Q1 2022 Market and Strategies Update

This year and Q1 2022 began with hopes that the pandemic would recede and that the global economy could begin the process of getting back to normality. Vladimir Putin had other ideas. Both stock and bond markets were down in the first quarter driven by the war in Europe and a more aggressive Federal Reserve responding to persistent inflation. Normally bond prices have a low correlation to stock prices. When the price of stocks goes down because of some fear, bond prices typically go up as investors look for a safe haven. That did not happen this past quarter, rather, bond prices also dropped because interest rates rose at a fast clip driven by higher-than-normal inflation rates (when interest rates rise bond prices fall).

Fuel

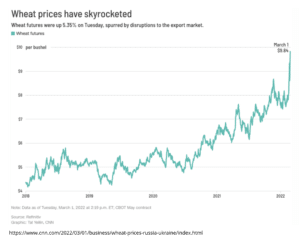

In our last letter we stated that we expected, “2022 to be no less eventful than the last couple of years. What events will occur is anyone’s guess.” Well, we got both points right in that the world was not preparing for our current geopolitical reality of a major European war on a scale not seen since WWII. Global markets were not prepared either and did not fully expect a European war to break out. This is evidenced by the dramatic increases in prices of oil, certain metals, and wheat on the day Russia launched its invasion. Oil prices spiked from $91 per barrel to $124 per barrel and May wheat jumped in price over 50% in a day!

