Navigating Politics, Policy & Portfolios

(October 15, 2025).

As we close another quarter, we wanted to share our perspective on the markets, the economy, and most importantly, how we’re positioning portfolios to thrive in the months ahead.

Politics vs. Policy: What Actually Matters for Long-Term Investors

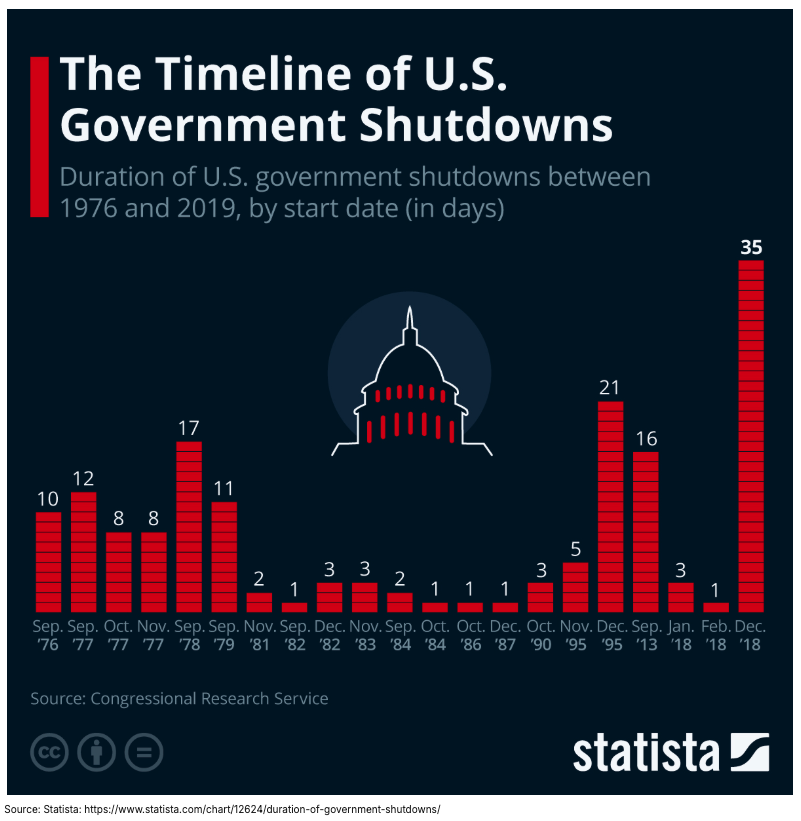

The recent government shutdown reminds us that Washington doesn’t always make things easy. While the headlines can be unsettling, temporary political disruptions like this rarely derail well-constructed portfolios or long-term market progress. Here’s what matters: shutdowns typically have a small, short-lived economic impact. History shows us that markets look past these events relatively quickly. In fact, we’ve continued to see stocks reach new highs even during this period of uncertainty. That’s not to say we’re ignoring the situation—we’re simply keeping it in proper perspective.

For the Federal Reserve, already walking a tightrope between taming stubbornly high inflation and sustaining full employment, this kind of policy noise makes its dual mandate even harder to manage. Missing or delayed data releases, coupled with a temporary hit to confidence, cloud the very indicators the Fed relies on to set the course for interest rates. Yet markets continue to climb to new highs

Economic Update: What a Shutdown Means for Growth, Inflation, and Rates

When Congress fails to pass funding bills, the resulting shutdown forces a temporary pause on many government functions. At the writing of this newsletter, hundreds of thousands of federal workers are furloughed without pay, economic data releases are being postponed, and public-facing services—from small business loans to national parks—are disrupted.

Historically, the direct economic impact of shutdowns has been modest and temporary, with markets often looking past the disruption. the drag on growth can still be meaningful—estimated at 0.1–0.2 percentage points of GDP per week, according to the Congressional Budget Office and the Brookings Institution,1 according to the Congressional Budget Office and the Brookings Institution. The larger concern this time lies not in the shutdown itself, but in what it signals—ongoing fiscal gridlock at a moment when policy clarity matters more than ever.

