Q1 2023 Market and Strategies Update

The first quarter of 2023 saw a reversal of fortunes in the stock and bond markets, with solid gains across the board. While Nasdaq and growth stocks led the way, all major indices, including bonds, saw increases. However, the gains were not without some intra-quarter volatility, driven by textbook bank runs.

Last quarter, we predicted that the Fed would raise rates until it breaks something. In 2022, fissures began to appear with the UK pension system and the collapse of FTX. In March 2023, the bankruptcy of Silicon Valley Bank (SVB), the second-largest bank failure in history, occurred because the bank did not properly manage its interest rate risk, and the Fed raised rates. Silvergate Bank and Signature Bank also collapsed, and several banks required government intervention, including, most notably, Credit Suisse.

Why this time is different with banks

While we believe the bank runs may slow economic growth, we do not anticipate another Great Financial Crisis (GFC).

It is worth reminding ourselves how banks operate. In their basic form, banks accept deposits from customers and loan most of that same money to borrowers. They must maintain a certain amount of those deposits in cash or cash-like instruments to satisfy depositors who want their money back. Normally, this amount represents only a fraction of total deposits on any given day.

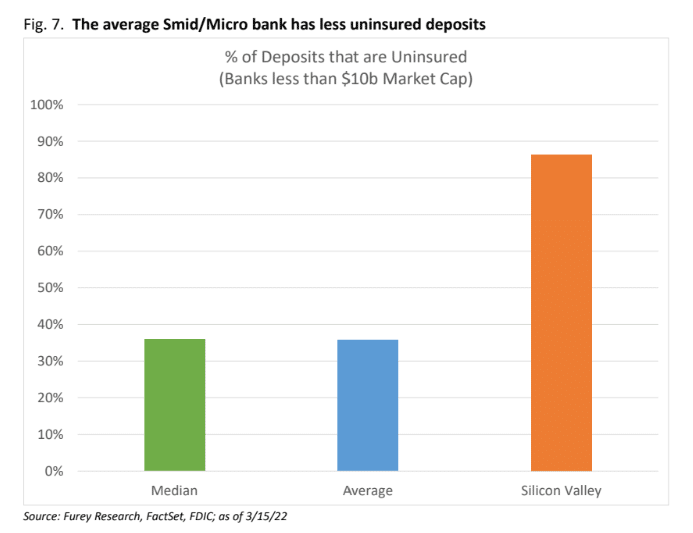

A bank run occurs when too many depositors want their money back at the same time. That is what happened to SVB. The collapse of SVB was unique in that, compared to most other banks, they had a relatively high number of customers with very large balances above $250,000. Once those large depositors became nervous (deposits above $250,000 are not insured by FDIC), they pulled their funds. And since those customers in Silicon Valley are in a close-knit group, they told other large depositors to redeem their accounts as well. The nervousness was driven by the bank’s sudden attempts to raise funds to satisfy regulatory capital requirements. At the end of 2022, SVB had $175 billion in deposits. On March 9th, depositors pulled $42 billion. Regulators shut the bank down at the end of the day on March 9 because the bank could only come up with $40 billion.[1] On March 10th there were requests to withdraw another $100 billion!

The commonality of the recently collapsed banks were they all had large concentrations of uninsured deposits (those above $250,000) and their focus in the tech industry, which was much more concentrated than most every other bank.

In response to the bank failures, the Federal Reserve created a new funding program that allowed banks to access cash by using the bank’s treasury holdings as collateral to meet redemptions. Since it was put in place, we have seen no deposit issues. Equity markets also rallied nicely after the Fed’s intervention.

Recent Fed bailout is not the next GFC

This bailout is not the next GFC. In recent months, the banks suffered unrealized losses on US Government Treasuries and government-backed mortgage bonds, some of the safest assets in the world, due to the unprecedented rise in interest rates. In the GFC, banks dealt with underwater mortgages on homes and other financial products tied to housing that had tremendous losses and were illiquid. Today, banks can liquidate treasuries in a matter of hours if funds are needed. If the cash is not needed, the losses on the treasuries are temporary. (In a high interest rate environment as bonds get closer to maturity the value increases back to par).

Outlook good for bonds

We believe that banks will be less likely to grow their loan books given current events and that should, in itself, slow the economy down. Additionally, the Fed continues to raise interest rates to battle inflation, which is another drag on the economy. Inflation is cooling and we agree with the market’s belief that the Fed is just about done.

Balanced portfolios suffered last year as both stocks and bonds declined. The good news is that bonds now finally have decent yields. This means there are some good options available for investors holding onto large amounts of cash. If you are one of those investors, give us a call – we would be happy to help you determine the best place to allocate your dollars right now.

As usual, we can never know what the future holds, but we are optimistic that if there is any stock weakness as the year unfolds, bonds should soften the blow.

As always thank you for your trust and confidence.

All the best.

Adam

Disclosures: The information contained within this market and strategies update represents the opinion of Riverwater Partners and should not be construed as personalized or individualized investment advice.

- Riverwater Sustainable Value Strategy

- Riverwater Micro Opportunities Strategy

- Riverwater ESG Large Value Strategy