Q1 2021 Market Update

The first quarter of 2021 saw individual investors participate in the market at levels not seen in over 20 years. Their collective buying helped propel equity markets to new highs. It’s important to remember that markets are auction markets, with fixed supply. Therefore, when there are more buyers than sellers, prices rise. The opposite is also true.

Retail investors, not surprisingly, did not buy bonds. For the first time in many years, even traditional bond investors started to reconsider owning bonds, despite the fact that their income yield has been lower than historical inflation rates.

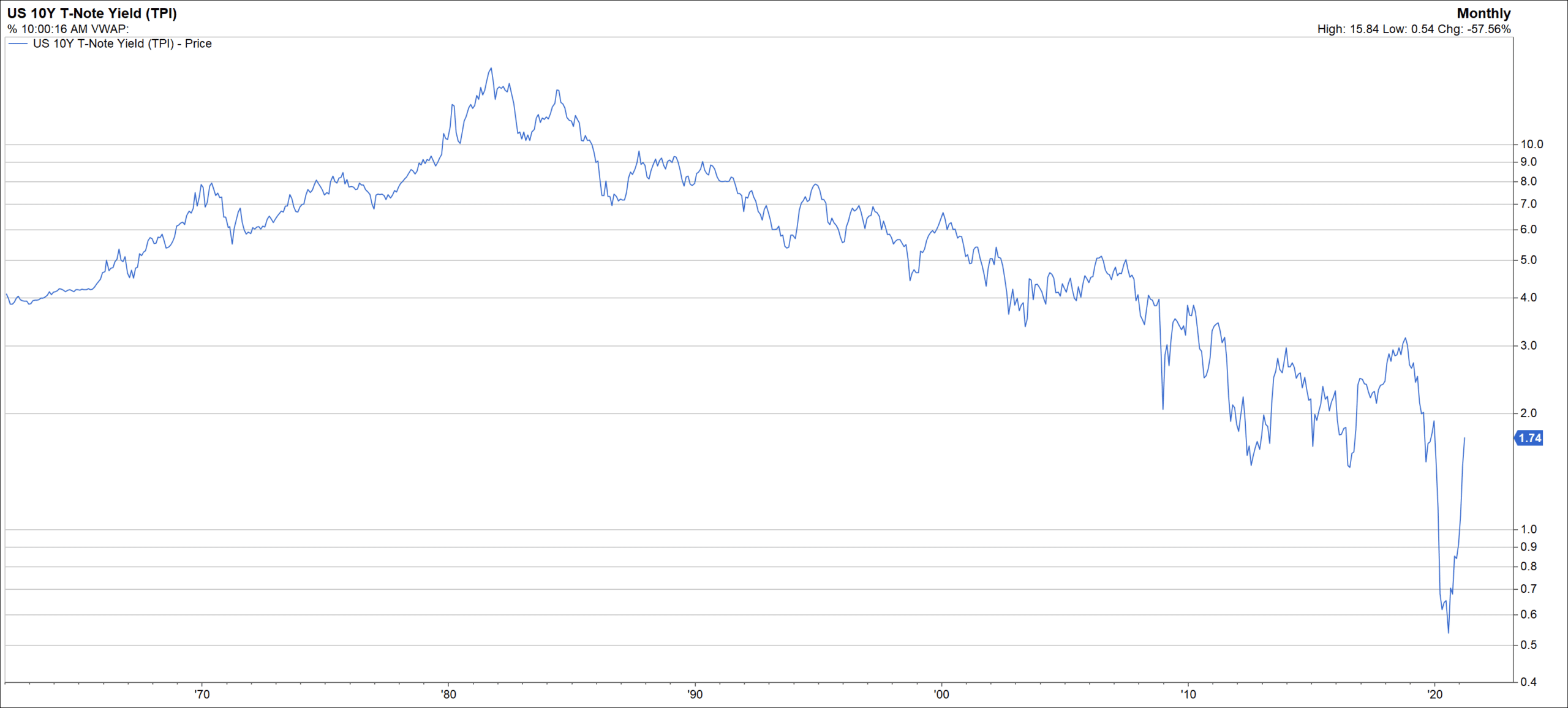

The ten-year treasury yield bottomed out at 0.54% last July, ended the year at 0.92%, and closed out the quarter at 1.74%. Inflation has averaged 1.75% over the last decade and 3.1% since 1913[1]. Assuming the next ten years are anything like the last seventy-five, an investor buying 10-year US Treasuries today at an interest rate less than 1.75% will end up with a negative real return over the next ten years as inflation would outstrip the interest payments.