For the Federal Reserve, the government shutdown introduces additional uncertainty at a time when its mandate is already difficult to manage. Balancing price stability with full employment was never going to be easy in a post-pandemic economy, but delayed data and political noise make that task even more complex. Inflation remains above target, and the labor market has shown early signs of softening—though thus far in a relatively controlled manner.

If policymakers respond thoughtfully and remain focused on actual trends rather than political disruptions, a growing economy is still very possible. But the risks run in both directions. Ease too soon, and inflation could reaccelerate; wait too long, and unemployment could rise more than intended. It’s a delicate balancing act, made harder by noise—but this doesn’t change their fundamental approach.

Temporary disruptions and political headlines may stir volatility, but they rarely derail long-term market progress. Our positioning remains focused on resilience, balance, and opportunity. We continue to emphasize high-quality investments, thoughtful diversification, and a flexible mindset—one designed not just to endure periods of uncertainty, but to take advantage of the clarity that often follows.

Market Review: Small Caps Lead—Why Quality Still Counts

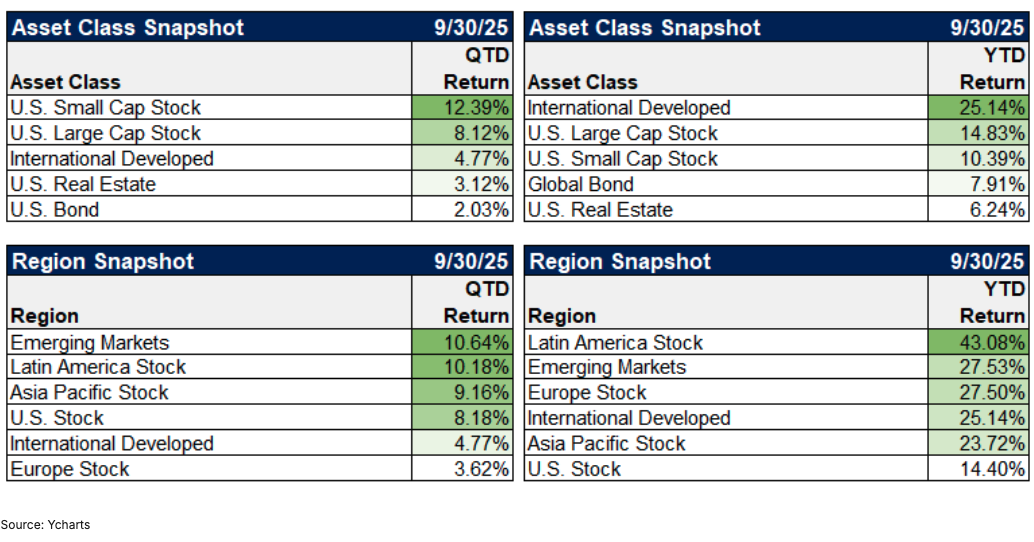

The third quarter delivered solid gains, but as always, the story beneath the surface is where things get interesting, and a reminder that not all rallies are created equal.

U.S. stocks broadly posted gains, the underlying drivers varied significantly. U.S. small caps led the way in the quarter with over a 12% return, but the rally was powered by low-quality companies and higher beta benefitting from the risk-on attitude during the quarter.

U.S. large cap stocks were the second best performing asset class, up over 8% over the last three months, though leadership was once again dominated by a handful of mega-cap names, continuing the trend over the last few years. This narrow leadership has been opined ad nauseam over the last few quarters, and our thoughts remain consistent. We continue to believe that large cap space remains dominated by tremendous companies that are transforming the technological and economic landscape, but which trade at incredibly elevated valuations pricing in perfection. These companies may be able to deliver on these lofty valuations, but we consider the risk to be skewed toward a reversion to historical levels.

U.S. Bonds have also delivered competitive returns following years of interest rate driven headwinds. Starting the year with high income levels and a decrease in treasury rates has boosted returns.

Our Portfolio Playbook: Quality, Diversification, and Flexibility

Our approach remains grounded in three principles: quality, diversification, and flexibility.

In U.S. stocks, we’re keeping a balanced stance overall, but we’re starting to see more opportunity in smaller companies. These “small caps” have lagged behind their larger peers for several years and now offer better relative value. While the recent rally in small caps was driven by riskier names, we’re focused on higher-quality companies within that group. If interest rates come down as expected, these smaller companies—especially those focused on the U.S. economy—could benefit more than the large, global firms that have led recent market gains.