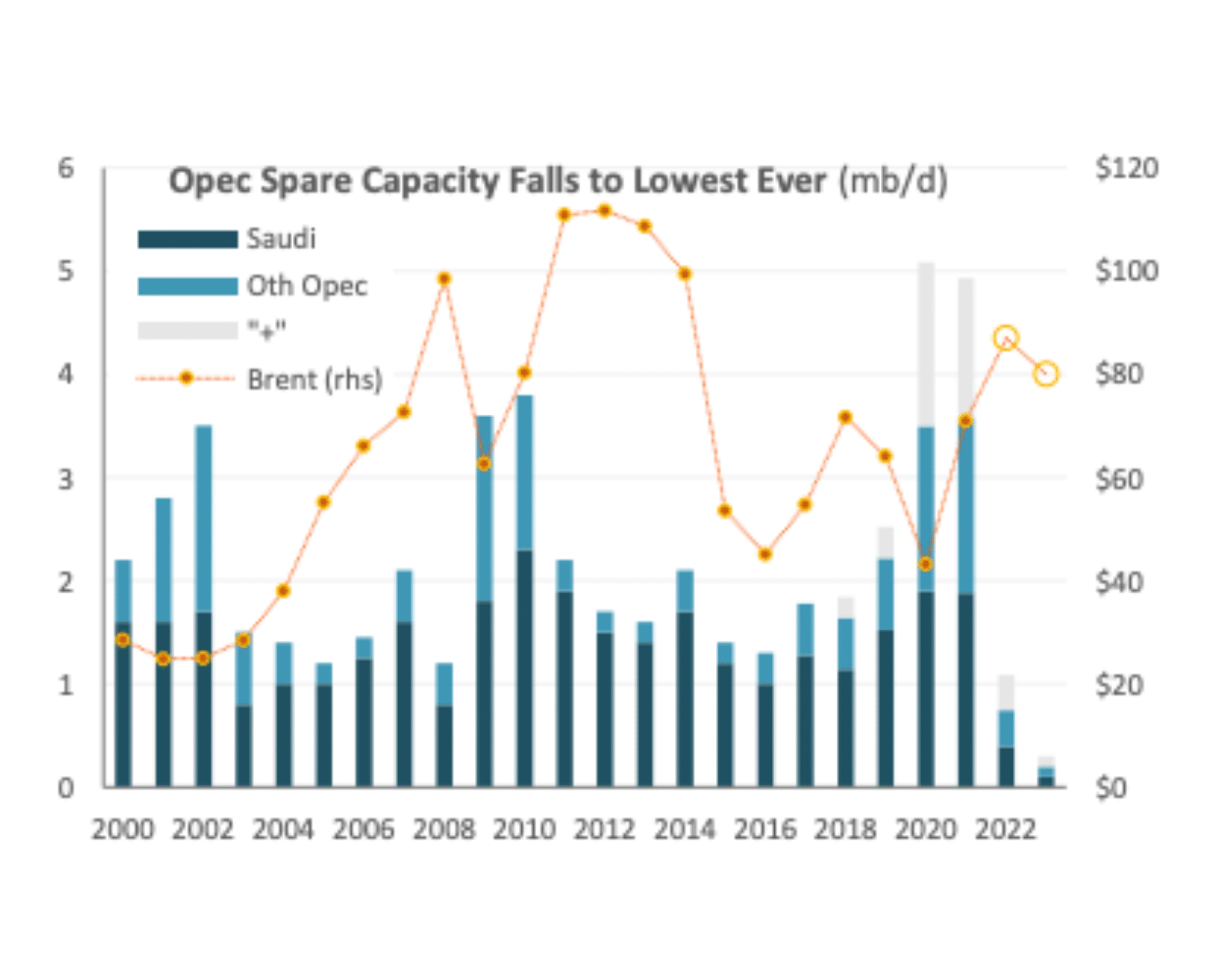

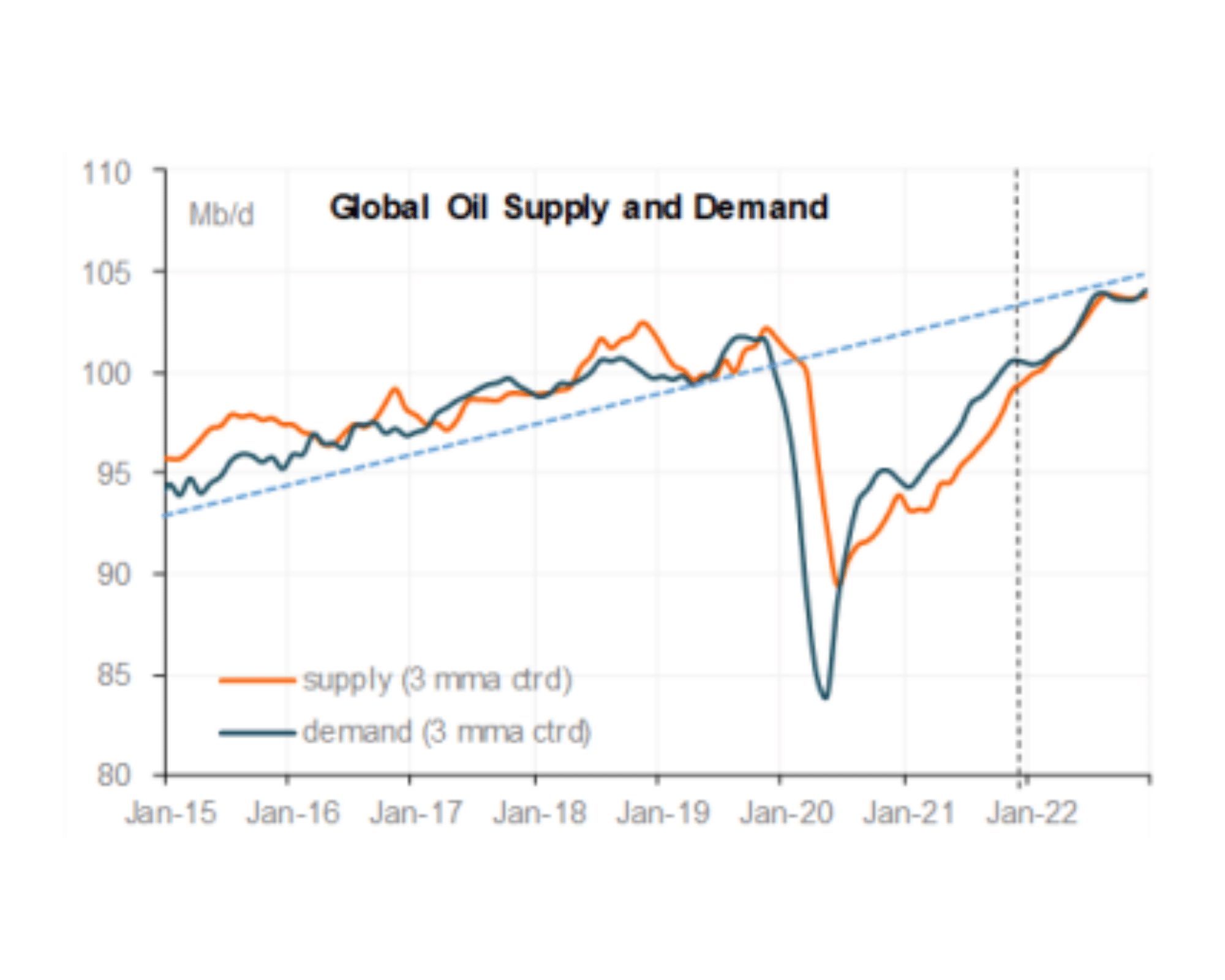

The events in Ukraine are heartbreaking and it is truly amazing that in this day and age one person can so negatively impact the fate of millions of lives. While we hope that good will prevail over evil, we must also think through how these events impact markets. The loss of Russian oil production will likely keep oil prices at this elevated level for an extended period. The issue is that there is no spare capacity to replace Russian production in the short-term (see below) and global oil demand today is larger than supply. The same can be said for wheat. As the war drags on, there will be massive declines in the export capability of Ukraine and Russia, who combined supply 29% of all global wheat exports.

We expect higher wheat prices to trickle down to the US consumer through higher cereal and bread prices. Thankfully, the impact will be blunted in the US because we are a major wheat producer. The same cannot be said for many countries like Egypt, Turkey and Bangladesh who rely almost entirely on imported grains. We would not be surprised to see unrest, driven by food shortages later this year or next. We also won’t be surprised to see many economies in Europe go into recession driven by higher energy costs. While gasoline prices in the US are higher today than at any point since 2014, we can still consider ourselves fortunate. Natural gas prices in Europe are up 300% and they must buy most of their fuel from Russia, who could cut off supply at a moment’s notice.

The Fed

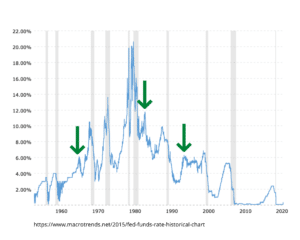

