Q2 2023 Market and Strategies Update

Macro Economic Update

The second quarter of 2023 saw continued gains for equity markets driven by a pause in interest rate increases and stabilization in the banking industry. Bonds were down slightly in the quarter but still have positive returns year-to-date after their drubbing in 2022.

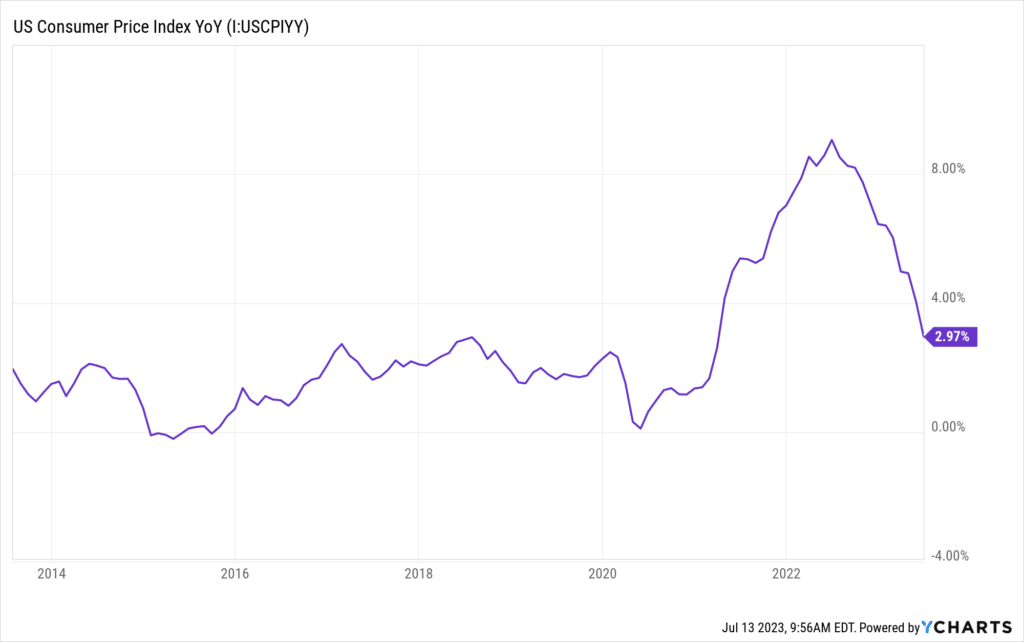

Inflation continued its descent toward a more historic and moderate level. We think the pace at which inflation is declining (already a 50% drop from the peak last year) will slow as it approaches the Federal Reserve’s stated target of 2% since price increases for the stickiest inputs (i.e. wage inflation) are harder to corral. Prices of food, energy, electricity, and new cars are all declining nicely. In contrast, prices paid for services have not seen much, if any, improvement. If inclined, you can view all the CPI inputs here.

S&P gains driven by AI

The S&P 500, the most commonly used index to represent the general US stock market has advanced by 16.9% year-to-date. The vast majority of the return has been achieved by a limited number of companies…seven to be exact.

The S&P 500 is market-cap weighted, meaning each constituent’s contribution to the index’s return is based on the percentage of the index it represents. For example, if XYZ represents 20% of the holdings in the S&P 500 it will essentially contribute 2% to the index’s performance if XYZ stock goes up 10% (Math : 20% times 10% is 2%). In an equal weighted benchmark of the S&P 500 each stock only represents 0.2%. (Math: 1 out of 500). In the equal-weighted case, XYZ’s 10% gain would only contribute 0.02% to the index’s performance.

The equal-weighted S&P 500’s performance through May of this year was down slightly on a year-to-date basis while the actual market-cap weighted S&P 500 was up close to 10%. The large divergence was attributed to just a handful of stocks driven in part by Artificial Intelligence (AI). The handful mostly consisted of the leaders in AI: Microsoft, Nvidia, Alphabet (Google parent), Meta (Facebook parent) and Amazon. Apple is not considered a leader, but they do have a foot in the door of generative AI. Tesla is included in the seven and is the only non-AI driven company.

Those seven companies now represent 28% of the S&P 500 and on average they are up 61% year-to-date, driving a vast majority of the index’s return. The other 493 names in the S&P 500 were only up 4%. We don’t think any of those seven are cheaply valued, especially Nvidia which trades at 56x earnings and 41x sales.

Alan Greenspan, the Fed chair back in the 1990’s, famously said in 1996 that irrational exuberance had unduly escalated asset values. He was a bit early as the dotcom bubble had just begun and didn’t deflate for another three years plus. The current valuations for the AI leaders seem to be elevated, but we are by no means calling any top. We think that unless these companies take over the world, the other thousands of public companies should play catch up. That did start to happen at the end of the quarter. In June, the rest of the market came to life and rose almost inline with the AI leaders.

