An Unimaginable Year in Review and 2021 Outlook

An Unimaginable Year

As we review 2020 and position for the future, it goes without saying that the past year was exceptional and unpredictable. Who in their right mind could have imagined a global pandemic, racial injustice protests, the worst economic decline in history and a contentious election that resulted in an insurrectionist storming of the US Capitol? No one.

Nor would anyone in ada million years have guessed at the depths of the bear market in late March that global stock markets would have performed like they have. In March, the virus was ripping through New York, Italy and China and taking the global economy down with it. Fear was rampant given the unknowns; fear of contracting the virus, fear of losing one’s livelihood and fear of losing savings. The US Federal Reserve and central banks around the world came to the rescue and with swift action gave confidence to market participants. They have not looked back since March 23rd, the market’s nadir.

With professional sporting leagues and most casinos shut for months, many new investors flocked to the sport of buying stocks to keep themselves occupied. We have not seen this many newcomers to the market since 1999. And these newcomers have had a tremendous influence on the market.[1]

Party Like it’s 1999

The stock market run in 1999 and early 2000 centered on technology stocks and, more specifically, internet stocks. New technologies (plus greed) excited the imagination and investors ran wild as they paid insane prices for companies. Everyday investors were able to get in on the fun like never before as online brokerage firms democratized investing by slashing fees to trade stocks to $29.99 from hundreds if not thousands of dollars as commissions had been up to 1% of value for a one-way trade.[2]

The NASDAQ ran up 100% from August 1999 through March 2000, but as we all know every party must end. On March 10th, the bell rang. It then took 15 years for the NASDAQ to get back to its old all-time-high!

Today, Robinhood has become the new tool to facilitate ease of trading and technology stocks have reemerged as the driving force of the market’s returns. FAANG +M is a much-used acronym that represents Facebook, Apple, Amazon, Netflix, Google and Microsoft. These six companies were all major beneficiaries of the lockdown and saw their stocks all reach all-time highs. If you take these six stocks out of the S&P 500 return in 2020, the benchmark would lose a third of its gains. Since 2013, if these stocks were removed the market would lose over a quarter of its performance. The concern is that if a market’s performance is driven by fewer and fewer names the bull market is long is the tooth.[3]

Similar to the turn of the century, excesses exist in certain areas of the market like cryptocurrencies, but we do not believe the overall market is close to the bubble levels of late 1999 early 2000.

We’ll say it, too: “Don’t Fight the Fed”

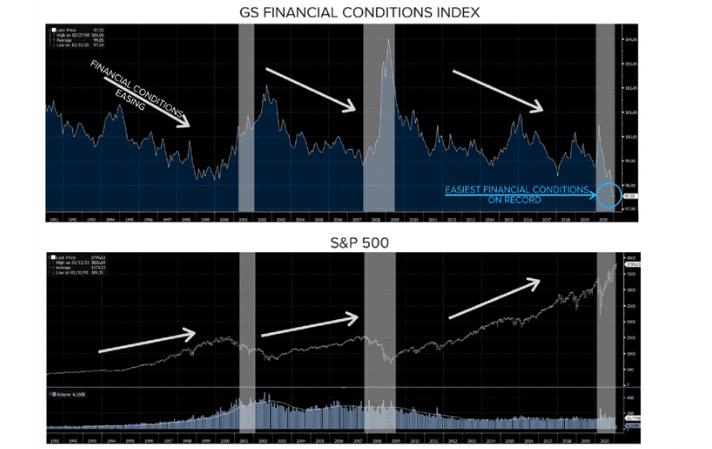

Don’t fight the fed is a simplistic saying, but there is much truth in it. Cue Metallica singing, and nothing else matters here. When liquidity is easy, stocks go up. When liquidity is drained, markets end up going down as seen in the chart below. Financial conditions have NEVER been this easy and so stocks have gone up.

Interest rates are at generational lows (Globally there is over $18T of negative yielding debt today), the Fed continues to buy bonds (trying to keep rates low) and while stocks are hitting all-time highs, as the saying goes “There Is No Alternative” (TINA) to stocks.

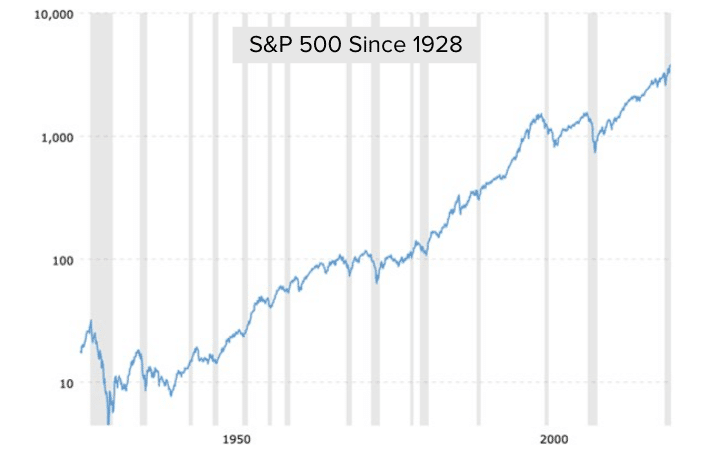

It’s hard to argue with TINA as over the long-term stocks have produced phenomenal gains. Going forward we are sure to see market drops, but as you can see in the chart on the left,[4] those drops over the long-term just appear as blips. It seems much much worse while they are actually occurring as fear dominates. Companies have and will continue to adjust, adapt and forge ahead like they (and for that matter all of us) have with the pandemic.