10 Year Treasury Constant Maturity Rate Since 1962

The Federal Reserve has done all it can to lower rates, with the exception of taking them below zero, which they have said they won’t do. When the Fed is accommodative and floods the economy with liquidity, stocks have a huge tailwind as supply of money to invest exceeds supply of shares to buy. (We advised as such in our last letter, “Don’t Fight the Fed.”) To boot, fiscal stimulus is at record levels creating a 1+1=3 on the stimulus front. We believe the speculation rampant in many markets, such as meme stocks, SPACs, crypto currencies and NFTs, are in large part natural outcomes of government policies.

The Gamestop frenzy was a mind-bending euphoria that still seems to have legs. Gamestop’s sales peaked in 2012 and are down 47% since then. The last time they turned a profit was 2018 and it seems physical video games are going the way of DVD’s and buggy whips. Yet, at its peak price of $483 per share in January, Gamestop had the same market value as Wendy’s, The Gap, Under Armour and Hyatt Hotels – combined! If you told a rational investor they could buy an entire company, and asked which they would rather own – Gamestop, or the other four combined – we suspect it would be the latter.

No matter, individual investors bid the price up from around $4 last summer to the aforementioned $483. The only logical explanation for someone paying $483 is that they believe there is a greater fool who will pay more. Yes, a short squeeze did contribute to the rally, but today with short interest down substantially, it still trades near $200.[2] Why should Gamestop have traded at a value of more than $25 billion (yes billion)? Pure speculation.

Speculation is not inherently bad for the market unless it causes systemic risks. If Gamestop plus all the other meme stocks like AMC Theatres, Blackberry and Koss Corp dropped to zero today the market would not be at risk of significant collapse. In contrast, when debt is used to buy assets that get caught up in a speculative frenzy… remember the housing bubble? . . . and the ball drops, owners end up owing the bank. When too many speculators owe the banks and can’t repay, the banks have a problem, and that can lead to a crisis.

A glaring example of “owing the banks” occurred at the end of March with Archegos Capital Management. Archegos was a family office and, as such, was excluded from SEC oversight to which other investment firms are subject. Therefore, we do not know exactly how much leverage the firm took on to buy stocks and other financial instruments. What we do know is that when the stocks they owned like CBSViacom and Discovery Communications started to fall, the banks and brokers that lent to Archegos initiated margin calls.[3]

Once the margin calls started, $30 billion of stocks were sold in a few days. Archegos appears to now be bankrupt and a number of the banks that lent them money are taking losses which are estimated to be as high as $7.5 billion.[4] The good news is banks like Credit Suisse and Nomura can handle the billion-dollar losses (although a number of higher-ups have been fired and their stocks tanked) because they have sufficient capital. What is concerning is the possibility that the Fed has encouraged so much risk taking and speculation (Archegos and Gamestop) that this marks just the beginning and not the end.

At this point we do not believe systemic risks are present, but recent events like Gamestop and Archegos do keep us mindful. We won’t know for a while, but rest assured there is no speculation occurring at Riverwater. We are long-term investors and base our decisions on sound fundamentals and extensive due diligence.

The economy has a lot going for it. Vaccinations are almost available to all adults, jobs are coming back, people are itching to get out, and many economists’ estimates for 2021 US GDP exceed 8% – an annual number we have not seen since 1951.[5]The bond market could be pressured as the heating economy could continue to force rates up, and with it bond prices down. Stocks, while having a phenomenal trailing twelve months, are likely due for a breather, but our ability to forecast with certainty is worth a cup of coffee.

We hope everyone that wants to be vaccinated either has been or is close to it. We look forward to meeting face-to-face in the near future and are excited to start planning our annual charity golf outing this coming summer. The date is dependent upon when the beer trucks will be at Lake Park – so stay tuned and practice your wedge putting!

RIVERWATER ESG SMID VALUE STRATEGY

Small caps followed up on the heels of last quarter’s record return and had a banner first quarter. In other good news, we are happy to see value continue to power ahead of growth after a long exodus in the momentum desert for value. Small cap value stocks have now posted their best ever consecutive two-quarter relative performance versus growth. According to Furey Research, value returns average 11% following periods such as the one we are in and continue to outpace growth by 7% in the following year.