The likely impact of the Russian invasion is higher inflation and therefore a more aggressive Federal Reserve. The market has now priced in nine interest rates actions vs. just six before the Invasion. The Federal Reserve has a very good track record of ending almost every economic expansion when attempting to engineer a “soft landing.” Unfortunately, they have only been able to accomplish this three times out of the last 14 going back to the 1950’s. Below is the Federal Funds rate with the gray bars representing recessions. Outside of the three green arrows every time the Fed embarked on a tightening cycle, it ended in recession.

We expect the Fed will end this cycle the same way they do most, and that a recession will be the likely result (chances are better than 50/50). If we are correct, we have no way to know when it will happen. Interest rate hike cycles can last for years, and stock markets can have significant gains in the interim. It does not pay to try and time them because not only do you need to pinpoint the start, but then you also need to pinpoint the end.

Fear

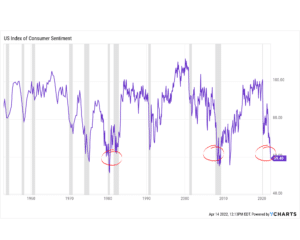

Fear is pervasive today with consumer confidence at levels last seen during deep recessions of 2008 and 1981 (see the red circles below). Even with the stock market and home prices not far off all-time highs, and with unemployment at decades lows, the US consumer is concerned about inflation and the war in Europe. There is always something to worry about, right?

We stand firm in our confidence in the long-term outlook for the US economy, and by extension the outlook for the markets. No doubt volatility will remain high, but we believe that a properly diversified portfolio with a long-term horizon is the best way to weather volatility and grow wealth over time.

All the best,

Disclosures: The information contained within this market and strategies update represents the opinion of Riverwater Partners and should not be construed as personalized or individualized investment advice.

- Riverwater ESG SMID Value Strategy

- Riverwater ESG Micro Opportunities Strategy

- Riverwater ESG Large Value Strategy