Q2 2021 Market Update

Inflation is real.

If you have experienced sticker shock this year purchasing food, renting cars, or simply getting your haircut, you are not alone. Used car prices are up over 34% in the last year and rental car rates are now commonly $150 to $400 per day depending on location, compared to daily prices below $100 last year. Honolulu, for example, saw rental prices of up to $67,000 per day for a rental! Prices of some commodities, such as lumber more than tripled from pre-pandemic levels and the list goes on. No doubt you, too, have experienced inflation in some way or another these last few months.

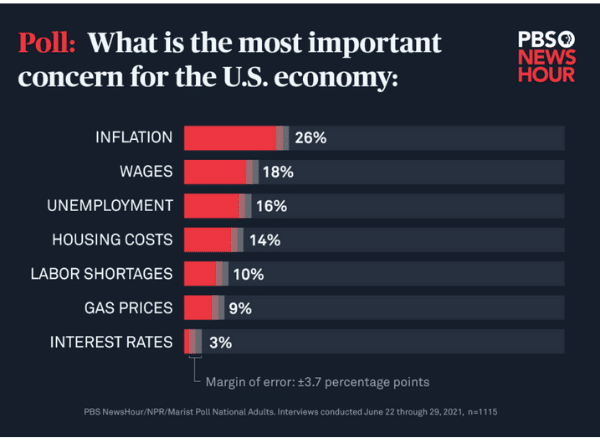

The pain we are all feeling is real. The Consumer Price Index, a key measure of inflation jumped sharply in June, by 5.4%, the largest year-over-year gain since 2008. And inflation has Americans concerned, as evidenced by recent polling by PBS NewsHour, NPR, and Marist which shows inflation as the primary economic concern of Americans.

So, what’s fueling today’s inflation? For one, we are witnessing a traditional supply and demand imbalance driven by immediate decreases in both supply and demand early during the pandemic. Once restrictions were lifted and the vaccine roll out began in full force, demand snapped back, but supply chains have not been able to keep up. We think that once supply chains fully recover, the higher levels of inflation across many industries will begin to subside. As an example, lumber prices have now declined over 50% in price from their recent high as mills have been able to ramp up production.

What’s Next For Inflation?

Will the seemingly omnipresent price increases stabilize, rise, or fall back to pre-pandemic levels? We, like many others, are closely watching core inflation, which increased 4.5% in June of 2021, the largest 12-month increase since 1991. But looking at inflation rates alone does not provide the full picture.

Interest rates are one of several good indicators pointing to how investors think about the future direction of inflation. The second quarter of 2021 saw the bond market recovering from negative first quarter returns, as interest rates fell back toward levels seen last year. The ten-year treasury yield started the year at 0.9%, rallied to 1.75% in March, and has since fallen back to 1.2% in the last week. (Read Q1 2021 Market Update for more on the ten-year treasury yield). This is important because if bond investors were indeed concerned about inflation, one would expect yields to continue to rise.

Wage gains also contribute to inflation, but we think long-term persistent wage gains are unlikely. Government stimulus is rolling off and COVID-related reasons keeping employees out of the workforce (lack of childcare, fear of infection) are subsiding, incenting workers to return to the workforce. This increase in supply of workers relative to demand should alleviate some wage pressure. If the current wage gains we are witnessing were to continue, employers would be forced to raise their prices to cover the increase, thus leading to inflation…potentially to levels reminiscent of the 1970’s. Again, we do not believe this will be the case.

There are two additional reasons we believe inflation will not return to double digit levels: demographics and debt. (Globalization and technology are two additional drivers of lower long-term inflation rates).

The Impact of Demographics and Debt.

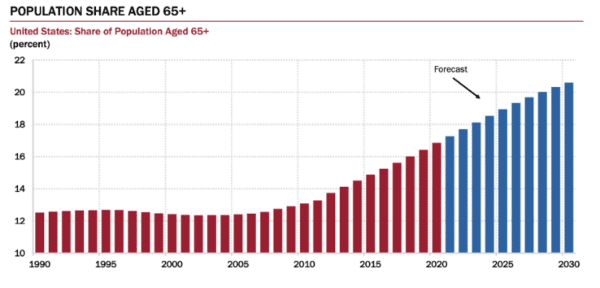

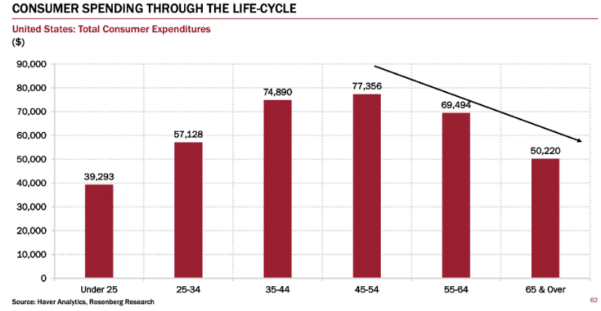

Demographics have a large impact on long-term economic trends. The older we get the less we spend. The less we spend the less pressure on inflation. You can see in the charts below the percent of the population older than 65 will continue to climb for the foreseeable future. This is because the American birth rate is too low to keep the average age constant.