Our forecast for the year ahead is that it will be hard to forecast what will happen.[5] Last year we guessed that the market would see single digit returns as valuations were stretched and the market would need earnings growth to go higher. We got it totally wrong! Earnings were down, but investors were willing to pay higher prices for each dollar of earnings (P/Es) and so the S&P 500 was actually up. The difficulty in predicting the short-term is best displayed by 2020. That is why a diversified portfolio with a long-term focus is the most prudent way to invest.

Again, we hope that you, your friends and family are holding up and doing well, all things considered. While 2021 has started off like an extension of 2020 we hope and believe things will get better!

RIVERWATER SMID STRATEGY

Small caps had a banner fourth quarter (The best quarter on record for the Russell 2000 and the second best since the 1960’s) and ended the year up nicely. It’s crazy to think that Apple had a larger market cap than the entire small cap space as represented by the Russell 2000 earlier this year.

The Riverwater SMID strategy underperformed in the strong upswing in the fourth quarter but did end up outperforming by a significant margin for the entire year, driven by strong downside protection at the depths of the selloff in February and March and some opportunistic purchases after the selloff.

Our friends at Furey Research have looked into forward year returns after strong quarters and found that one and two-year returns have averaged over 20% and, in every instance, have been positive. Past performance is no guarantee of future returns and no two markets are alike, but we are hopeful small caps can begin to reclaim performance leadership.

During the quarter we bought four new companies and sold three. We sold Principal Financial Group, FLIR Systems and Financial Institutions to invest in companies that we felt have better longer-term prospects. There was nothing inherently wrong with any of the companies we sold, but over the long-term we feel more confident in the new additions.

StoneX Group (SNEX) is a diversified global brokerage and financial services firm providing services across asset classes and markets around the world. It has carved out a niche in servicing mid-tier clients that are underserved by large multinational investment banks. SNEX will continue to benefit from an increase in trading and volatility and could see further upside if interest rates continue to rise. The company was founded by its current CEO who along with a seasoned management team has grown the book value of equity over the last 10 years by 20.7% per year. We have been engaged in dialogue with management about improving their ESG reporting.

Farmer Mac (AGM) is a stockholder-owned, federally chartered corporation that combines private capital and public sponsorship to serve the farm sector. Farmer Mac is a unique company with a large moat because Congress has charged it with the mission of providing a secondary market for a variety of loans made to borrowers in rural America. Farmers came under pressure during the boycott of US farming products by China and then from the pandemic. This provided an opportunity to purchase a high-quality asset at a reasonable price. In the short-term farmers have not only received aid from the Government but there has been an increase in crop prices. In the long-term farming will only become more important as populations increase. AGM has consistently earned mid to high teens return in equity over the years, and with the strength of the farming sector can continue to earn strong returns into the foreseeable future. We have spoken with management and the board to give them input on ESG issues and the issuance of their first sustainability report.

We purchased Valvoline, (VVV), a brand that has been around since the mid 1800’s and servicing automobiles since the Model T. In 2017, Valvoline was spun out from Ashland and is still in the early stages of executing its long-term objectives. We are excited about Valvoline for many reasons, including: strong brand recognition, a long-term plan of growing their retail locations servicing internal combustion engines (ICE) as well as electric vehicles (EV), a strong international presence and a thoughtful approach to ESG strategies and recycling. Additionally, they have an excellent training program which creates high employee satisfaction and happy customers. If you get a chance, stop by and check out their services. We’d enjoy hearing your feedback!

Lastly, we purchased Atkore International (ATKR), a supplier of electrical and mechanical products for commercial, industrial and construction markets. Since its IPO in 2016, Atkore continues to increase their value proposition as their products form the critical infrastructure from the original power source to the final outlet. We are encouraged by their focus on quality, leadership in their respective markets such as data centers and renewable energy and their steady gains in revenue and margins.

RIVERWATER LEI STRATEGY

On an absolute basis, our Large strategy had positive returns, but did underperform our benchmark in the quarter. For the year we were essentially in-line with the Russell 1000 Value Index. We were not terribly active again in the quarter with just one trim of Chevron (CVX) and two additions to existing holdings, Carrier Global (CARR) and Otis Worldwide (OTIS).

Year-to-date we have added only six new positions and three of those were in the month of March amongst the market mayhem. Over the course of the year total portfolio turnover came in at just under 10%, meaning at the current rate we would hold on to positions in the portfolio for over ten years. We invest for the long-run and we strive to emulate Warren Buffett who has said his favorite holding period is forever.

We still have slightly elevated cash levels at just over 5% and expect to have one or two new names added in the first quarter.

[1]https://www.cnbc.com/2020/05/12/young-investors-pile-into-stocks-seeing-generational-buying-moment-instead-of-risk.html

[2] https://www.businessinsider.com/historical-trading-commissions-2014-3

[3] https://www.yardeni.com/pub/faangms.pdf

[4] https://www.macrotrends.net/2324/sp-500-historical-chart-data

[5] We still take a guess that the broad market will be up 8-12%, driven NOT by higher P/E ratios, but rather by higher earnings because of a rebounding economy.

DISCLAIMER: Past performance is not indicative of future results. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.