THE “NEW” NEW NORMAL

There are many superlatives to choose from to describe last quarter’s rally. This winter saw the quickest pivot to a bear market in history, followed by an equally rapid rebound in the spring. In fact, we just experienced the strongest 100-day rally since 1933.[1]

After the market bottomed on March 23rd, the Nasdaq returned to its all-time high and the S&P 500 got close to even for the year. Some market segments – small capitalization stocks, international markets and non-investment grade credit – have not rebounded all the way back, but have certainly recovered a good chunk of their losses.

It is hard to square market returns with macroeconomic realities. GDP is predicted to have its steepest decline in history this quarter, layoffs continue in the job market, and COVID-19 cases are flaring across more than 30 states, with many states even reversing re-openings.

While the stock market generally correlates to the economy, the relationship is not always congruous as the market is generally more forward-looking. Today, higher returns driven by the market’s positive outlook are largely a result of the record-breaking stimulus from the Federal Reserve and Congress. The enormous stimulus provided sufficient fuel for the stock market to power ahead even with so much uncertainty.

Market cycles normally span years, if not a decade plus. Different sectors perform better at different points along the market cycle. At the onset of a bear market, consumer staples, health care and utilities are most stable and generally outperform. When the bear market ends, companies with high levels of debt rebound as fear of their going bankrupt subsides, and lead the market forward, followed by cyclical sectors like banks, industrials, and consumer companies, as the economy picks up steam. Finally, at the end of a bull market, the market cycle reaches what some call market “euphoria,” where investors become increasingly excited over potential returns. This point is also where the most risk is present. Legendary British-American investor Sir John Templeton is quoted as saying, “Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.”

What is amazing is that the entire cycle that usually lasts ten years occurred in totality over the last 90 days. Each of the aforementioned sectors outperformed in order beginning in March. Even more recently we experienced crazy moves in speculative stocks that make no sense. The best example is in the shares of Hertz, the car rental company. Hertz declared bankruptcy on May 22 when the stock was priced at $2.84 a share.[2] Based on a number of factors, the value of the equity will be worth zero when they emerge from bankruptcy. Amazingly, after the bankruptcy announcement, the stock rose to a level higher than the pre-bankruptcy share price, jumping to $6.25 a share. This was a +1,000% gain from the bottom of $0.56 a share on May 26th, the first trading day after the bankruptcy announcement.

In this craziness, the company shrewdly announced a stock sale to investors in order to raise money. In our experience, bankrupt companies cannot raise equity capital as everyone who invests will surely lose their entire investment. The company subsequently withdrew the offering and the stock has since come back down. The only reason to buy a bankrupt company is because you believe you will be able to sell it to a greater fool either days or hours later. This is speculating, not investing.

Many have called this the “new normal.” While it’s true we are adjusting to a new, hopefully temporary, reality, the term “new normal” seems almost cliché. A little history: the first new normal was mentioned in 1918 in books and articles describing what was to be expected as the country emerged from WWI.[3] More recently, it was used after 9/11 and then again post the financial crisis.

COVID-19 has upended peoples’ lives, the economy and the markets. We went through a whole market cycle in hyperdrive and it seems like we are now in a speculative phase. The outlook is too uncertain to make any confident guesses on what will happen when the rest of the year unfolds as much will be determined by the direction of the virus and when and if a vaccine is developed. We invest with a long-term perspective, thinking in terms of years and decades, not days and hours. So, while we can’t say what will unfold over the near-term, we remain confident that our philosophy and process position us well in the years ahead in our “new” new normal.

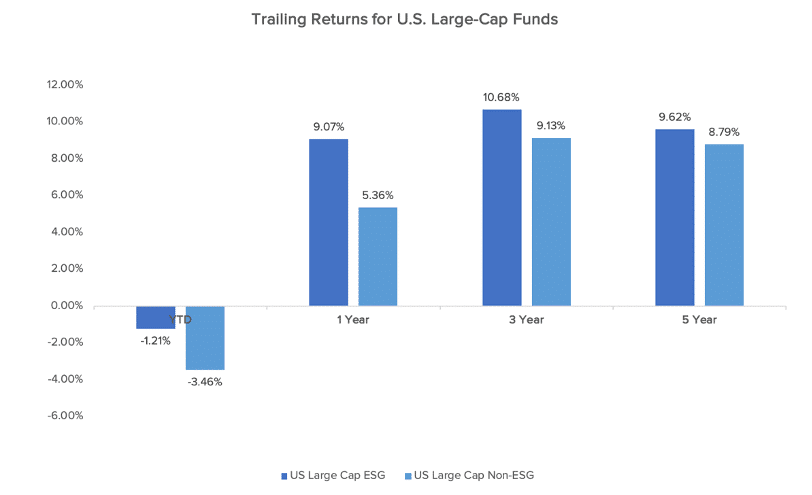

Perhaps another new normal is developing. Proponents of responsible investing have long understood that a focus on the environmental, social, and governance practices of companies helps uncover potential risk and opportunity. Companies with a clear focus on these metrics have outperformed their peers over the long-term because of this. During the market decline precipitated by the economic disruption caused by COVID-19, responsible investments handily outperformed their peers, given the resilience of these companies, and a recognition by investors.

