How Trustees Can Fulfill Their Duty of Care While Protecting Themselves

Being named a trustee is an honor—but it also places you in a complex role, especially if you are not experienced in this area. As a trustee, you are responsible for stewarding someone’s financial legacy while balancing family dynamics, legal obligations, and investment decisions. Missteps happen and can lead to personal liability, family discord, and unintended consequences.

Yet with the right structure and support, trustees can transform this burden into confident stewardship that benefits everyone involved.

What becomes clear quickly is the considerable knowledge and experience required to fulfill this responsibility effectively. As one client recently confided, “I thought I was simply honoring my brother’s wishes—I had no idea I was signing up for a part-time job without training or support.

The Trustee’s Duty of Care: What It Really Means

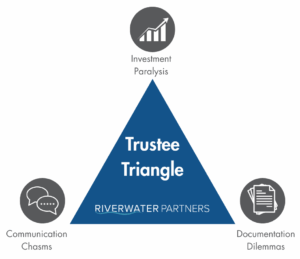

The risks are real: personal liability if decisions are questioned, family disputes that can tear relationships apart, and tax inefficiencies that erode the trust’s value over time. Many trustees find themselves caught in what we call the “trustee triangle”—investment paralysis when unsure about market decisions, communication chasms when difficult conversations are avoided, and documentation dilemmas when discretionary choices aren’t properly recorded.

But here’s the encouraging news: these challenges are entirely manageable with the right approach and support system.

The Hidden Risks Trustees Face (and Often Overlook)

Every trust is unique, and what works for one situation may not work for another. Administering a trust for a 20-year-old with decades ahead of them requires a different approach than for a 60-year-old nearing retirement. As life circumstances evolve, the approach adapts accordingly.

Some of the most common—yet overlooked—risks include:

1. Documentation gaps that create future problems. When you make discretionary distribution decisions without clearly documenting your reasoning, you’re setting the stage for potential disputes down the road. Beneficiaries and family members may question your choices years later, and without proper records, defending your decisions becomes much more difficult. It can be easy to make quick emotional decisions when a beneficiary presents their need for a distribution from the trust.

2. Misaligned distribution timing. Making distributions without considering the beneficiary’s broader financial picture can actually harm both parties. A large distribution to someone who’s unprepared to manage it wisely can create tax problems and poor financial outcomes, while also exposing you to criticism. Large unplanned distributions especially are challenging.

I have worked with many beneficiaries who are not emotionally ready or financially prepared to handle the responsibility that is carried out in a distribution. A car or home purchase is the most common situation. Depending on the circumstances, it’s generally best to take extra care and time in order to help the beneficiary understand whether they are ready not only for the distribution, but the ongoing expenses that could come along with it.

3. Changing beneficiary circumstances. Life happens—marriages, divorces, job changes, health issues, new children. A beneficiary’s financial situation or personal circumstances can shift dramatically, and your trust administration approach needs to shift with them.

In my experience, documents often require the trustee to consider “other resources” available to the beneficiary. This allows the trustee to ask personal financial questions of the beneficiary and prepare a financial plan to help the trustee decide if and how much of the trust income or principal to distribute based on the beneficiary’s life and financial circumstances.

The good news? These risks become opportunities when you have a systematic approach to stay ahead of them.

A Framework for Trustees: Your Annual Trustee Support Schedule

Rather than waiting for problems to arise, successful trustees take a proactive approach. We think of it as an annual trustee review—a systematic way to stay connected with the beneficiaries, review the assets of the trust, and document review to ensure a trustee is fulfilling their fiduciary duty.

A systematic approach creates structure around what can otherwise feel like overwhelming responsibilities.

Practical Strategies to Protect Yourself While Serving Others

Confidence comes from having clear processes and professional support. Here are the key strategies that successful trustees use to protect themselves while serving beneficiaries:

- Document everything, especially your reasoning. When you make discretionary decisions, record not just what you decided, but why. What factors did you consider? What alternatives did you evaluate? This documentation protects you and provides valuable context for future decisions.

- Embrace regular communication, even when it’s uncomfortable. Those difficult conversations you’re tempted to avoid? They’re actually your best protection against future problems. Regular, open communication prevents small issues from becoming big disputes.

- Partner with professionals for investment strategy. The Prudent Investor Rule doesn’t require you to be an investment expert—it requires you to act prudently. Working with qualified professionals ensures your investment approach meets legal standards while achieving the trust’s goals.

- Use cash flow planning and tax-aware investing to manage trust assets effectively. This sophisticated approach maximizes value for beneficiaries while minimizing unnecessary tax burdens and timing issues.

- Incorporate family wealth counseling to support intergenerational stewardship. When beneficiaries understand the trust’s purpose and develop strong financial skills, everyone wins.

Why Trustees Don’t Have to Navigate This Alone

One of the biggest misconceptions about being a trustee is that you must “figure it out” alone. Many trustees feel they should have all the answers and handle every decision independently. This mindset often leads to stress, suboptimal outcomes, and unnecessary risk.

The reality is that the most successful trustees build strong support teams. They recognize that their role isn’t to be experts in every aspect of trust administration—it’s to ensure the trust achieves its intended purposes while protecting all parties involved.

Working with professionals like Riverwater Partners transforms the trustee experience from an overwhelming obligation into a meaningful opportunity to fulfill the grantor’s intent while safeguarding yourself. This partnership provides the confidence and clarity you need to make excellent decisions, while ensuring beneficiaries have the support they need to thrive.

When you have the right structure and support, being a trustee becomes less about managing problems and more about creating positive outcomes. You can focus on the honor of stewarding someone’s legacy rather than worrying about potential pitfalls.

Your Next Step Toward Confident Trusteeship

Being a trustee doesn’t have to feel like carrying the weight of the world on your shoulders. With the right framework, professional support, and systematic approach, you can fulfill your duty of care with confidence while protecting yourself and creating excellent outcomes for beneficiaries.

If you’re a trustee seeking to align your duty of care with confidence, let’s talk. We can help you build a clear, structured plan that fulfills your obligations while ensuring you’re protected along the way.