Q4 2022 Market and Strategies Update

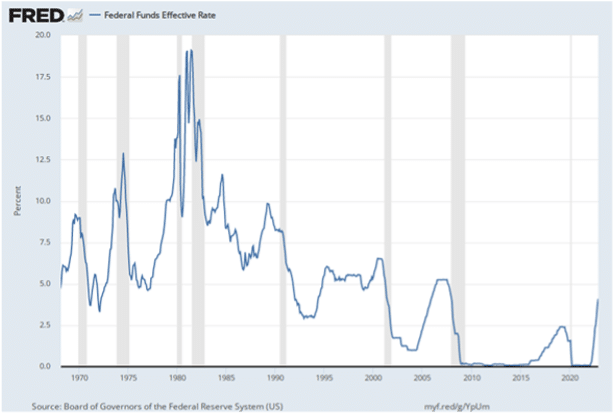

There is a saying in the financial markets that the Fed will raise rates until it breaks something. This seems especially relevant today when the entire global economy moves trillions of dollars on the words of one-man, Federal Reserve Chairman Jerome Powell.

Coal for Christmas

The S&P 500 was down roughly 20% in 2022, does this mean the Fed has broken anything? While down 20% constitutes a bear market and doesn’t feel good, it is not broken.

The UK pension system appeared to be on the verge of breaking as it was on course to go insolvent, but the Bank of England stepped in very quickly to save the day.

The UK pension system appeared to be on the verge of breaking as it was on course to go insolvent, but the Bank of England stepped in very quickly to save the day.

The crypto market, and specifically FTX, did break. At its peak, FTX was valued at $32 billion and in a few days went belly up. We are sure everyone is now familiar with the FTX story since it has been in the national news, but what has not been covered as much (but is more interesting to us) is what FTX means and represents for the psychology of the markets.

Headquartered in the Bahamas, FTX had a small very young group of employees and no board of directors. The exchange had ties to Sam Bankman-Fried’s trading firm/hedge fund, Alameda Research, and allegedly would not let investors see its financial statements. Sam Bankman-Fried, FTX’s founder and CEO, said everything anyone hoping to make easy money wanted to hear. This led “smart” investors like Sequoia and the Ontario Teachers’ Pension Plan to fund FTX with apparently no due diligence.

Our dinner table conversations, and we are sure many of yours, asked how it was possible that so many “smart” people were fooled by such a massive alleged fraud. The red flags were not hidden but no one cared; they just wanted to believe. Much of this can be attributed to greed and FOMO (fear of missing out), coupled with liquidity injections by the Federal Reserve and the Federal Government (i.e., stimulus checks) in the last few years since the pandemic.

Everyone from retail investors to sophisticated institutions were flush with liquidity and ready to invest in the next big idea. FOMO and greed took over the market and many companies and new asset classes came public to take advantage of investor sentiment.

What ultimately resulted was a bubble, subsequently named the “everything bubble”, that was larger than the dotcom boom and bust of the late nineties, based on market cap value lost. Looking back, it was amazing what could pass as a good investment. Crypto tokens, special purpose acquisition vehicles (SPACs), and IPOs priced at greater than 50x projected sales were all bought and sold without a second thought.

In the spring of 2022, the Fed realized that inflation was not transitory and needed to get inflation under control by raising rates aggressively.

Companies claiming they were the next Amazon, celebrity managers that had been going on financial TV guaranteeing 40% returns annually for five years, and fake crypto coins (e.g., Luna coin) all saw massive drawdowns. For example, the Renaissance IPO ETF, which tracks recent IPOs, was down roughly 56% in 2022. The tidal wave of failures in “story” stocks finally peaked in 2022 with the collapse of FTX. We cannot think of a faster and more unexpected implosion in recent memory. FTX had its name on sports stadiums, MLB umpire uniforms, and don’t forget all the Hollywood celebrity endorsements!

Greed took over the last few years and investors wanted a get rich quick alternative to hard work and integrity. Greed attracts even the smartest fraudsters that will promise the world. Warren Buffet once said, “You don’t find out who’s been swimming naked until the tide goes out”. When the Fed changed the tide, there were a lot of companies swimming naked in 2022.

The best thing an investor can do is trust their process. At Riverwater Partners we take great care to protect our clients’ money and are somewhat shocked at the lack of due diligence on the part of large institutions with significantly larger budgets than ours. We understand that venture investing is risky, and they throw a lot at the wall to see what sticks, but investing in what is alleged to be a fraud from the beginning with so many red flags is a different story. Investing is difficult and we obviously don’t get every single investment right. We, too, find red flags in potential investments, and if we don’t get satisfactory answers from management regarding these issues, it is an easy pass.

We invest in many different asset classes and product types and have a disciplined process whether we invest in external managers or directly in stocks in one of our strategies. Our three-pillar approach of investing in companies with a superior business, exceptional management teams, and an attractive valuation allows us to find companies with sustainable business models and bigger goals for the future, without risk of being exposed as naked swimmers. With the uncertainty ahead, we believe 2023 will be a good year for active stock pickers.