At the same time, we remain cautious about big tech and mega-cap stocks, which continue to dominate large-cap indexes and are priced for near-perfect results.

International stocks remain an area of strength in our portfolios. For the first time in years, developed markets overseas—especially in Europe—are outperforming the U.S. That leadership has been backed by solid fundamentals: better valuations, favorable currency movements, and improving profit margins. We think these markets still have room to run and provide helpful diversification to U.S.-heavy portfolios.

In bonds, we’re focused on safety and steady income. Credit markets—especially corporate bonds—are not offering as much reward for the risk right now, so we’re being selective. Instead, we see better opportunities in areas like mortgage-backed securities and asset-backed bonds, where the return potential looks more attractive for the level of risk. Municipal bonds are also appealing, especially for clients in higher tax brackets, where tax-adjusted yields can be quite competitive.

When it comes to interest rate exposure, we expect short-term rates may come down slightly if the Fed starts easing next year. But we’re more cautious on the long end of the yield curve, where rates could rise again if inflation re-accelerates or government borrowing drives rates higher. As a result, we’re keeping a balanced approach to bond maturities, focused on the middle part of the curve to help manage risk while still capturing income.

Finally, we continue to see value beyond traditional markets. Investments in private markets and liquid alternative strategies can provide meaningful diversification, especially when stock and bond markets are volatile. These tools allow us to access return sources that behave differently than public markets—an advantage in uncertain environments like the one we’re in today.

Closing Thoughts: Discipline Over Headlines

This quarter reminded us that when politics and policy collide, progress can quickly become fragile. The shutdown adds noise just as the Fed faces a narrowing path, with inflation still elevated and labor signals softening. Markets rallied despite this, led by low-quality small caps and increasingly concentrated large caps, while international equities continued their fundamentally driven outperformance. In this environment, we’re positioning portfolios with discipline and flexibility—recognizing that both a soft landing and a policy misstep remain on the table. Quality, selectivity, and diversification remain our anchors.

As always, we’re here if you have questions or want to discuss any aspect of your portfolio. Thank you for your continued trust.

Footnotes

- “What is a government shutdown and why are we likely to have another one?”, Brookings (includes weekly GDP impact estimate).

brookings.edu

↩︎

Responsible Investment Spotlight: Nuveen Asset Management

To underscore our commitment to making the world a better place through responsible investing, we spotlight a positive impact achieved by one of our fund managers through their sustainable investments. Nuveen, a 125+ year-old global investment leader managing $1.3 trillion in assets, offers responsible investment strategies across multiple asset classes.

Nuveen’s stewardship program emphasizes collaborative engagement, where investors, companies, and stakeholders work together to achieve long-term, sustainable value creation. The approach goes beyond single-issue engagements by fostering pragmatic, multi-stakeholder solutions that look at complex issues holistically. These engagements aim to reduce uncertainty, giving companies the confidence to invest in strategies that deliver both strong financial returns and meaningful stakeholder benefits.

Nuveen engaged with 47% of its global corporate equity assets under management in 2024, which included 612 total engagements across 458 companies. For example, through its Nature Risk initiative, Nuveen engaged Pepsi, Tyson, and Kraft Heinz on how packaging and pollution contribute to biodiversity risk. Using letters, live meetings, and performance assessments, Nuveen evaluated disclosures against key indicators, benchmarked companies against peers, and communicated findings.

The results? Nuveen withheld support for a shareholder proposal at Pepsi, recognizing the company’s strong transparency and progress in agriculture practices, water usage, and packaging. Conversely, Nuveen supported proposals at Tyson and Kraft Heinz to encourage stronger packaging innovation, improved recycling rates, and preparation for regulatory change. These aren’t just feel-good conversations—they’re about reducing real risks that can affect company value over time.

Biodiversity presents material and often underpriced risks to companies’ long-term value. This engagement approach aligns with our belief that responsible investing isn’t about sacrificing returns—it’s about building a better future while protecting and growing your wealth.