Q3 2023 Market and Strategies Update

Rates, Rates, Rates

Location, location, location – that’s a popular saying in the real estate world, emphasizing the significance of a prime location in determining a property’s maximum value. When it comes to valuing both stocks and bonds, interest rates take center stage as the most crucial factor. The Federal Reserve’s actions influence all US bond yields, and stocks are valued relative to the “risk-free” interest rate. So, when interest rates rise, stocks theoretically become less valuable. Apart from the largest stocks (the top ten to be precise), the markets have been relatively stagnant this year.

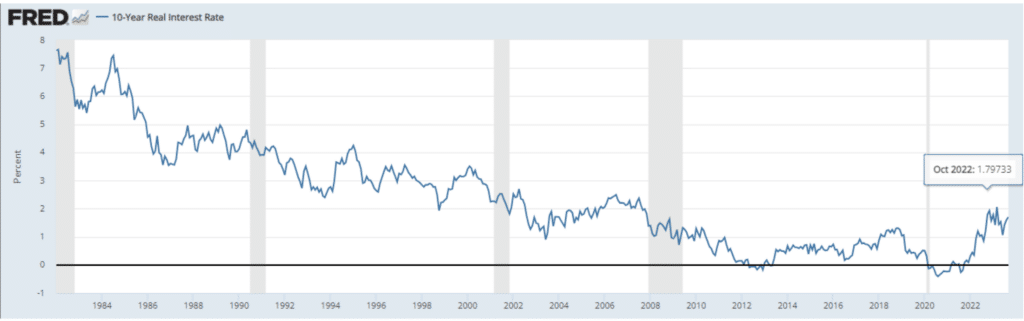

During the third quarter, interest rates experienced a sharp increase, negatively impacting both stock and bond returns. As we write this letter, the 10-year yield is on the verge of breaking through the 5% mark, while 30-year mortgages are approaching 8%. Below, you’ll find a chart illustrating the real ten-year Treasury yield, which equals the current yield minus the prevailing inflation rate. Over the past 40 years, real yields have been steadily declining, and they even went negative during the Covid pandemic, meaning that, in essence, you weren’t making money as a bondholder when factoring in inflation.

The good news is that bonds now offer returns that surpass the projected level of future inflation. Higher rates can cause bond prices to fall, but if held to maturity, bond prices return to par. As lower-yielding bonds mature, they can be reinvested at higher rates. For savers, this is great news. For borrowers, not so much.

As we read the tea leaves, we think the odds of the Federal Reserve engineering a soft landing to avoid a recession are heading lower. If the soft landing ceases to be the expected outcome, bond yields are likely to reverse course, providing a boost to diversified portfolios as bond prices rise.

While inflation remains persistent in certain sectors of the economy, it is getting closer to the Fed’s 2% target. With a potentially weakened economy and lower future inflation levels, we believe the Fed is done, or nearly done, raising interest rates.

Both stocks and bonds have had a rough stretch over the last couple of years. Unfortunately, we expect the disarray in Washington to continue, but hope the House can come together to create a budget before year-end. While a government shutdown may loom on the horizon, history has shown shutdowns to be typically short-lived and to not have a lasting impact on the overall health of corporate America. We hope history repeats this time.

As always thank you for your trust and confidence.

All the best,

Adam

Disclosures: The information contained within this market and strategies update represents the opinion of Riverwater Partners and should not be construed as personalized or individualized investment advice.

![]()

- Riverwater Sustainable Value Strategy

- Riverwater Micro Opportunities Strategy

![]()