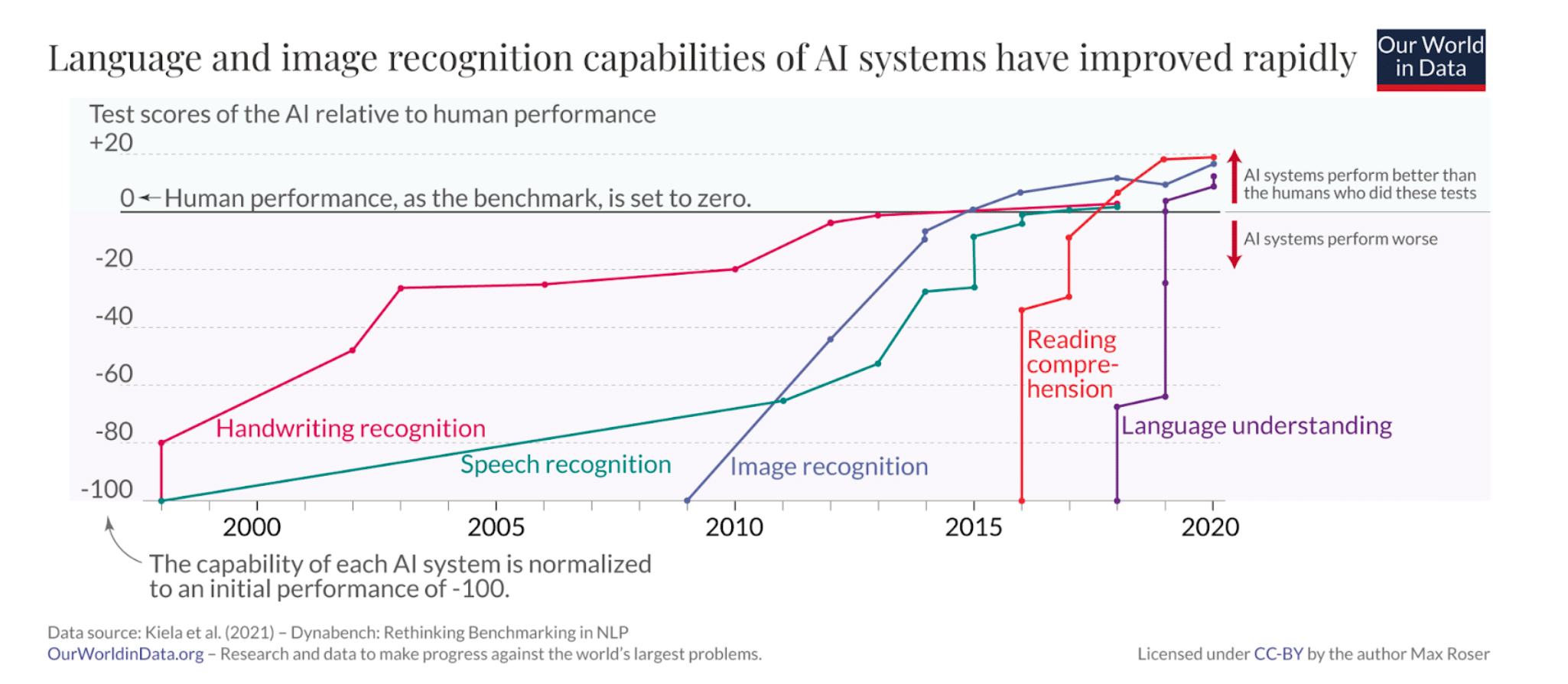

Artificial intelligence has been around for over 50 years, but in the last few years computing power has finally advanced to a level where AI can have a monumental impact – both positive and negative. As you can see in the chart below computers can now perform certain language tasks better than humans.

We are hopeful that the Terminator scenario does not play out, but it is a credible fear as many leaders in the AI space wrote an open letter in May on the topic.

“Mitigating the risk of extinction from AI should be a global priority alongside other societal-scale risks such as pandemics and nuclear war,” the letter, released by California-based non-profit the Center for AI Safety, says in its entirety.

We are glass half full and see AI in the same light as the internet. Twenty years ago none of us could have imagined hopping in a stranger’s car to get from point A to point B, but here we are hopping in Ubers. New technologies and innovation have always disrupted jobs, but have also created more and better jobs that often pay more. The internet changed our lives and we believe AI will as well.

AI is significantly impacting public companies across various sectors. By leveraging AI technologies effectively, companies can enhance efficiency, improve customer experiences, make data-driven decisions, drive innovation, and navigate industry disruptions. As investors, it is crucial to assess how public companies embrace and adapt to AI advancements to identify investment opportunities that align with long-term growth objectives. (This paragraph was 100% written by ChatGPT after we asked it to write about AI’s impact on investing. We trust that it is right!)

As always thank you for your trust and confidence.

All the best,

Adam

Disclosures: The information contained within this market and strategies update represents the opinion of Riverwater Partners and should not be construed as personalized or individualized investment advice.

- Riverwater Sustainable Value Strategy

- Riverwater Micro Opportunities Strategy