The growing share of the US population aged 65+, accompanied by decreased spending in that demographic, will help keep the odds of 1970s inflationary levels low.

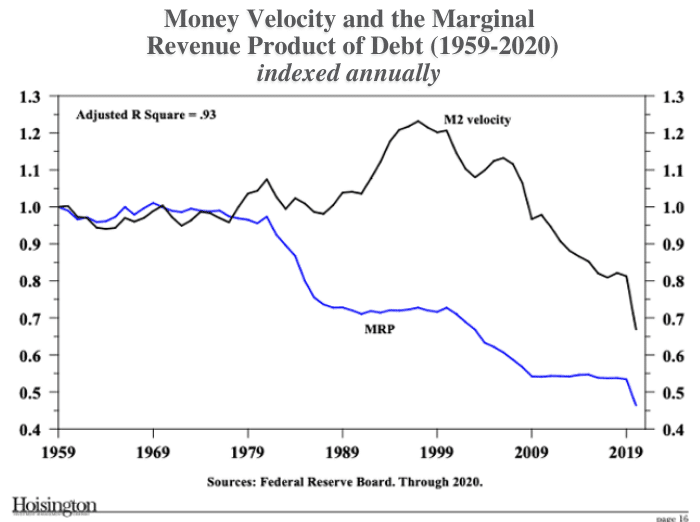

Additionally, higher levels of government debt are deflationary. As the government issues more debt, the incremental impact debt has on economic growth shrinks. The marginal revenue product of debt reflects how much GDP is created for each dollar of debt issued. As you can see in the chart below, the marginal revenue product of debt (the blue line) has been on a downward slope since Fed Chairman Volker broke the back of inflation in the early 1980s.

While Americans are right to be concerned given the inflation that is affecting our pocketbooks and is clearly visible as we go about our daily lives, a deeper dive into macroeconomic trends tells us we will likely not see a redux of 1970’s style inflation as we believe odds are high that we will revert to pre-pandemic inflationary levels.

As with any future unknown economic environment, the best defense is managing the risks via portfolio diversification. Having exposure across asset classes like stocks and bonds is a good strategy to maintain and grow wealth no matter what the future holds for inflation.

Riverwater Strategies Update

RIVERWATER ESG SMID VALUE STRATEGY

Small caps continue to grind higher, notching their fifth consecutive positive quarter. We would expect returns to normalize as stock prices have recovered fully from the pandemic and the majority of returns have been driven by expanding valuations, as opposed to earnings growth. Going forward, we believe earnings growth will shine as easy comparisons are ahead, but we also hope that the market comes back to favoring quality stocks. The main beneficiaries of the quarter’s second half return were low quality factors like unprofitability and low returns on capital. We believe the meme stock phenomenon is a large contributor to the low-quality rally.

AMC Theaters (AMC) would be an example of a low-quality company that had a poor history of profitability, a heavily indebted balance sheet and five-year returns on capital that were negative. None-the-less the stock rallied from $2 at the start of the year to $56 per share by quarter’s end. Given its weight in our benchmark, as well as the weights of some of its low-quality peers, outperforming the benchmark was challenging.

The Riverwater SMID strategy slightly underperformed its benchmark the Russell 2500 Value, which was up 5% in the quarter. There was nothing significant from a sector perspective either to the positive or negative as sector attribution had no variance more than 1% from the benchmark. We made no sales and purchased one new company, Osisko Gold Royalties (OR).

Osisko Gold Royalties (OR) is primarily a precious metals royalty, streaming, and offtake company. Royalty companies have the advantage of participating in the rise in prices of precious metals without the risk of running a producing mine. This allows royalty companies to have large operating margins and a diversified asset base. OR’s flagship asset is 5% NSR royalty on the Canadian Malartic mine located in Canada and operated by Agnico Eagle. Recently, OR has made an investment in a carbon streaming company that plans to go public later this year. It will be the first of its kind that is publicly traded. We are especially interested in their ownership in Carbon Streaming Corp. We believe that with their ability to go public and raise capital that they could fund multiple carbon projects both in preservation and capture.

