Some investing styles, such as value investing, have proven themselves useful over the course of many decades. By contrast, investing fads are short-lived. They look promising in a particular market context but fade away as the world changes. Examples of such fads include day trading, house flipping, and, in our view, Bitcoin and liquid alternative investments. What about ESG? Is it an investing style that will stand the test of time or is ESG an investing fad bound to fade away?

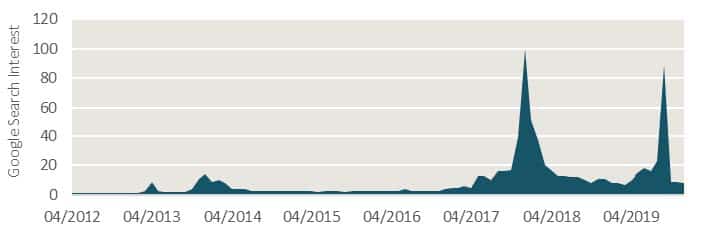

Anything new and fast-growing has the potential to turn out to be an investing fad. Consider interest in Bitcoin, as examined by Google Trends, a tool that measures online search activity and presents it on a relative scale (thereby including a relative peak of 100 in each chart).

After a giant upward spike, general interest in Bitcoin fell back nearly to where it was prior to the word “cryptocurrency” entering the lexicon. This has all the hallmarks of an investing fad.

Bitcoin: Google Trends (1/2004-1/2020)

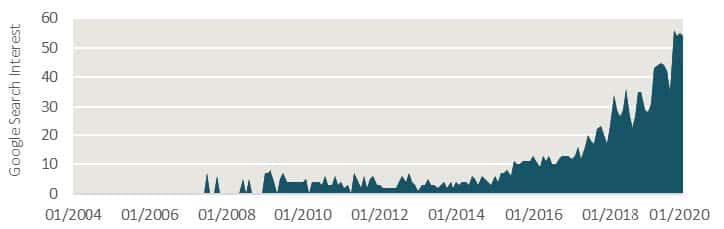

Below is a chart for the same time period, this time reflecting interest in ESG investing.

ESG Investing: Google Trends (1/2004-1/2020)

Eventually, as more people become aware of ESG, the trend may level off and even fall back a bit, which may signal great success: widespread integration of ESG as a standard investment process.

In fact, normalization is already happening. The “G” (governance) in ESG has long been recognized as an essential investment factor for anyone seeking to identify quality firms. Without good governance, there’s no assurance that “quality” on the financial statements is sustainable…or even real. Now, more investment managers are recognizing the “S” (social) and “E” (environmental) factors as important for companies’ own business sustainability. We’re seeing investment-level specificity join with societal-level responsibility.

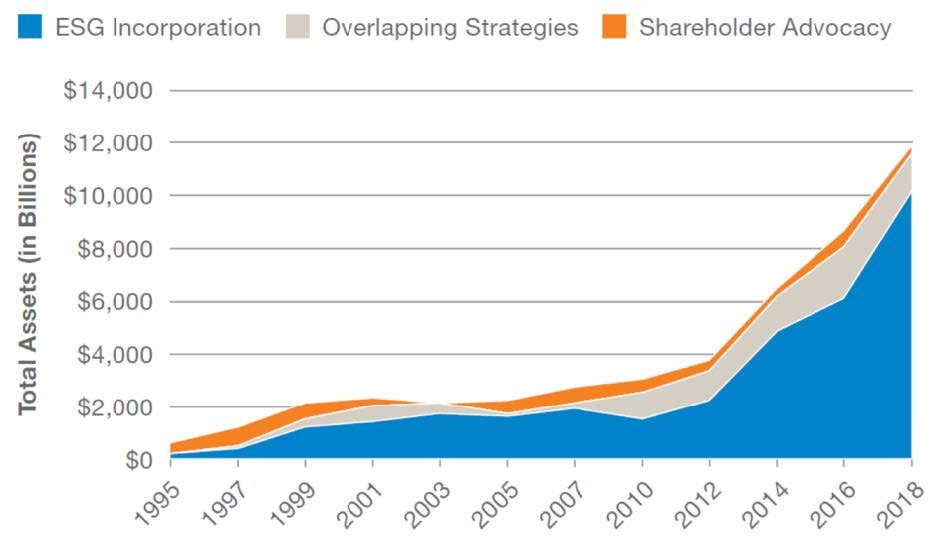

Data on the growth of ESG assets bears out this integration. As shown in the chart below, ESG assets have more than tripled in the last 10 years and have grown more than ten-fold in the last 25 years. Today, one in four professionally managed dollars in the U.S. is invested along sustainable, responsible and impact strategies.*

Domestic Assets are Growing

Source: USSIF Report on US Sustainable, Responsible and Impact Investing Trends, 2018

We expect the strong growth trend to continue, as both investment managers and their clients, many of whom are led by women and millennials, recognize broad benefits from ESG integration. Strikingly, financial advisors are lagging behind: over half of those surveyed have “little or no interest” as reported by Morningstar in 2017**.

For now, the comprehensive attention to ESG that we provide at Riverwater – across both investment selection and financial advisory services – is still rare. We think it will be much less rare after another decade of industry progress. And that’s a good thing.

*https://www.ussif.org/files/Trends/Trends%202018%20executive%20summary%20FINAL.pdf

**Ray Sin, Samantha Lamas, Caroline Brooks. How We’re Exploring Advisors’ Interest in Sustainable Funds Nov. 17, 2017. https://www.morningstar.com/insights/2017/11/17/advisor-messaging