2023 Outlook

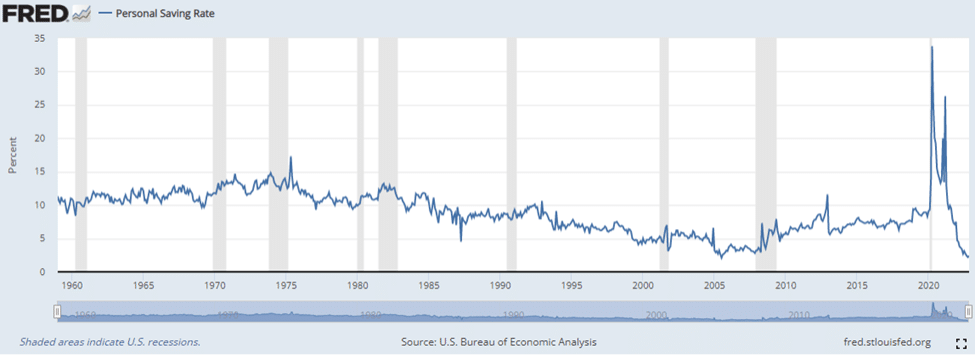

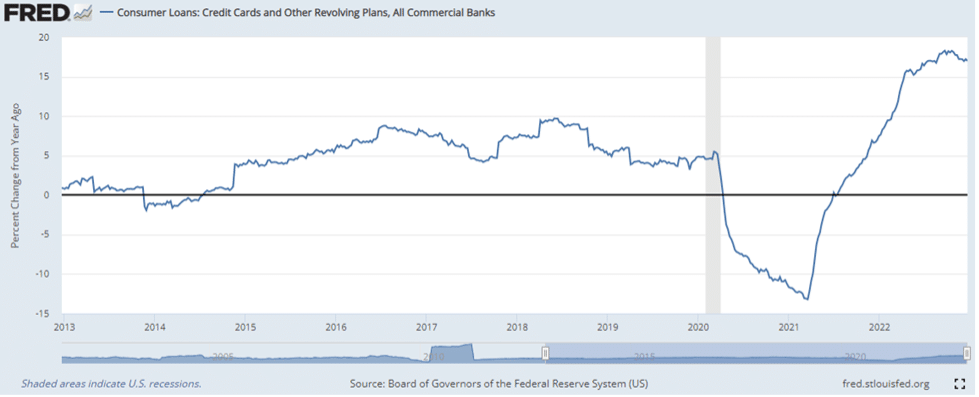

The Federal Reserve is currently expected to continue raising rates in the first half of 2023. Fed policy affects the economy with long and variable lags, meaning many of last year’s rate hikes should start impacting the economy in 2023. Chairman Powell has said the Fed wants to keep rates high for some time, at least through 2023, until they are certain inflation has subdued. This means that if the Federal Reserve cuts rates in 2023, it will likely be because something bad has happened. While some market pundits say that 2022 was technically a recession (one definition is two consecutive quarters of negative GDP growth), 2022 will likely not officially be labeled a recession by the NBER due to the strength of the consumer and a strong jobs market. Consumer strength is unlikely to continue in 2023 as savings rates are at the lowest since 2005 and credit card debt has started to surge, both of which indicate more stress for the consumer. The job market has remained resilient so far (outside of Technology), so we will be keeping an eye on unemployment numbers in 2023 to see if any weakness might cause a greater reduction in consumption.

On the inflation front, we believe CPI will come down in 2023. This likely will be initially viewed positively by the stock market, as it may cause the Fed to become more dovish, but ultimately may be viewed negatively if sales and profits for some industries/sectors experiencing deflation decline. Many companies over earned during the pandemic and are now masking it with pricing power. If this reverses in 2023, it will not be good news for corporate earnings. The Federal Reserve has been very clear about their goals and any market participant should pay close attention. Too many investors tried unsuccessfully to predict a pivot by the Federal Reserve last year. They likely needed a pivot because they owned bubble stocks or stocks that over earned the prior few years. Anyone using the same playbook from late 2020 through 2021 needs to adapt because the game has changed. Investment returns in 2022 were driven by inflation and worries about how far the Federal Reserve would raise rates. 2023 will likely see the Federal Reserve stop raising rates by March and holding them steady for an extended period. This will finally put the focus of the stock market back on companies and earnings power, not promises and stories. This higher rate environment will be a good time for disciplined active managers to show their worth. All the best,

Adam and Nate

Disclosures: The information contained within this market and strategies update represents the opinion of Riverwater Partners and should not be construed as personalized or individualized investment advice.

- Riverwater Sustainable Value Strategy

- Riverwater Micro Opportunities Strategy

- Riverwater ESG Large Value Strategy