RIVERWATER ESG LARGE VALUE STRATEGY

The Large Strategy was essentially in line, but slightly underperformed its benchmark, the Russell 1000 Value for the quarter which was up 5%. There was nothing significant from a sector perspective either to the positive or negative as sector attribution had no variance more than 1% from the benchmark. The largest negative was the Communications sector where we underperformed by .6% and the largest positive was Industrials where we outperformed by .9%.

We sold no holdings and purchased one new company, Teredyne (TER). Teradyne, founded in 1960, is a leading global supplier of automation equipment for test and industrial applications. Teradyne designs, develops, manufactures, and sells automatic test systems used in semiconductors, wireless products, data storage and complex electronics systems in many industries including consumer electronics, automotive, industrial, and various other industries. The proliferation of semiconductors into everything has greatly expanded the need for TER testing equipment.

TER’s industrial automation products include collaborative robotic arms, autonomous mobile robots (AMRs) and advanced robotic control software used by global manufacturing, logistics and light industrial customers to improve quality, increase manufacturing and material handling efficiency, and decrease manufacturing and logistics costs.

Collaborative robots are designed to mimic the motion of a human arm and can be fitted with task specific grippers or end effectors to support a wide range of applications. They work side by side with production workers to improve quality, increase manufacturing efficiency, and decrease manufacturing costs. Autonomous mobile robots (AMRs) are low-cost, easy-to-deploy and simple-to-program mobile robots, designed to move material from point to point via autonomous navigation rather than the need for traditional mobile robot guidance infrastructure such as painted or magnetic strips, and are designed to navigate safely around obstacles and people. Teradyne has an experienced management team and a focus on sustainable business practices, offering steady growth potential leveraged to these two market growth trends. The company has a solid balance sheet and an estimated $11 in cash per share by the end of next year. Net the cash it trades at a market multiple with double digit growth potential.

RIVERWATER ESG MICRO-CAP OPPORTUNITIES STRATEGY

The micro strategy continued to post double digit returns and handily beat its benchmark. Drivers of outperformance in the quarter were the Consumer Discretionary, Healthcare and Industrial sectors. The one sector detractor was Technology.

The strategy was up over 16% in the quarter and is now up over 38% for the year. We continue to find under-the-radar stocks that quickly become popular – so much so that we need to trim position sizes as they become too large.

We discovered several attractive new ideas and with low cash levels exited two holdings we had lower conviction in: Prime Meridian Bank (PMHG) and Kindred Biosciences (KIN). As luck would have it, Kindred agreed to be acquired at a 40% premium shortly after we sold exited our position. So it goes.

Atomera Incorporated (ATOM) is a semiconductor materials and intellectual property licensing company focused on deploying its proprietary technology into the $450+ billion semiconductor industry. ATOM has developed Mears Silicon Technology (“MST”) which is a promising solution to alleviate the severe supply/demand imbalance in the semiconductor industry today. We believe that ATOM’s royalty and license model offers significant recurring revenue potential over time and have been impressed with the experienced and shareholder-aligned management team.

We purchased Limoniera (LMNR), a premier integrated agribusiness headquartered in California with a history dating back to the 1890’s. Their primary focus is growing lemons, avocados, and oranges. Limoneira historically sold mainly to restaurants, but with the pandemic it put more focus on the grocery channel. We think once restaurants return to historical buying levels Limoneira can reach higher annual sales given all the new grocery business.

Limoniera has contracts to sell excess land to commercial and residential developers over the next five years and will generate more than $80 million or 25% of their total market cap. Additionally, Limoniera has significant and long-established water rights in California and Arizona. The focus is on quality and supply is maintained through rigorous lab testing, filtration systems and a network of micro sprinklers. If Limoneira were to monetize the value of their water, we think it would be worth close to $1 billion vs. their current market cap of just over $300 million. We believe LMNR is a nice addition to our micro portfolio with an attractive valuation and strong commitment to the environment and the communities in which they operate. A quick lemon tip from Limoniera to leave your pricy dry-cleaners and harsh chemicals in the past. Scrub the stained areas on your shirts with equal parts lemon juice and water for a fresh and easy fix. You can soak your delicates in lemon juice and baking soda for 30 minutes before washing as a natural alternative to chlorine bleach.

Usio, Inc. (USIO), founded in 1998, provides integrated electronic payment processing services in the U.S. The emerging fintech company offers solutions in Payment Facilitation (PayFac), ACH, Prepaid Cards Issuance and Electronic Bill Presentment & Payment (EBPP).

USIO has made several acquisitions and signed partnerships over the past 18 months. These partnerships have expanded USIO’s offering and brought long-term recurring revenue opportunities. One highlight is a contract signed with Voyager, a leading crypto brokerage. We are attracted to the growth opportunities in the crypto space and like that the valuation is half that of the fintech peer group. USIO has been very receptive to our dialogue about focusing on its sustainability efforts.