The chart above illustrates the trailing returns (through June 30, 2020) of U.S. large-cap stock mutual funds that integrate ESG factors into their financial analysis versus those that do not. It is clear that integrating ESG factors into financial analysis is not detrimental to returns and, to the contrary, appears to enhance them.

Again, we hope that you, your friends and family are holding up and doing well, all things considered. Please reach out to us if there is anything we can do to help.

All the best,

| Adam | Greg | Matt |

DISCLAIMER: Past performance is not indicative of future results. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

RIVERWATER SMID STRATEGY

While on an absolute basis, our SMID (small and mid) cap equity strategy had positive returns, it slightly underperformed its benchmark. When markets roar, we will likely lag, but having trailed only by a small amount, we remain satisfied that, on a year-to-date basis, we are still handily beating our benchmark.

We are especially happy with the performance considering we have not cycled into the riskier areas of the market. We have held our positioning for the most part over the last 90 days with just a few changes and likely will not get more aggressive until we see sufficient green shoots on the economic front.

We sold two positions in the quarter: Shenandoah Communications (SHEN) and Biofrontera (BFRA). We had previously trimmed Shenandoah after it reached an all-time high last quarter and closed out the position at similar levels this quarter. We threw in the towel on Biofrontera as their new product launch will be slowed down with COVID-19 and the limited profitability could force them to have to raise capital.

We initiated one new position in the quarter, ICF International. ICF International (ICFI) is a global consulting services company with over 7,000 employees in 70 locations. Since 1969, they have served public (65% of sales), and private sector clients like nonprofits and universities (35% of sales) to navigate change and shape the future. ICFI’s recent acquisition of ITG brings government IT modernization expertise, a new growth driver, given the antiquated systems at the federal, state, and local government levels.

Over $600mm of ICFI’s $1.3B revenue is derived from services that drive social impact, including support of health, education, development, and social justice programs. $300mm of revenue is generated from services that create positive environmental impact, including helping clients reduce energy consumption, manage carbon footprints, and protect natural resources.

Recognizing the importance of these trends beginning 20 years ago, ICFI embarked on its own sustainability journey, focusing on its own social and environmental impact, making it a top small-cap ESG name at Riverwater.

RIVERWATER LEI STRATEGY

While on an absolute basis, our Large strategy had positive returns, it also slightly underperformed its benchmark. We were not terribly active in the quarter with two sales and one buy. We sold American Express (AXP) after owning it for over three years. The company is a leader in the payments industry, but we felt like they would have to work through both losses and limited growth in the near-term. We still like the company long-term and will revisit when we think the valuation of future fundamentals align. We also closed out our position in TE Connectivity (TEL). TEL is highly exposed to the auto market which we believe will be pressured for the next couple of years.

We recycled the proceeds from the sales into Kirkland Lake (KL). Kirkland engages in the acquisition, exploration, development, and operation of gold properties. Its principal properties in Australia and Canada are high grade underground mines that will be very profitable with the current spot price of gold.

Kirkland acquired an open pit mine called Detour Lake Mine located in Canada last year. Detour Lake is the second largest gold producing mine in Canada and has a mine life of approximately 22 years with an average gold production of 659,000 ounces per year. This stock investment is also a way to invest alongside a rising price of gold. We believe gold will continue to rise in the future due to historic Fed balance sheet expansion and a collapse in real yields for the next 2-3 years.

During the COVID-19 pandemic KL donated $20 million to assist community groups in the areas of Canada and Australia where they operate in recognition of the essential services that these groups provide.

[1] https://www.marketwatch.com/story/its-been-100-days-since-coronavirus-sent-the-stock-market-to-rock-bottom-heres-what-comes-next-after-its-best-rally-over-that-period-in-80-years-2020-07-01

[2] https://www.nbcnews.com/business/business-news/hertz-files-bankruptcy-protection-after-more-100-years-car-rental-n1213591

[3] https://english.stackexchange.com/questions/215012/origin-of-the-new-normal-as-a-freestanding-phrase