Small cap earnings are expected to double this year after the decline in 2020. Much of that has likely been discounted in prices (small caps have doubled in the last year), but we think small caps are positioned well for the economy ahead.

The Riverwater SMID strategy underperformed in the strong upswing, but was still up over 12% – we’ll take that any quarter. We sold one position, Hologic, as it grew too large after more than doubling from the March lows of 2020.

We trimmed two positions, Iridium Communications and Renewable Energy, after their weight in the portfolio became outsized. Our timing was prescient as both retreated after the sales. In hindsight, we wish we would have sold more of Renewable Energy as it dropped 50% from where we sold, along with its renewable energy peers which arguably had become extended as interest in green energy investing is on the rise. Even after the drop we are up 3x from our initial purchase and believe it is attractive enough to potentially rebuy and add to the position.

InfuSystem (INFU), the only new position, is a healthcare company that provides products and services to facilitate outpatient care by supplying, managing, and servicing medical device products to hospitals, clinics, infusion providers and homecare.

The service includes medical equipment order logistics, 24×7 nursing support, and billing and biomedical services. The infrastructure they have built over the last 20 years cannot be replicated! We won’t bore you with why, but it takes a lot of time to get approvals from all the insurance companies on a regional basis to cover payments for their customers.

The majority of INFU’s revenue today is derived from the supply and service of infusion pumps for cancer treatment at home. In 2018, INFU began offering a device for nerve blocks, an alternative to opioids, that helps mitigate pain associated with surgery. We think there is a huge opportunity here if Congress acts upon ways to solve the opioid crisis and the company can eventually get reimbursement for their nerve block. In early 2020, INFU became the at-home turnkey provider for Cardinal Health’s negative pressure wound therapy (NPWT) franchise. INFU’s high recurring revenue business is expected to grow in the 10-12% range and deliver faster earnings growth due to its asset-light model and established network of prescribing physicians. Riverwater has begun a dialogue with the management team regarding a focus on ESG factors.

RIVERWATER ESG LARGE VALUE STRATEGY

The Large Strategy underperformed its benchmark, the Russell 1000 Value. As we analyze the quarter there was not any one factor which drove the gap – just a lot of paper cuts. We were underweight in the best performing sectors, Energy (+31%), Financials (+18%) and Consumer Discretionary (+15%), and were overweight in one of the worst performing sectors, Healthcare (+4%). The strategy had some nice winners like Corning and PNC Financial services which were both up over 20%. The strategy only had three companies that dropped more than 2%: Nestlé (-4.5%), Kirkland Lake (-13.7%) and Viatris (-25.8%).

We just purchased Viatris in the quarter and were a bit too early but are confident over time it will be a winner for us. Formed in November 2020 through the combination of Mylan and Pfizer’s Upjohn business, Viatris (VTRS) brings together scientific, manufacturing and distribution expertise to deliver high-quality medicines to patients in more than 165 countries. Some of the more well-known products in their portfolio include Viagra, Lyrica and Xanax.

Viatris’ portfolio comprises more than 1,400 approved molecules across a wide range of therapeutic areas, the combined entity sells generic and off-patent branded drugs, biosimilars, and some active pharmaceutical ingredients, or API. Forty percent of the 23 million people treated for HIV use a Viatris product.

Management’s plan to optimize its portfolio via divestiture of underperforming products, a focus on those with more promise, and cost synergies from the combination should drive accelerating revenue and profit growth over the next 3-5 years. The company is unlikely to grow its sales for the next 12 months and Wall Street has no patience to wait so the stock trades at an incredibly cheap valuation of only 4x earnings! Viatris is a UN Global Compact Signatory and will operate using a sustainable social framework.

RIVERWATER ESG MICRO-CAP OPPORTUNITIES STRATEGY

We are approaching our three-year anniversary in the Micro strategy and are happy to begin sharing what we have been up to. The Micro strategy invests in companies that are generally below $500 million in market cap and, like our other portfolios, runs a focused strategy with 20-40 holdings. Smaller companies are significantly more volatile to both the downside and upside. We end up trading this portfolio more than the other two as successful stocks can grow to outsized positions which necessitates more frequent replacement. This quarter we sold out of Digital Turbine (APPS), Celsius (CELH) and Silvergate Capital (SI). All three had monumental gains and grew anywhere from between 10 to 90 times our original investment. We also trimmed two other positions; Centrus Energy (LEU) and TPI Composite (TPI) which were up 155% and 278% respectively from our original purchases.

