Q2 2022 Market and Riverwater Strategies Update

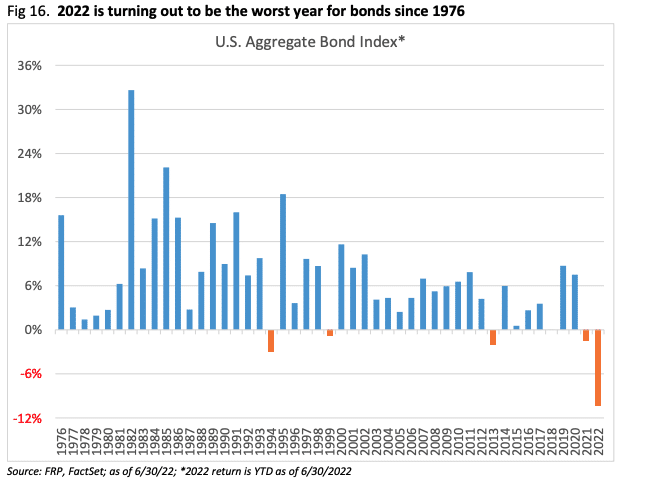

The volatility experienced in the first quarter of 2022 continued in the second quarter, with all major markets down for the first half of Q2 2022. The S&P 500 officially entered a bear market (defined by a decline of 20% from its all-time-high) as stocks had their worst first half of a quarter in over 50 years! Bonds also declined during the second quarter, posting their worst return in over 40 years, driven by both persistent inflation and a hawkish Federal Reserve intent on driving that inflation down.

Albeit staggering, the Q2 2022 20% decline of the S&P 500 is mild relative to the negative return posted by cryptocurrencies. Many cryptocurrencies are down more than 80%, some having lost 100% of their value. Bitcoin, the most well-known cryptocurrency, is only down 73%. This year’s crypto bubble is reminiscent of the dot.com craze of late 1999 which preceded the market top in March of 2000. At that time, traditional valuation metrics were eschewed for website traffic. The number of eyeballs on a given website became the metric that dictated insane corporate valuations for public companies. Today, cryptocurrencies are valued based on an even more ephemeral factor: how much hype each company can create for its own currency. If you watched the Superbowl, you may remember a plethora of crypto commercials for companies you had never heard of. In retrospect, it seems crypto’s peak earlier this year was a bellwether that rang the top of the market.

The Fed remains intent on stamping out inflation. In their last meeting, they raised short-term interest rates by .75% – the largest single raise in 28 years. The market expects rates to keep going up from today’s 1.75% level to 3.75%. Leading economic indicators have started to reverse and the early signs of an imminent recession are becoming more pronounced. We stated in our last quarterly letter that the odds were better than 50/50 and we’d bump that up even higher now.

The Fed’s work to curb inflation has already influenced mortgage rates, which rose from 2.75% to 5.75% in 6 months. This will no doubt put the brakes on home sales, which will likely slow home value appreciation as well, which is the Fed’s goal, as home prices are a meaningful component of inflation. We are seeing layoffs begin to inch up and some economically sensitive commodities like copper, lumber and steel have declined 30-50% from their highs earlier this year.

Recession Likely but We Have Seen Worse

Markets decline regularly and the most severe declines are often associated with recessions. The average market decline during recessions is 24% and the S&P 500 got there on June 17. This means equity markets have already priced in a moderate recession at this point. This is nothing compared to recessions such as the one we experienced in 2008/09 which saw market declines of 48%. We don’t think we are anywhere near that type of economic imbalance today and so are comfortable saying that we are easily past the midway point of the current downturn.

We also think the worst of the bond declines are in the rear-view mirror. As you can see in the chart below, this has been the worst year for bonds since 1976 and by a large margin. Volatility could remain as the Fed continues to raise interest rates, but we believe that going forward, bonds will have yields more in line with historical norms. And this is good news.

Things will get better. All bear markets must end. Valuations are now more reasonable and if we indeed do have a recession, it should help bring down the level of inflation. This will allow the Fed to stop raising interest rates, which should push bond and stock markets higher. We expect volatility to continue up until the coming elections, as historically markets have, on average, rebounded after November 1st in mid-term years. In fact, in a study published last July in the Journal of Financial Economics, the authors found that between 1871 and 2015, annualized U.S. stock-market returns were 15.41 percentage points higher in the winter months following midterms than during all other months.

It may not be easy to find good news in today’s market, but as they say, it is always darkest before dawn.

All the best,

Adam

Disclosures: The information contained within this market and strategies update represents the opinion of Riverwater Partners and should not be construed as personalized or individualized investment advice.

- Riverwater ESG SMID Value Strategy

- Riverwater ESG Micro Opportunities Strategy

- Riverwater ESG Large Value Strategy