Navigating Climate Risk: How We Use Scenario Analysis for Responsible Investing

As Director of Responsible Investing, I’m proud of the unique approach we’ve crafted for integrating responsible investing into small cap equities. Today, I am pleased to present our climate change scenario analysis framework. We use this forward-looking tool to identify potential risks and uncover opportunities as the world transitions toward a lower carbon economy.

Understanding Our Four-Scenario Framework for Climate Analysis

At Riverwater, our approach to climate change scenario analysis considers how different combinations of public policy and “market dynamism” might create risks or opportunities for companies. By market dynamism, we mean the corporate and individual actions taken in response to climate change.

To guide our analysis, we’ve adapted a graphic from the Mark Cliff for Real World Climate Scenarios Initiative, which outlines four potential futures:

- The Roaring Twenties: In this scenario, both public policy and market dynamism are aligned for climate change mitigation.

- The Green Phoenix: Here, the market takes the lead in driving change while policy lags behind.

- The Carbon Bubble: This scenario imagines a future where policy only steps up after a surge in fossil fuel investment bursts.

- The Meltdown: In the bleakest scenario, neither policy nor markets are aligned to address climate change.

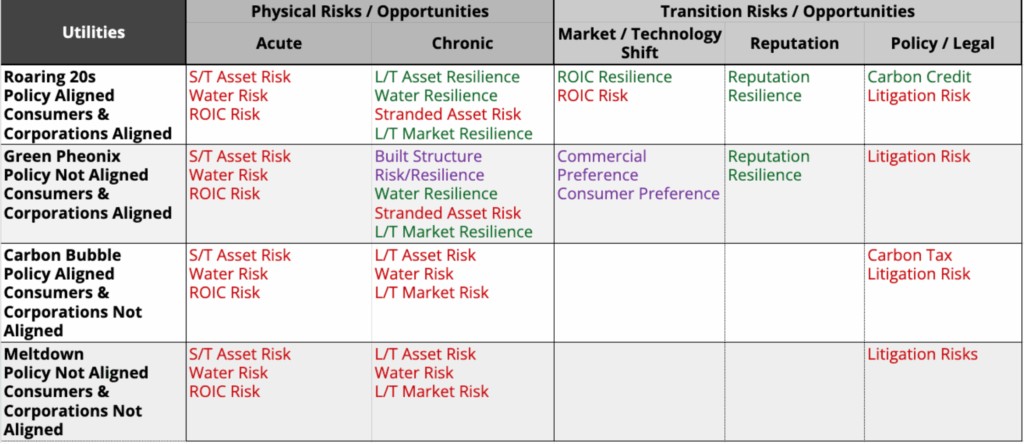

A Deep Dive into the Utilities Sector: A Case Study on Climate Impact

Using these four scenarios, we began our analysis by looking at companies in the utilities sector. We chose this sector specifically because utility companies are both very impacted by and impactful on greenhouse gas emissions and climate change.

We evaluated companies using the TCFD (Task Force on Climate-related Financial Disclosures) matrix, which considers both physical risks (like extreme weather events) and transition risks (like policy changes, new technologies, and shifts in the market). As you might imagine, the “Roaring Twenties” scenario presents the most opportunities (represented by green), while the risk level (represented by red) increases dramatically as the scenarios feature less attention to climate change.

Spotlight: How Pinnacle West Manages Wildfire and Water Risk

Located in the Southwest, Pinnacle West is exposed to wildfire risk but has implemented a comprehensive mitigation plan to protect against this acute physical risk. The company also faces chronic physical risk related to water use, as it operates in severely water-stressed areas. .

We are happy to see the company is beginning to implement new strategies to protect against this risk. Pinnacle West has built a positive reputation as a green energy producer with its solid plan to transition to lower carbon-intensive energy production..

Spotlight: Black Hills Energy’s Transition to Green Energy

Operating in the northern and middle parts of the country , Black Hills has also enacted a wildfire mitigation plan. Given its geographic location, an additional area of focus could be mitigating risks from extreme cold temperature events. Like its peers, the company relies on water, which could present chronic physical risk, making water stewardship important. Black Hills has also earned a positive reputation as a green energy producer due to its transition plan. .

Chesapeake’s Resilience in a Lower-Carbon Future

This company also faces acute physical risks and has developed a robust emergency response system. It faces chronic risks related to water, which could be impacted by sea level rise, making water stewardship a key issue. Overall, Chesapeake is very well positioned for a transition to a lower carbon energy future.

Why This Matters: The Real Financial Impacts of Climate Change

This isn’t just a theoretical exercise. The evidence shows that severe weather events caused by climate change are already having a pecuniary impact on companies.

A 2025 report from the Morgan Stanley Institute for Sustainable Investing,The Sustainable Signals.1, surveyed 325 companies and found significant impacts from climate-related weather events. These included:

- Increased operational costs (e.g., insurance)

- Supply chain disruptions

- Workforce issues like employee safety and absenteeism

- Revenue loss from business interruption

- Damage to physical infrastructure and property

Our Commitment: Supporting Action on Climate Strategy

Our goal with this analysis work is threefold:

- To make the case to our portfolio companies that they may be impacted by climate change.

- To encourage companies to stay the course and implement sound climate change policy and practices, regardless of short-term policy changes.

- To offer suggestions where we see potential holes in their strategies.

In conclusion, we believe that market dynamism, in the form of corporate action, must rise to the challenge to change the long-term trajectory of climate change. It is essential that we act, regardless of short-term policy shifts, to protect our planet, its people, and our collective prosperity.

1Morgan Stanley Institute for Sustainable Investing. (2025, June). Sustainable Signals: Corporates 2025 [PDF]. Morgan Stanley.