Q1 2024 Market and Strategies Update

Houston, the Eagle has Landed

Nearly 55 years have passed since the historic Apollo 11 mission culminated with Neil Armstrong’s iconic declaration from the lunar surface: “Houston, Tranquility Base here…the Eagle has landed.” This momentous achievement teetered on the brink of failure as the lunar module, Eagle, initially bypassed its designated landing area, leaving the crew in a precarious search for a viable soft landing site with fuel running critically low. Yet, they succeeded against the odds.

Today, the Federal Reserve faces a similarly daunting challenge navigating its own soft economic landing. Soft landings are rare, as an economy must successfully navigate through a cycle of tightening by the Federal Reserve. Despite a marked rise in interest rates, the economy has continued to demonstrate resilience. Employment rates have remained impressively robust, with unemployment staying below 4% since the end of 2022—a consistency not seen since the late 1960s. Furthermore, inflation rates are on a downward trend, while financial markets have not only remained strong but have also continued to reach new highs.

2024 Q1 Review

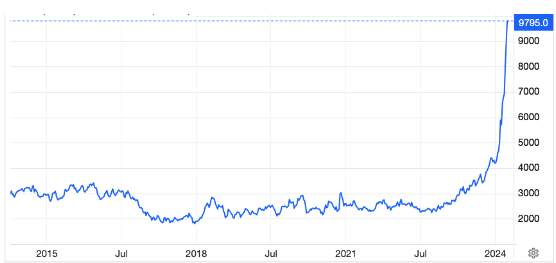

The first quarter of 2024 witnessed a continuation of the upward trajectory in the US equity markets that began last fall, with all US equity asset classes generating positive returns. Similarly, international markets experienced uplifts across Europe, Asia, and the majority of emerging markets. The commodities sector also saw an increase, albeit with mixed performance. Notably, natural gas prices plummeted to levels last seen in the early 1990s, attributed to a pause in LNG exports and an unusually mild winter. Conversely, oil prices surged by 15%. Bitcoin experienced a significant resurgence, achieving all-time highs.

An interesting observation can be made from the chart to the left. Contrary to what you may expect, the chart does not depict the 10-year trajectory of Bitcoin. It is actually the 10-year price of Cocoa in US dollars per tonne.

An interesting observation can be made from the chart to the left. Contrary to what you may expect, the chart does not depict the 10-year trajectory of Bitcoin. It is actually the 10-year price of Cocoa in US dollars per tonne.

Cocoa Chaos

The past year has seen cocoa prices more than triple, primarily due to adverse weather conditions severely impacting crops in West Africa, a region that accounts for approximately 60% of the global cocoa supply. Successive seasons of heavy rains, floods, droughts, and high winds have led to consecutive years of crop devastation.

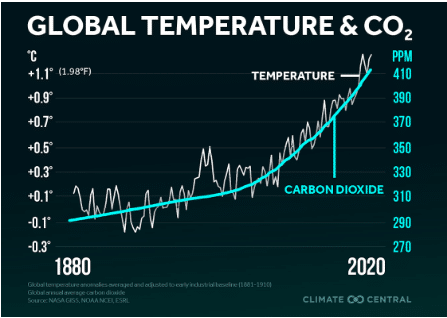

A contributing factor to the climate challenges facing cocoa production is the rising levels of carbon dioxide, as illustrated in the chart below, which is a primary driver of global warming.

And the effects go beyond simply an increase in prices. Increased temperatures adversely affect cocoa yield, reducing farmers’ incomes and prompting them to clear more forests for cultivation. This deforestation, particularly notable in Côte d’Ivoire and Ghana with rates of 2.7% and 2.9% respectively, exacerbates the cycle of rising temperatures and further climate change.

The rise in cocoa prices has a multifaceted impact on the global economy, affecting various sectors from agriculture to retail. For industries reliant on cocoa as a key ingredient, such as chocolate manufacturing, a rise in cocoa prices increases production costs. This can lead to higher retail prices for chocolate products, potentially reducing consumer demand. Companies might also explore cost-cutting measures or ingredient substitutions to maintain profit margins, which could affect product quality.

Hershey (HSY), for example, has seen its stock price dip 25% in the last year. Smaller manufacturers and retailers are also affected. Rocky Mountain Chocolate Factory (RCMF) stock is down close to 30% over the last year. Consequently, we have seen a significant increase in chocolate prices, with DataWeave reporting a 15% rise in chocolate prices at major US retailers over the past year, in stark contrast to a 4% increase in non-chocolate candy prices and a total inflation rate of 3.2%.

Cocoa is just one example of the interconnectedness of global supply chains and the diverse impacts climate changes can have across different sectors and geographies. It illustrates why paying attention to an environmental factor is relevant when making an investment decision.

As fiduciaries, it is incumbent upon us at Riverwater to evaluate all variables capable of influencing long-term investment returns, including environmental, social, and governance (ESG) factors. The interplay between the environment and societal developments poses both risks and opportunities, capable of significantly affecting individual business profitability and, ultimately, portfolio returns.

We remain hopeful for a recovery in West African cocoa crops. The origins of chocolate trace back 4,000 years to what is now Mexico, marking a journey of human innovation that not only transformed cocoa into chocolate but also accompanied mankind into space. Yuri Gagarin, the first human to orbit Earth, had a diet that included a tube of meat and a tube of chocolate sauce during his historic flight — a combination that might seem less than appetizing to many.

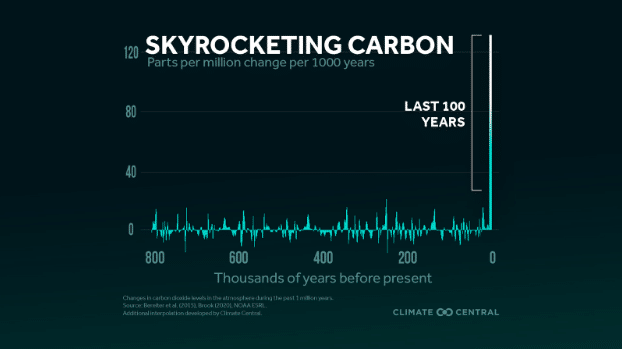

The chart above illustrates that carbon dioxide levels have remained relatively stable for 800,000 years, only to surge dramatically in the past century. This underscores our belief in the ongoing environmental and social impacts of climate change on commerce and investment.

At Riverwater, our focus extends beyond merely identifying risks; we actively seek opportunities to invest in ways that can mitigate these challenges and foster a positive change.

2024 Outlook

In our last letter we thought an accommodative Federal Reserve would be conducive for positive markets. So far that call is looking good. However, as the year progresses, we anticipate the political climate will bring on some volatility. No matter how the rest of the year unfolds we remain bullish on the long-term for both the US economy and markets. We are committed to navigating through these uncertainties, always with an eye towards sustainable growth and the well-being of our clients’ investments.

As always thank you for your trust and confidence.

All the best.

Adam Peck, Founder and CIO

Disclosures: The information contained within this market and strategies update represents the opinion of Riverwater Partners and should not be construed as personalized or individualized investment advice.

- Riverwater Sustainable Value Strategy

- Riverwater Micro Opportunities Strategy