2021 Year End Markets and Strategies Update

Having circled the sun one more time, we are reflecting on the markets and ESG in 2021 and looking ahead to what we can expect in 2022.

COVID’s Continued Impact.

In 2021, the global pandemic dominated economies for a second year and brought with it seemingly lasting changes to our daily lives. The economy continued its climb from the deep, yet quick, recession of 2020. In the wake of mass reopenings following the vaccine rollouts, the economy bounced back. In fact, it grew so much so quickly that it snarled supply chains as demand for all types of goods exceeded the ability to supply them.

Below is a chart showing the ratio of retailers’ inventories vs their sales. The chart indicates we are at the highest level of demand vs. inventory since this data set began recording 30 years ago.

This imbalance drove inflation to levels last seen 40 years ago. While there is a chance that the inflation could persist if the supply/demand imbalance doesn’t begin to correct itself this year, we think we are seeing peak inflation and expect it to begin to decline as 2022 unfolds.

Equity markets in 2021 rose to record levels as interest rates remained low, vaccinations became widely available, and earnings growth continued to be strong. The bond market however, for only the fifth time in the last 42 years, was down in value. The Federal Reserve’s actions and the impact of Omicron and potentially other variants will likely drive what the economy and markets do in 2022.

2022 Outlook

The Fed has begun the winddown of quantitative easing, or bond buying, and has indicated that they will raise rates later this year. This will not necessarily present a major headwind to the market given their planned measured pace and our expectation that short-term rates won’t go too high. We do expect more muted equity returns given the fact that earnings will grow at a slower pace and valuations may decline somewhat with higher interest rates, in addition to the fact that broad equity markets just notched their third consecutive year of double-digit returns.

As Omicron sweeps through with, what appears to be, lower hospitalization and death rates, we hope that it is a sign we are closer to the end than the beginning of the pandemic. It is likely that this current infection wave will limit economic growth to a degree this winter. Business interruptions and quarantining are the norm now. You may have experienced these effects firsthand with the thousands of airline flights cancelled over the holiday season and schools are going virtual again with infection rates spiking. These issues should not have a major long-term economic effect, but they represent the continued impact the pandemic has on us.

Despite the pandemic, the US economy and stock markets marched higher. As we think back to February and March of 2020 and then to the staggering returns over the last 22 months, we marvel at how it has all played out. Not even in our best estimation would we have guessed financial assets could have performed this well.

ESG in 2021

ESG in 2021 saw record inflows

What does not surprise us is the continued strong performance and acceptance of ESG (Environmental, Social and Governance) investing over the last two years. For reference, sustainable funds took in net flows of $5.4B in 2018 and $21.4B in 2019. In 2020, inflows grew to $51B and that number is estimated to be $120B this past year.[1][2] That’s a 5x increase from the approximate start of the pandemic. These figures only represent investors that buy mutual funds and don’t include all other types of investors like institutions and investments into direct stocks. When all these investments are considered, one third of all assets in the US are invested with sustainability in mind.[3]

ESG in 2021 saw increased corporate adoption

It is not just the investor that is embracing ESG. Corporations have adopted ESG at a fast pace as well. Five years ago when we spoke with small and mid-cap CEOs and CFOs we’d have to ask them if they knew what ESG was. Fast forward to today and we find very few companies of any size that haven’t implemented some type of ESG practices into their business.

Corporate leaders now realize that their customers, their employees, and their investors all want to be associated with companies that think about and improve upon their impact on the environment and the communities in which they operate.

At least 21% of the world’s largest companies like Verizon, Pepsi, Facebook and Nissan have announced targets to reach zero emissions in the next 10-20 years. At Riverwater, we’ve committed to net zero and are there already! We’ve bough carbon credits to accomplish it as we still drive gas vehicles. Carbon credits are an investable asset class now and one we believe will have a bright future as more and more companies move to lower their carbon footprint.

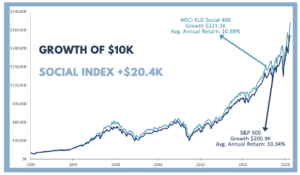

The fear that companies’ stock prices would suffer as they focused on ESG has not come to pass. As the chart above shows, companies that embrace ESG have been rewarded with higher stock prices and have shown lower volatility.

We expect 2022 to be no less eventful than the last couple of years. What events will occur is anyone’s guess. We do feel very confident that ESG investing and adoption by investors and companies will continue, given its broad appeal and slightly better risk and return profile. Thank you for your trust and confidence and best wishes for a healthy 2022.

All the best,

Adam, Greg, Jan and Matt

[1] https://www.nasdaq.com/articles/esg-investing-continues-to-attract-record-flows%3A-4-fund-picks-2021-05-25

[2]https://www.fastcompany.com/90706552/esg-investing-continued-to-soar-in-2021-the-government-could-boost-it-even-more

[3]https://www.cnbc.com/2020/12/21/sustainable-investing-accounts-for-33percent-of-total-us-assets-under-management.html

Disclosures: The information contained within this market and strategies update represents the opinion of Riverwater Partners and should not be construed as personalized or individualized investment advice.

Riverwater Strategy Updates

- Riverwater ESG SMID Value Strategy

- Riverwater ESG Micro Opportunities Strategy

- Riverwater ESG Large Value Strategy