The strategy had another strong quarter after a stellar 2020. The strategy was up over 20% in the first quarter though slightly trailed its benchmark the Russell Microcap Index.

With the large gains the aforementioned stocks became large positions, so we had a lot of work to do to recycle the capital. We ended up buying five new positions: Marcus Corp (MCS), A-Mark Precious Metals (AMRK), First Western Financial (MYFW), Tuesday Morning (TUEM), and Farmer Brothers Coffee (FARM)

The Marcus Corporation owns or leases over 90 movie theatres and owns or manages 16 hotels and resorts across the US, mainly in the Midwest. In 2020, it had to close all its theatres and most hotels due to the Covid-19 pandemic. We believe there is massive pent-up demand for a premium experience at a Marcus movie theatre or stay at one of its hotels. Additionally, we are attracted to the ability to acquire competitors or fill-in locations from smaller theatres closing. We like the fact that MCS has one of the strongest balance sheets in the industry and has an industry leading ownership of 55% of its theatres and eight of its hotels. The Marcus Corporation has been a leading corporate donor for many causes in the city of Milwaukee.

A-Mark Precious Metals (AMRK) engages in the trading of precious metals, predominantly gold and silver. Since the pandemic started, the demand for gold and silver bars/coins has skyrocketed. This has been a tailwind for AMRK since they make money on the volume sold and the spreads between finished bars and coins to the underlying metal. Higher demand drives higher spreads and they have been seeing record highs for both. While AMRK’s business is selling gold and silver, it does not mean it loses money when prices fall and to the contrary has stayed profitable in the most recent downturn for gold prices. A large differentiator for AMRK versus the competition is that they own a silver mint. In the first quarter of the year, silver supplies ran out (an example of the speculation as silver became popular on Reddit), resulting in AMRK being one of the only suppliers that was able to fill demand. Going forward, we see volumes and spreads staying high as the metals market deals with flare ups in inflation and geopolitical tensions.

First Western Financial (MYFW) operates as a financial holding company, which engages in the provision of banking, wealth management and mortgage services. The bank has a loyal customer base of high-net-worth individuals in attractive western geographies (CO, AZ, WY, ID). Last year MYFW benefitted from a boom in mortgage refinancing and while rates have risen, the mortgage business should stay strong. The bank is still founder-led by their CEO who has already sold a previous bank startup. MYFW would be an attractive takeout target for someone looking for a solid deposit base and a foothold in a number of attractive cities.

Tuesday Morning Corporation (TUEM) operates as an off-price retailer in the United States. The company offers products such as upscale home textiles, home furnishings, housewares, gourmet food products, pet supplies, bath and body products, toys, and seasonal products. TUEM is a special situation given it just exited bankruptcy and trades over-the counter for now. In bankruptcy they were able to exit bad leases and shrink their store footprint to the most profitable locations. As TUEM revamps its management team, they have committed to improving their inventory management and rising to a peer multiple for inventory turnover. As execution improves, TUEM will up-list to an exchange and we believe should close the valuation gap to peers. It now only trades at 6.5x earnings!

Farmer Brothers Co. (FARM) manufactures and markets coffee and other culinary products to restaurants, bars, convenience stores, hotels and other institutional settings. They’ve been around since 1912, but have had a number of issues over the last couple of years exclusive of the covid pandemic. Namely, they moved headquarters and roasting facilities from California to Texas causing large hiccups. Farmer Brothers has new leadership, with whom we are very impressed with and we believe they are setting the company up for success. This company should do well as the economy reopens and we think it has the potential return to the levels the stock traded at just a few years ago.

ESG Micro-Cap Opportunities Strategy Factsheet Q12021

[1] https://inflationdata.com/Inflation/Inflation/DecadeInflation.asp

[2] Youtube Video -What’s a short squeeze?

[3] Youtube video -What is a margin call?

[4]https://www.forbes.com/sites/antoinegara/2021/03/29/the-firm-behind-the-30-billion-yardsale-shaking-financial-markets-disclosed-almost-nothing/?sh=410e74eb3567