continent are creating multi-year tailwinds for industrial and infrastructure companies.

- Currency Tailwinds: After years of headwinds, currency dynamics are finally turning favorable for U.S. investors in international markets as the US Dollar has depreciated relative to many foreign currencies

- Margin Expansion: European corporate margins are expanding as wage growth normalizes post-inflation while productivity gains accelerate

International shares outperformed the S&P 500 by over 13% in the first half—a trend we believe has room to continue as investors broaden their opportunity set beyond expensive U.S. markets.

Fixed Income: Quality and Duration Focus

In an environment where equity volatility may increase, our bond positioning serves dual purposes: capturing attractive 4.0-4.5% yields while providing portfolio stability. We’re maintaining a slightly underweight duration stance to mitigate interest rate volatility but still benefit if growth concerns materialize. This positioning biases us towards high-quality investments including U.S. Treasuries, municipal bonds, and securitized bonds.

Looking Ahead: Positioned for Multiple Scenarios

As we enter the second half of 2025, we’re positioned for multiple scenarios while maintaining focus on quality, diversification, and long-term value creation. The current environment rewards patience and selectivity—qualities that have served our clients well through previous market cycles.

We believe this thoughtful, grounded approach will serve our clients well whether markets continue their ascent or face the reality check that elevated valuations and weakening fundamentals might eventually demand.

As always, we appreciate your continued trust and are here to help navigate whatever opportunities and challenges the markets bring next. Please don’t hesitate to reach out with any questions about your portfolio or our outlook.

Responsible Investment Spotlight: Calvert Asset Management